How bitcoin mining can support the energy transition

While not a magic bullet, bitcoin mining has strong potential in both demand response and exploiting stranded capacity in electricity generation

1 minute read

Bitcoin mining* often makes headlines because of the large quantity of electricity the process consumes. But there are opportunities for it to support the energy transition.

We have identified two key short-term opportunities for bitcoin mining in the US: first, as a highly predictable and scalable demand response asset; and second, to provide additional demand for cheap, under-utilised electricity generated by independent power producers and utilities.

1. Bitcoin for demand response

Bitcoin is not a battery

In both a recent article published by Nick Grossman at Union Square Ventures and an investor letter from Aker, bitcoin mining was compared to a battery. In both instances the comparison was used to invoke the way bitcoin mining can help the energy transition. While the analogy is powerful in its simplicity, it is not accurate.

Like batteries, bitcoin mining can shift demand across time and act as an energy load. Bitcoin mines, however, cannot store and discharge electricity. In fact, shifting mining demand literally requires turning off computers. The real potential for bitcoin mining is in decreasing loads through demand response.

What differentiates bitcoin mining for traditional demand response?

Much of the load at bitcoin mines is associated with the cooling of systems and computing power. Historically, turning off heating, ventilating and air conditioning (HVAC) systems, reducing industrial loads and shifting operations has been a mainstay of demand response programs.

In this light, what differentiates bitcoin mining from other industrial loads for demand response?

- Speed to scale

The Electric Reliability Council of Texas’ (ERCOT) 2020 annual demand response report highlighted three new registrations from data centers to participate in ancillary services as controllable load resources. Meanwhile, a press release from Lancium and MP2 (a Shell company) states that theirs is the first load-only controllable load resource to register with ERCOT. The 100 MW of capacity can participate in multiple markets, including frequency stabilising non-spinning reserves directed by ERCOT.

Using data from the Cambridge Bitcoin Electricity Consumption Index, we estimate peak demand from bitcoin mines across the US in March 2021 at 1.2 GW, using 9.6 tWh annually.** By comparison, we estimated in 2020 that all assets enrolled in demand response programs constituted 32.9 GW. If Bitcoin and other cryptocurrencies continue to grow in line with historic trends, these data centers could grow significantly, creating tens of gigawatts of new demand.

- Reliability and predictability

While scale is important, it's insufficient on its own to change the way grid operators see bitcoin miners' potential for demand response services. Reliability and predictability are also key: if grid operators have highly predictable, reliable, scalable loads, they can use these assets in a similar way to peaker plants to manage peak demand. In addition, they can be used to increase demand during renewable curtailment events in a way that is not feasible with current demand response resources.***

For context, the California Independent Service Operator highlighted that during the August 2020 rolling blackouts “about one third of demand that was counted towards meeting resource adequacy requirements was not available”.

And so, what makes bitcoin mining more reliable for demand response that traditional assets? We identify three features of bitcoin mining that could make it more reliable and predictable than traditional industrial processes for demand response:

- Sensitivity to electricity price incentives

Energy costs can account for over 80% of bitcoin mines’ operational expenses, so they are often more sensitive to electricity prices than other industrial customers. If the price of electricity suddenly spikes during the afternoon peak, for example, this can incentivise bitcoin mines to shut off operations temporarily.

- 24/7 operations

Power system operators need flexible resources to be available 24/7, not just industrial loads that are running during work hours, as recent events in Texas have illustrated. Because bitcoin mines operate around the clock, they can be used at any time of day to decrease load, for example during a sudden cold snap or evening peak.

- Non time-sensitive computation

Ramping computational power up or down to align with renewable generation is already being explored for traditional data centers: for example, Google is shifting when to complete its non time-sensitive computations to align with generation from renewables. Bitcoin mining’s computations are similar to non-time sensitive computation because of the probabilistic nature of mining new coins; whether a mining algorithm is run in the middle of the day or the middle of the night it is effectively fungible, which provides flexibility.

As an illustration, Layer1 used their data centres for demand response events in the summer of 2020 and announced a 700% profit compared to mining new bitcoin. Demand response providers such as MP2 and Voltus are finding new customers, while multiple bitcoin mining companies are putting forward a savings thesis including Layer1, Lancium, and Seetee (a division of Aker).

We see a second big opportunity for bitcoin mining to act as additional load for cheap, stranded generation.

2. Bitcoin for under-utilised generation

An untapped opportunity?

As we mentioned, bitcoin mines differ from batteries. Rather than storing electricity, they consume large quantities of it. As a result, we see a second big opportunity for bitcoin mining to act as additional load for cheap, stranded generation.

