Why floating solar has an important role to play in the energy transition

Land scarcity, decarbonisation targets and falling prices will all fuel the growth of this niche industry

1 minute read

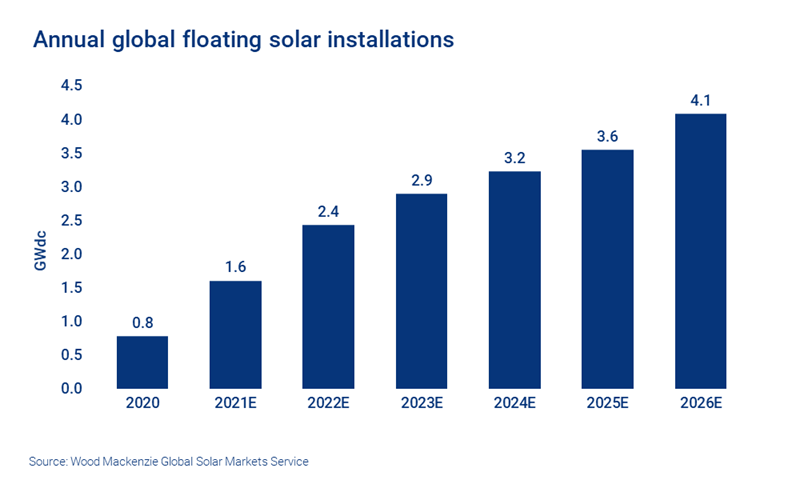

The global floating solar (FPV) market has seen remarkable growth over the last few years, and it shows no signs of slowing. We estimate that the global FPV market will reach 1.6 GWdc in 2021 – more than double the total installed capacity in 2020.

So, what are the benefits of FPV and what role will it play in achieving net zero ambitions?

Fill in the form for an extract from our Floating Solar Landscape 2021 report, or read on for an overview.

Although FPV will likely represent around 1% of global solar demand in 2021 – a drop in the bucket for global solar installations of 149 GWdc in 2021 – the market is a promising one.

FPV has an important role to play in the energy transition as it presents an opportunity for solar markets facing challenges with traditional PV applications. As more countries commit to competitive solar and overall renewable energy targets, FPV will be key to meeting these goals.

China leads the way in FPV, but others are catching up

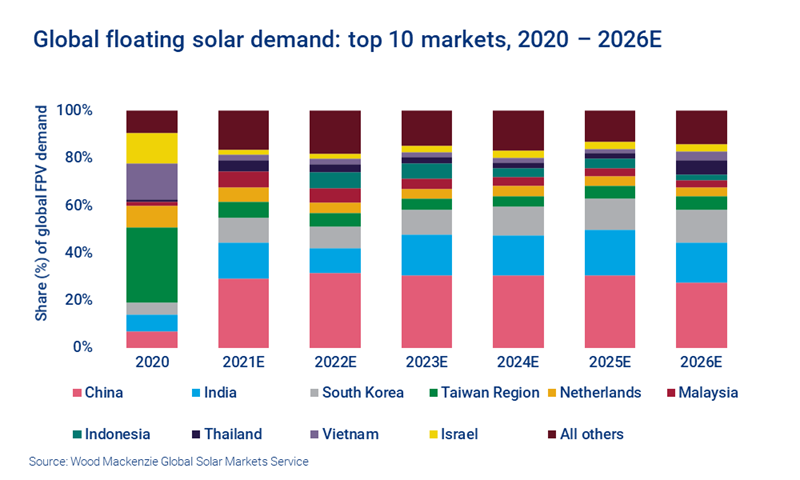

China will dominate FPV installations over the next five years, with India and South Korea trailing close behind. Country-level targets, such as China's carbon neutrality goal, South Korea’s 9th Basic Plan, and India’s 2022 solar installation target, will all contribute to growth in these countries.

Although Japan currently has the largest number of completed FPV projects of any country globally and will see high growth of FPV, projects are typically smaller and therefore cumulative capacity is less than that of other countries in Asia. This is a trend that we expect to continue. Other markets in Asia, namely Taiwan, Malaysia, Indonesia, Thailand, and Vietnam, will see FPV become huge growth markets this decade.

Outside Asia, the Netherlands will continue to lead the European FPV market through 2026, with other countries, such as France and Spain, expected to maintain a significant share of the European market by the same year.

While Asia and Europe are expected to hold most of the global FPV capacity through 2026, other markets will emerge over the coming years. For example, Israel had a record year in 2020 in terms of FPV installations and is likely to continue to be a strong FPV market participant in the Middle East.

What are the benefits of floating solar?

FPV installations won’t work for just anyone. Most FPV systems are large-scale and provide solar power for utility companies, large communities, companies, or municipalities.

One of the biggest advantages of FPV is that installations don’t need the large amount of land required by ground-based systems. Most of these installations can take unused space on bodies of water, therefore minimising the impact on land that could serve another purpose in the future.

The bodies of water that host FPV systems help the array to cool down. This increases efficiency of the solar modules in hot climates, which presents multiple opportunities around the globe.

The challenge: balance of system and soft costs

All-in costs for FPV applications are typically more expensive than ground-mount technologies of a similar size and location. This is typically because of high soft costs and structural balance of system costs (SBOS).

FPV system costs are highly variable by country and site. Japan continues to be the highest cost market with average system costs of $2.68/Wdc in 2021, while India currently has the lowest system costs of $0.78/Wdc. While there are multiple factors that cause system costs to be high or low within countries, larger projects can typically take advantage of economies of scale for both component and labour costs.

Although FPV systems are typically more expensive than their ground-mount peers, increased development and installation experience will contribute to reduced costs in the future. Average FPV project costs in South Korea, India and the Netherlands are inching closer to ground-mount applications of a similar size. While in the Netherlands, average FPV costs are approximately 25% higher than ground-mount projects in 2021 – down from over 50% in 2019.

What does the future hold for FPV?

As costs continue to fall, solar’s share of power supply will rise and begin to displace other forms of generation, according to our research. And this will only benefit the FPV market.

The confluence of land scarcity, country-level carbon neutrality targets and falling prices will all contribute to the growth of this niche industry. Given the higher cost of floating applications compared to ground-mount systems, financial incentives and government support are still crucial in most markets for floating solar to survive and thrive.

Interested in our Floating Solar Landscape 2021 report? Fill in the form at the top of the page for a complimentary extract.