Get Ed Crooks' Energy Pulse in your inbox every week

The coming US low-carbon energy boom

Subsidies in the Inflation Reduction Act have stoked fears in other countries that investment will be drawn to the US

8 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Inside the ‘crazy grid’

-

Opinion

The Big Beautiful Bill is close to passing

-

Opinion

Ceasefire in the Israel-Iran conflict

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

EBOS: the unsung hero that’s accelerating clean energy deployment

-

Opinion

What the US attack on Iran’s nuclear installations means for energy

In the fable of the hare and the tortoise, the hare wakes up from his nap just in time to see the tortoise about to cross the finish line and win their race. The international response, especially in Europe, to the passage of the US Inflation Reduction Act last August has felt rather like that. European policymakers have become used to thinking of themselves as global leaders in the race to build a low-carbon energy economy. But the extensive tax credits and other subsidies for low-carbon energy included in the Inflation Reduction Act have been widely seen as propelling the US into first place as a location for investment in those technologies.

Many European politicians and business leaders have raised concerns about the new law, particularly over its tax breaks for products manufactured in the US. Margrethe Vestager, the European Commissioner for competition, said in December: “The Inflation Reduction Act is… a very strong pull factor to move investment and jobs to the US at the cost of partners and allies like the EU.” She added: “It goes against the spirit of our transatlantic partnership.”

Senator Joe Manchin, a centrist Democrat from West Virginia whose support was critical for passing the act, said that when he met President Emmanuel Macron of France in Washington late last year, the president said to him: “You’re hurting my country.”

The US has been in talks with the EU to try to resolve some of those concerns. But in general the administration has argued that other countries should be following the US lead, not trying to stop it. John Kerry, the US climate envoy, said at the World Economic Forum in Davos last week: “Europe already spends an enormous amount of money, but let’s go, folks. All of us need to be doing more.”

Europe is already responding to his challenge. Ursula von der Leyen, president of the European Commission, last week announced a package of proposed measures, including a Net-Zero Industry Act, intended to “focus investment on strategic projects… [and] simplify and fast-track permitting for new clean-tech production sites.” The commission is also proposing reform of state aid rules to “keep European industry attractive... [and] be competitive with the offers and incentives that are currently available outside the EU.”

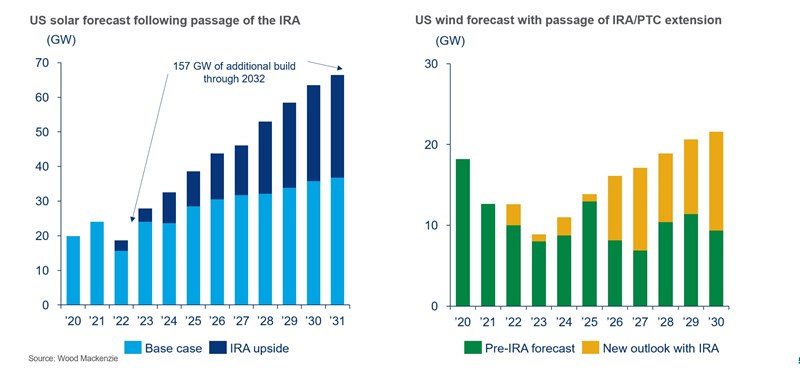

There have been objections to these plans from some European politicians. But the case for Europe doing more to respond to the US strategy seems compelling. Wood Mackenzie forecasts for expected investment in solar, wind, battery storage and other low-carbon technologies suggest that the Inflation Reduction Act has transformed the outlook for the next ten years.

There are still significant uncertainties, in particular because the US Internal Revenue Service has not yet provided detailed guidance on eligibility for some of the new credits. But the magnitude of the impact already seems clear.

In solar power, for example, the Investment Tax Credit, which was previously being phased out, is now available at 30% until 2032. Projects can also choose instead to receive a Production Tax credit, which was not previously available for solar. As a result, Wood Mackenzie now expects the US to add 500 gigawatts of solar generation capacity in the next ten years, up about 50% from the projection before the Inflation Reduction Act passed.

(Of course, the act is not the only factor affecting the outlook, but it is clearly the single most significant factor strengthening expectations for investment in low-carbon technologies.)

In the wind industry, the picture is similar. If the Production Tax Credit for wind generation, which expired at the end of 2021, had not been revived, Wood Mackenzie expected about 94 GW of additional capacity to be installed in the US, onshore and offshore, over 2022-31. With the new tax credits in the Inflation Reduction Act, we expect installations over the same period to total about 173 GW, an increase of 84%.

The charts showing the changes in expectations for utility-scale solar and wind make the point very clearly.

The picture is similar for energy storage. Under the Inflation Reduction Act, stand-alone storage systems are for the first time eligible for the Investment Tax Credit, and the credit for hybrid storage paired with solar generation has been extended. The result has been a sharp increase in expectations for future investment.

Wood Mackenzie’s latest forecast is that the US will add grid-scale battery storage with output capacity of about 143 GW between 2023 and 2032. That is about 42% higher than the projection of about 101 GW without any new tax credits.

Putting that in monetary terms, we now expect about US$150 billion to be invested in storage in the US over 2023-32, compared to about US$85 billion in our pre-Inflation Reduction Act forecast.

There are similar pictures for other low-carbon technologies. The Inflation Reduction Act included significant increases in the value of the 45Q tax credits for the storage and utilisation of carbon dioxide, whether from capturing industrial emissions or by Direct Air Capture.

