US grid edge deal flow surges

Key trends from our latest Grid Edge Quarterly Briefing

3 minute read

It’s been a good start to the year for the US grid edge technology sector. It has benefitted from a surge in deal flow and there are positive signs that investment will continue to flood in.

Every quarter, experts from our Grid Edge Service provide a comprehensive briefing with updates and analysis of the key trends in the grid edge ecosystem. Read on for four key themes from our latest report – and fill in the form on the page to receive a complimentary extract.

1. Massive deal flow across the grid edge

2023 has been tipped to be a banner year for the US grid edge. Deal flow certainly looks to be vibrant.

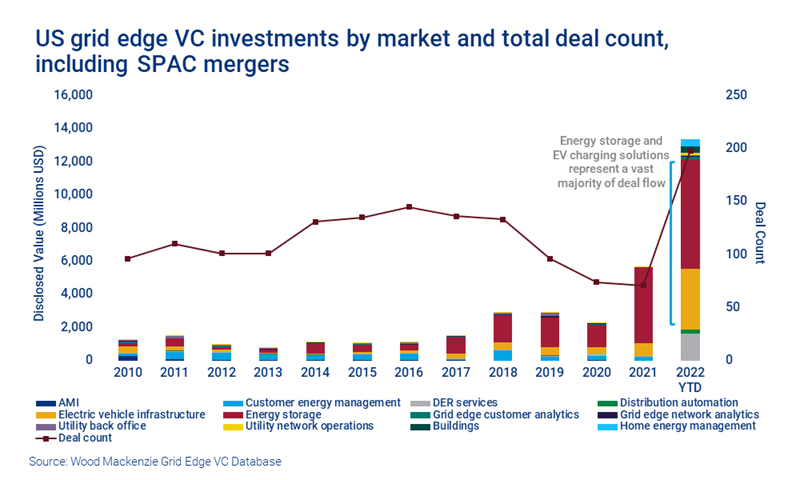

Massive venture investments have been made in electric vehicle (EV) charging infrastructure as demand for charging solutions grows. And federal investment will continue to spur the deployment of public charging infrastructure throughout 2023. During the course of this year, US$4.2 billion in funding is expected to be released to the sector from the US Department of Energy’s Grid Resilience and Innovation Partnerships program.

Energy storage has been another big area for deal-making, with at least eight investments in Q4 2022 exceeding US$100 million. All four US-based companies that have made those investments have also been awarded DOE grants – suggesting that federal dollars may well have been an investment driver.

Storage investments spanned the value chain, from manufacturing to recycling. Investors are equally diverse, from climate to infrastructure funds, which shows that storage appeals to a range of investors.

2. Drive to modernize US grid infrastructure supported by positive regulatory changes

After years of underinvestment in US grid infrastructure, public funding and regulatory support will drive grid modernization in the year ahead. Regulators are increasingly amenable to utilities rate-basing grid modernization investments, for example, as well as more targeted cost-recovery mechanisms, like rate riders. US$8 billion is also available through two massive grid-related federal grant programs.

Despite this support, a bottleneck has emerged in grid innovation. While corporates and venture funds have invested billions of dollars per year in R&D, investor-owned utilities have invested an average of only 0.1% of ratepayer revenue. The speed and scale of utility investment will need to increase in order for vendor R&D to reach commercialization and cover its costs.

Heat pumps will also get a boost from regulatory changes. In building codes across the country, regulators are setting efficiency requirements that essentially mandate their use. Meanwhile, heat pump adoption will be supported by subsidies offered under the Inflation Reduction Act (IRA), as well as state and city electrification policies.

3. Costs continue to increase for heat pumps and other technologies

While heat pumps will be supported by regulatory incentives, their costs have risen 11% year-on-year since 2020 across major manufacturers. In 2023 alone, heat pump costs are 4% higher. Contractor shortages and increased metal, refrigerant and labour costs will continue to drive the all-in price further upward.

Regulatory support can’t address the operating costs of heat pumps. Those depend on the ratio between the retail electricity price and retail natural gas price during the heating season. The breakeven threshold for this ratio, below which heat pump raise customer costs, depends on the efficiency of the appliance and the mildness of the climate. Heat pumps make more sense in milder climates, such as Florida, which has a favourable electric/gas ratio and has consequently long been in the money for this technology.

Heat pump adoption is most likely to succeed in markets where it saves customers money on their winter heating bills. Right now that is in a large majority of US states.

4. Watch this space for innovation in home energy management

Historically, home energy management (HEM) systems have been toy technology. They are quickly becoming an imperative, however, in order to protect customers against rising electricity prices and help them manage time of use (TOU) tariffs and dynamic EV rates. These systems will also be needed to manage solar that is not net metered, such as under California’s new solar tariff, which must be aggressively self-consumed in order to make solar economics work.

New life has been breathed into HEM through partnerships between heavyweights of the grid edge space. Sunrun, Sunnova, Generac and Enphase are partnering to explore these systems – which will mean that your rooftop solar and storage could soon be talking to your home charger.

The Grid Edge Quarterly Briefing explores key trends and outlooks in more detail. Our complimentary extract includes charts on:

- How heat pump operating costs depend on the spread between retail electric and gas prices

- The impact of government incentives on commercial charging infrastructure growth

- US energy storage deployments.