Exploring the long-term outlook for hydrogen and ammonia

Electrification and low-carbon hydrogen are critical for taking the world towards a net-zero future. But cost pressures and the resilience of fossil fuels will take time to subside. How and what can be done to accelerate the transition?

4 minute read

Murray Douglas

Vice President, Hydrogen & Derivatives Research

Murray Douglas

Vice President, Hydrogen & Derivatives Research

Murray is responsible for Wood Mackenzie’s global coverage across the hydrogen value chain.

Latest articles by Murray

-

Opinion

Hydrogen: the outlook to 2050

-

Opinion

Our top takeaways from the World Hydrogen Summit

-

Opinion

eBook | The hydrogen opportunity from now to 2050: what utilities and developers need to know

-

Opinion

eBook | The hydrogen opportunity from now to 2050: what industrial players need to know

-

Opinion

eBook | Investing in hydrogen from now to 2050: what you need to know

-

Opinion

What lies ahead for hydrogen and low-carbon ammonia?

Electrification of end-use sectors remains the primary goal. Electricity’s ability to reduce emissions and deliver efficiency across most sectors makes it the most attractive decarbonisation option.

Wood Mackenzie’s base case view of the world forecasts electricity to increase its share of TFC from 20% today to 31% by 2050. 75% of that power generation will come from low-carbon sources by 2050.

We recently presented our findings on the long-term outlook for hydrogen and ammonia at our London Hydrogen Conference 2023. Complete the form on the right to download the full presentation as it looks at hydrogen production globally, the main players in the market and our predictions for growth. Or, read on for a short summary of the presentation.

The promise of hydrogen

Europe currently has the largest number of announced hydrogen projects with over half planned across the continent. But the US has taken the lead in announced capacity of low-carbon hydrogen. Underpinned by the generosity of the Inflation Reduction Act, the US’ lead over other countries looks set to remain.

Established hydrogen incumbents such Air Products, Air Liquide and Linde, have all started to increase their ambitions across the value chain in low-carbon hydrogen. The energy majors are building out increasingly large project pipelines as are a number of major utilities. Indeed, the rapid growth in low-carbon hydrogen announcements has brought with it a slew of potential project developers. There are now over 750 companies with stakes in low-carbon hydrogen projects.

Although many announced projects will fall by the wayside, the sector is increasingly ripe for consolidation – especially for those most advantaged projects which can secure the most competitive feedstock options and government supports.

The slow progress forward

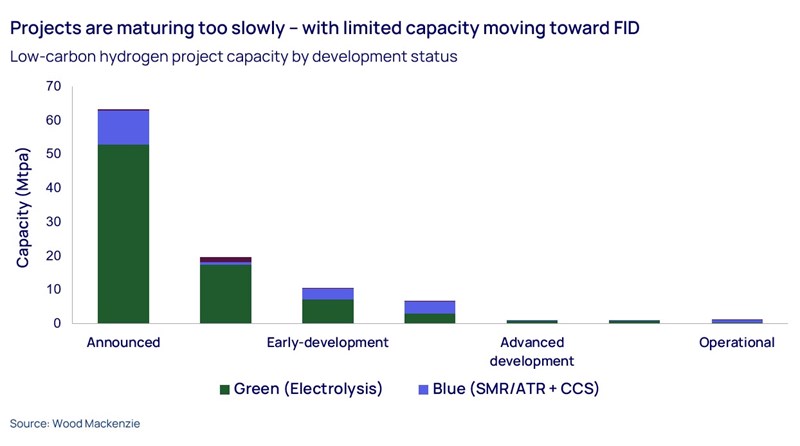

A sobering point to the great hydrogen revolution is that it is moving too slowly. More than 60% of announced capacity projects have not advanced. Projects under construction or in advanced development tend to be small and are only progressed by some of the more established players. Also, blue hydrogen projects account for over half of the capacity in the more advanced stages of development.

Of the projects at an advanced stage of development, we expect 1 Mtpa of capacity to reach FID in the next 12 months. That figure could extend towards 5 Mtpa by the end of next year but it would require rapid progress on some large-scale blue hydrogen projects, particularly on the US Gulf Coast and in the Middle East.

But much of this will come down to whether developers can overcome the many challenges they face.

From lack of clarity on global policy, to the volatility in gas prices and renewable costs, there is no shortage of challenges across both the blue and electrolytic hydrogen value chain. Financing of new industries can be challenging as lenders need time to understand the full risk profile.

For example, most electrolytic hydrogen projects in the near-term are looking to source through PPAs but these are difficult to source in many markets. Larger projects each pose different engineering challenges and in many cases are targeting exports which require additional infrastructure. All of this make it difficult to lock down project costs. Governments may have to offer loans and guarantees on top of other financial incentives.

And of course, securing offtake – can developers secure enough offtake, for how long, and at what price?

Costs remain a challenge for hydrogen

But the common challenge which we keep returning to is cost. Much of the feedback we have gathered from developers is around the higher costs on EPCs, and that these, together with some higher LCOE inputs, have lifted our forecast of the levelised cost of hydrogen (LCOH). While there are many variables in an LCOH calculation what matters the most is the cost of your electricity feedstock. The cost pressure on development in renewables is prevalent, especially in Europe, so the big challenge for the sector is to bring LCOH towards more affordable levels by bringing down the cost of the underlying electricity or renewables.

The willingness of offtakers to pay must increase – applying a cost on emissions to potential sectors is an important first step. And will help to close the difference between the cost of production and the price for offtakers – helping to reduce the burden on government finances supporting contract-for-difference type schemes.

The energy landscape is full of opportunity. The difference between traditional demand and new end-use sectors will continue to grow, with new energy demand opportunities dominating through to 2050. Much of the potential upside for this comes from the largest consuming sector right now – ammonia.

Learn more

To learn more about the opportunities in hydrogen and how ammonia could potentially break down the barrier for affordability, fill out the form at the top of the page to receive a free, complete copy of ‘Exploring the long-term outlook for hydrogen and ammonia’ .