The US currently has 23 million tons per annum of carbon capture capacity in operations, with a further 112 Mtpa planned. Over the next 10 years, we expect at least an additional 55 Mtpa of capacity to be announced, largely driven by the more generous incentives in the Inflation Reduction Act.

The act also includes a tax credit for “clean hydrogen” production, which will be most generous — at a rate of US$3 per kilogram — for green hydrogen produced by electrolysing water using electricity from renewables.

We have not yet seen much impact from that credit in terms of investment announcements, but it is forcing companies that aim to invest in hydrogen to reassess their plans, says Bridget van Dorsten, Wood Mackenzie’s senior analyst for hydrogen. A subsidy of that size could make it difficult for projects elsewhere in the world to compete against US producers. Some companies are exploring ways to invest in US projects or develop US production of their own.

US equipment suppliers will be well placed to win business in many of these fast-growing markets. As explained in Wood Mackenzie’s recent Horizons report, Boom time: what the Inflation Reduction Act means for US renewables manufacturers, the new incentives, particularly the Advanced Manufacturing Production Credit, will make US factories highly competitive sources for products including wind turbine blades and battery cells.

The US shift towards using economic policy more actively to favour domestic manufacturing began under President Donald Trump, and has been extended under President Joe Biden. It is a sign of a changing world that is not deglobalising, exactly, but certainly re-globalising, with shifting trade patterns that reflect new imperatives, including energy security and job creation, rather than the goal of ever more open markets.

European protests over the Inflation Reduction Act will continue. So will negotiations between the US and the EU over ways to mitigate the act’s impact on European industry. But ultimately, European and other governments around the world are likely to decide that it will be easier to join the US in offering more generous subsidies for low-carbon energy, rather than trying to beat it.

In brief

Eskom, the South African power company, announced it would have to increase load shedding – scheduled rolling blackouts – this week, after breakdowns of generating units at four separate power plants. As of Wednesday, Eskom had about 16 GW of generation capacity unavailable because of breakdowns, with a further 6.5 GW unavailable because of planned maintenance.

The increasingly frequent rolling blackouts have been hitting South Africa’s industries, including mining and agriculture. In a statement earlier this month, Eskom said “the only way to end load shedding is to add additional capacity”, and warned that the shortfall in electricity supply “can only increase as the current fleet gets on in years and its performance continues to deteriorate.”

The collapse into administration of Britishvolt, the UK-based battery start-up, means that Britain “will likely find itself having to import its EVs and batteries”, Wood Mackenzie’s senior analyst Max Reid has said.

Shell has launched a strategic review of its household energy retail businesses in the UK, the Netherlands and Germany, the Financial Times reported.

US airlines expect strong demand growth in 2023.

The rapid growth of EV sales in India is prompting a reassessment of the country’s long-term fuel demand outlook, Reuters reported.

EQT, the largest natural gas producer in the US, has cut its methane emissions by 70% with a US$28 million programme to replace all the gas-powered pneumatic devices from its production operations.

Other views

Fahimeh Kazempour – Grid edge: predictions for 2023

Sylvia Leyva Martinez, Michelle Davis and Sagar Chopra – Brighter skies for US solar in 2023?

Bill Gates – The surprising key to a clean energy future

Jackie Northam – Russia has amassed a shadow fleet to ship its oil around sanctions

Thea Riofrancos and others – Achieving zero emissions with more mobility and less mining

Quote of the week

“The key is to minimise the warming as much as possible… At this point, to stay below 2.5 °C would be pretty fantastic. I do think that’s possible.” – Bill Gates, the Microsoft founder who has become increasingly active in funding innovative low-carbon energy technologies and talking about climate change, gave his view on what might be a realistic goal for policy. He argued that there was “no chance” of keeping global warming since pre-industrial times to just 1.5 °C, the more ambitious objective set in the 2015 Paris climate agreement, and said even a 2 °C goal was “very unlikely” to be achieved.

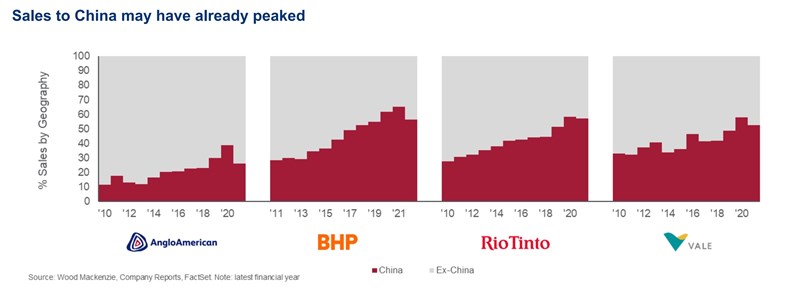

Chart of the week

This comes from a new report from our metals and mining corporate research team, highlighting five key themes to expect in the industry this year. One of those themes is companies starting to position for the “post-China era”. The strength of long-term demand growth in China for key commodities including iron ore, copper and nickel has shaped the global industry for decades. But Wood Mackenzie analysts argue that today “rising debt and unfavourable demographics dampen prospects for growth.” Mining companies are expected to focus more on building relationships in faster-growing Asian markets, including India, Indonesia and Vietnam. For the four large international groups shown here, the share of total sales accounted for by China may already have peaked.