Forecasting carbon offset use to 2050: what you need to know

While the growing role of carbon offsets is all but assured in the long term, there are challenges to overcome

2 minute read

Peter Albin

Senior Research Analyst, Carbon Markets

Peter Albin

Senior Research Analyst, Carbon Markets

Peter is part of the Carbon Research team which delivers intelligence, data and thought leadership pieces.

Latest articles by Peter

-

Opinion

A conversation with Decarb Connect: 3 key takeaways

-

Featured

Carbon management 2026 outlook

-

Opinion

Carbon markets: 5 things to look for in 2026

-

Opinion

Forecasting carbon offset use to 2050: what you need to know

-

The Edge

COP29 key takeaways

-

Opinion

Video | Lens Carbon: Deep insight into carbon removal projects, costs, and more

Michelle Uriarte-Ruiz

Senior Research Analyst, Carbon Offsets Valuations

Michelle Uriarte-Ruiz

Senior Research Analyst, Carbon Offsets Valuations

Michelle is part of the carbon team, providing clients with insights and analysis of carbon offset projects.

Latest articles by Michelle

-

Opinion

The forces shaping the future of carbon management

-

Opinion

Forecasting carbon offset use to 2050: what you need to know

-

Opinion

5 things you need to know about carbon offsets in 2024

-

Opinion

2024’s carbon policy so far: four key takeaways

Nuomin Han

Principal Analyst, Head of Carbon Markets

Nuomin Han

Principal Analyst, Head of Carbon Markets

Nuomin provides clients with insights into emissions and climate-related development.

Latest articles by Nuomin

-

Opinion

Flight path to net zero: aviation’s fuel outlook to 2050

-

Opinion

The forces shaping the future of carbon management

-

Opinion

Carbon markets Q2 update: policy shifts and market evolution

-

Opinion

Forecasting carbon offset use to 2050: what you need to know

-

Opinion

4 key carbon policy developments from Q1 2025

-

Featured

Carbon markets 2025 outlook

The flexibility of the carbon offset market is set to be its strength as governments and consumers increasingly pressure corporates to deliver emissions mitigation in the long term.

Our Carbon Offset Market Outlook presents Wood Mackenzie’s base case scenario for the evolution of the offset market through 2050. Fill out the form to access a free summary of the report, featuring key insights, charts and data—or read on for four key things you need to know.

1. Offsets will play an increasingly important role in a slower-than-hoped energy transition

We project that offset demand could increase more than tenfold over the next 25 years, fuelled by hard-to-abate sectors such as energy, aviation, consumer services and industry. As these sectors struggle to decarbonise, companies will increase offset purchases as an interim solution. Meanwhile, the long term transition to net zero will drive strong carbon removal demand to offset residual emissions, motivated by both voluntary and mandatory requirements.

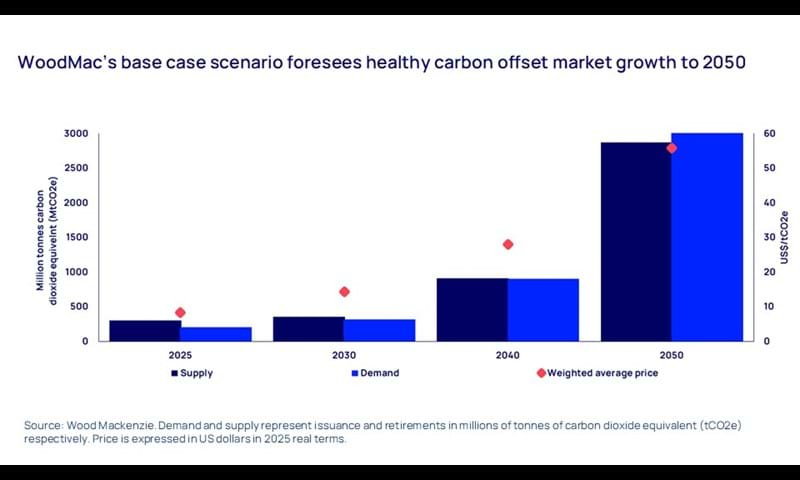

2. Volumes and prices rise in tandem to create a globally material market

We expect rising offset quality to support growing offset demand which will exceed supply by the 2040s and surge towards three billion tonnes of carbon dioxide equivalent (tCO2e) by 2050. Strong demand at higher prices will give developers and investors the necessary confidence to accelerate project deployment, enabling supply to broadly keep pace. The combined growth in volume and price will propel market value beyond US$150 billion, with highly priced carbon removals playing an increasingly important role.

3. Near-term challenges restrict market growth over the next decade

While we foresee a substantial long-term acceleration, the market faces a host of near-term challenges that will limit the initial pace of growth. Critical factors include offset quality, government regulation and endorsement, corporate claims guidance and carbon removal deployment. The broader economic and political landscape will also continue to influence the market, particularly while it predominantly relies on voluntary corporate action, though this reliance will diminish over time.

4. Higher offset quality and government endorsement will supercharge longer-term growth

Buyer preferences will play a pivotal role in market dynamics, with demand for high-quality, recently issued offsets creating upward price pressure. Offsets aligned with emerging guidance from governments and governance bodies, such as the Integrity Council for the Voluntary Carbon Market (ICVCM), are likely to be particularly sought after.

Although this quality focus may temper short-term growth, stronger long-term price signals are crucial to unlocking capital for projects with higher marginal costs. As market trust improves, reduced risk will attract voluntary buyers who are currently on the sidelines. It can also pave the way for further government endorsements of offsets in national and international compliance regimes, adding greater stability, depth and diversity to the composition of offset demand.

Together, these developments can create a positive feedback loop, accelerating the offset market’s transformation into a globally material one, both in terms emissions mitigation and market value.

Don’t forget to complete the form at the top of the page to receive your complimentary copy of the executive summary of this report. This covers the outlook for the carbon offset market to 2050 in more detail, including a selection of charts and data.