Harnessing the sun: how rising solar power demand impacts base metals

Solar is shining on aluminium, copper and zinc

1 minute read

Solar power has a key role to play in decarbonising the global economy. Falling production costs and improving efficiency are set to drive up demand for solar power significantly, and that could be good news for base metals like aluminium, copper and zinc, all of which are integral to the manufacture of solar panels.

Visit the store to read our report Harnessing the sun and opportunities for base metal demand in full, or read on for an extract. You can also fill in the form to access our latest metals and mining briefing, where our experts discussed the impact of the energy transition on different metals.

Solar: a rapidly growing market

Even under our base case scenario, solar generation capacity worldwide will triple between 2020 and 2030, then triple again by 2050. To keep global warming within the 1.5 °C to 2 °C range targeted by the Paris Agreement, capacity growth would need to be double that. According to our Power and Renewables team, around half of increased capacity will be installed in mature markets and the Asia Pacific region, with the lion’s share of future growth coming from rapidly evolving demand for green electricity in China.

The role of base metals in solar generation

Soaring demand for solar power means increased demand for a range of metals used in the construction of solar power plants. A typical solar panel comprises multiple base metal components, including aluminium and galvanised steel (coated with zinc) for structural parts. Copper is used in high and low voltage transmission cables and copper tubes in thermal solar collectors.

Of the three major categories of solar system, photovoltaic installations – which use panels of photovoltaic (PV) cells to convert the sun’s energy into direct current (DC) electricity – will account for most future growth. Concentrating solar power (CSP) plants use mirrors to focus the sun’s energy onto a heat transfer fluid. We expect the most metal intensive CSP systems will account for 8% of the annual capacity by 2050, from less than 1% today. The third type of installation, thermal solar systems, use the sun’s heat to warm water, and are likely to be increasingly displaced by PVs in the future.

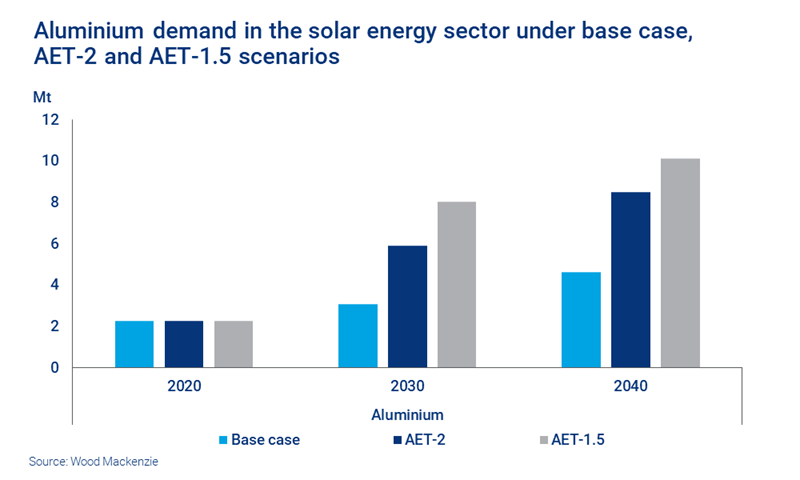

Annual aluminium demand from solar could rise by 3.5x

We estimate the average aluminium content of a PV system at 21kg per kW. In CSP systems the intensity of aluminium use is more than double that, totalling around 47kg per kW. As you can see from the chart below, in our base case that translates into aluminium demand in the solar sector of almost 4.6 Mt by 2040. On a 1.5 °C pathway, under our AET-1.5 scenario, it could be as much as 10 Mt – increasing solar’s share of total aluminium consumption from 3% to 12.6% in 2040.

Aluminium’s potential doesn’t end there, since several elements of CSP systems which currently rely heavily on steel could switch instead to aluminium-based designs. Given steel’s cost advantage in applications where weight isn’t an issue the degree of substitution is uncertain. However, it’s worth noting that a complete switch to aluminium would increase demand for the metal by at least 50%.

What’s more, solar power has the potential to decarbonise the electricity used in aluminium production, a process which is extremely carbon-intensive. (For an independent assessment of emissions in aluminium production check out our Metals and Mining Emissions Benchmarking Tool). The United Arab Emirates will soon be the first country to use solar energy in aluminium smelting, with a pilot project set to produce 40,000 tonnes per year of aluminium using 560,000 MWh of solar power. If scaled up, this approach would create a positive circularity between the use of solar power to produce aluminium and solar power as itself a component of aluminium demand.

How will copper and zinc consumption change as demand for solar power generation increases? Read the full report to find out more.

How will the trend towards larger modules impact metal intensity?

Since 2013, solar wafer and cell sizes have increased by between 2mm and 53.25mm in length, resulting in an increase of area between 6% and 35%. Wafer size increase has translated to module area increases between 25% and 50%, depending on the module design, within the same time period. Attempts to land on an industry-wide standardised wafer size have so far resulted in a market flooded with products varying in size and design – however, emerging trends indicate that in years to come a typical module will be 50% larger than they are today.

The increase in module size will affect the use of different metals to different degrees. We expect that the structural design of the module has approached the optimal level, so the aluminium intensity will remain broadly unchanged. How will the trend for larger modules affect zinc and copper demand? Find out more by reading the full report.

Want to know more about how the rise of renewables affects base metals demand?

Our recent Metals and Mining Briefing featured a discussion of the impact of the energy transition on different metals.