Sign up today to get the best of our expert insight in your inbox.

Can drayage trucks go electric?

Government funding and innovative business models are driving the electrification of the US drayage sector

3 minute read

Fleet electrification is gaining traction. And drayage trucks – which transport cargo containers from ports and rail yards to distribution centres – are the next step.

The average daily distance travelled by a drayage truck is 95 miles, well within the range of available battery electric trucks. However, the high upfront costs of these vehicles and the charging infrastructure have limited their adoption. Nonetheless, as truck models with longer ranges and increased payload capacity are being introduced into the market, the electrification of the medium- and heavy-duty vehicle sector for specific use cases is gradually increasing.

To support this transition, the US federal government has allocated substantial funding to decarbonize port operations, with the Infrastructure Investment and Jobs Act allocating over US$10 billion dollars for eligible projects.

In a new report, Wood Mackenzie partnered with the Columbia School of International and Public Affairs to highlight the technological, financial and infrastructural challenges faced by the drayage sector as it electrifies. The report also compares the total cost of ownership for drayage trucks across regions and as-a-service offerings that are crucial for fleet owners who cannot finance trucks themselves.

In this article Maysa Ashhab, one of the graduate students who performed the analysis, provides an overview of the report.

Government funding drives fleet electrification – with California leading the way

Federal and state governments have made grants and incentives available for the electrification of drayage fleets to licensed motor carriers and port authorities. Beyond purchase incentives, make-ready programs, in which utilities pay for necessary site upgrades, have made it easier for fleets to transition by reducing the capital needed to install infrastructure.

Among all states in the US, California has the largest number of electric trucks operating at port facilities. This has largely been driven by regulation and available incentives in the state. California also enacted the Advanced Clean Fleets regulation in April 2023, requiring all new drayage trucks registered to be zero-emission starting in 2024.

Incentive programs for zero-emission trucks have also been launched recently in New York, Maryland and New Jersey.

Incentives significantly improve the economics of electric truck ownership, while new business models help cut costs and complexity

When purchased with incentives, drayage battery-electric trucks provide fleet operators with estimated cost savings of up to 25% to 30% compared to diesel trucks over a lifetime of approximately 12 years. The payback period ranges between two to five years, as opposed to six to eight years without available incentives. For vehicles in California, revenue from the state’s Low Carbon Fuel Standard program further reduces operational costs.

The high upfront cost of battery electric trucks and associated infrastructure creates a barrier for smaller fleet operators. Over 60% of drayage drivers are treated as independent contractors even though they operate within a motor carrier’s authority. This not only prevents them from receiving wages and benefits but also reduces their ability to seek loans. Labor reforms across states are now requiring motor carriers to treat independent contractors as employees so that more fleet vehicles will be controlled by entities that can make large capital investments or sign long-term service contracts.

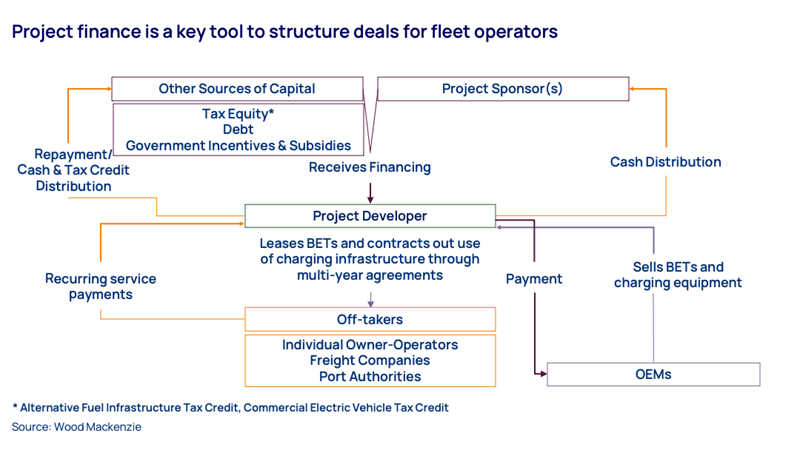

Further, emerging business models, such as fleet-as-a-service and depot-as-a-service, eliminate the massive upfront cost of procuring trucks and charging infrastructure. They also significantly reduce the complexity of the transition for fleet operators who lack technical and regulatory expertise.

Charging infrastructure deployment is a long and challenging road

Short duty cycles and planned routes of drayage trucks allow for overnight charging at depots, which reduces the need for reliance on public charging infrastructure. But the electrical grid requires significant, expensive and time-consuming upgrades to bring capacity to several planned charging sites.

Long lead times for transformer and switchgear upgrades have led to a significant delay in commissioning charging depots. Moreover, the crunch for real estate in the proximity of drayage truck operating routes and pushback from communities makes it challenging to install charging stations in ideal locations.

The full report, Drayage trucking electrification, focuses on the state of the market and provides insight into drayage operations, available government incentives, ownership economics across states and business models supporting the transition. It’s available via our Grid Edge Service, or via our store.