The high impact of electricity prices on their operational expenses has already seen bitcoin mines moving to the Pacific Northwest for access to cheap hydropower and to Texas for cheap wind and natural gas. This has led to much discussion of the potential of valuable off-take agreements for bitcoin mining to enable the development of new renewable generation. However, we have yet to identify individual solar or wind projects where this has come to fruition in the US: Plouton Mining had announced a 10 MW solar-plus-storage project in California for bitcoin mining in 2019, but they are no longer in operation.

Our discussions with industry participants suggest power purchase agreements (PPAs) of 15 years don’t align with bitcoin miners’ time horizons. To put this contract length in perspective, bitcoin was established in January 2009, just 12 years ago. The volatility and increasing difficulty of mining as new participants join the network have discouraged such long-term contracts.

Pioneering projects

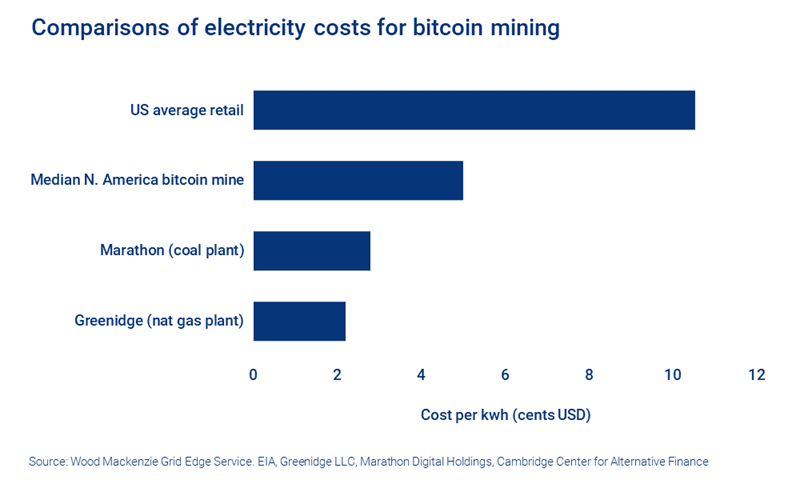

Despite the barriers, we’ve tracked three individual generation sources benefiting from US bitcoin mining. These projects provide electricity for under US$0.03/kWh, significantly less than the median price for bitcoin mines in the US and just over a third of average US retail rates. These examples illustrate where bitcoin miners could support additional solar and wind projects.

In 2019, Crusoe, EZ Bitcoin and others announced the development of mobile data centres which can be deployed at oil and gas extraction sites. The units use natural gas that would otherwise be flared to produce cheap computational power. Crusoe has over 30 mobile units operating primarily across North Dakota, Montana and Wyoming and expect to have over 40 MW of capacity by the end of 2021. We have heard estimates for electricity costs for these systems vary by site and can range from US$0.02 - US$0.05/kWh. It would not surprise us if oil and gas companies explored bitcoin mining at extraction sites as an uncorrelated revenue stream in addition to their traditional business.

In the same year, Greenidge Generation in New York announced the installation of a cryptocurrency data centre to augment the natural gas plant’s revenues from power generation. This power plant sits on some of the lowest priced pipeline gas in the US through the Empire Pipeline System. It currently provides 19 MW of electricity for bitcoin mining at US$0.022/kWh. The centre has potential to expand to use 106 MW of power generation capacity. The company plans to scale to at least 500 MW of bitcoin miners across additional power plants by 2025.

In October 2020, Marathon Patent Group announced plans to build a 37 MW bitcoin mine at the 119 MW coal plant in Hardin Generation Station In Montana. The mine will receive electricity at a price of US$0.028/kWh under a five-year PPA. Startups like Digital Power Optimization and Sangha Systems also plan to integrate bitcoin mining at power plants.

What's next?

While the design of the bitcoin mining algorithm pushes miners towards the cheapest electricity, time horizon is a key issue — as both Marathon’s five-year PPA and Crusoe’s systems’ mobility illustrate. With renewable generation increasingly offering shorter PPAs, utilising hedge agreements and having merchant-tail risk, this is changing. We foresee large solar and wind projects benefitting from five-to-ten-year off-take contracts with bitcoin mines to mitigate merchant risks. Bitcoin mining was not designed to enable the energy transition, but some of its features could shift the energy value chain.

Find out more about the pathway to global net zero

What would it take to limit global warming to 1.5 degrees? To find out, Wood Mackenzie developed a 1.5 °C Accelerated Energy Transition (AET-1.5) scenario, which our experts recently presented in a Pathway to global net zero 2050 webinar.

Fill in the form at the top of this page for a complimentary replay, and an extract of slides from the presentation.

Footnotes

*Throughout this piece we reference bitcoin mining over other cryptocurrencies because of the scale of market capitalisation (as of publication over $900 billion). A similar analysis applies to other cryptocurrencies using proof of work for verification as they reach similar market capitalisation.

**At the time of writing, estimates of demand were 16.79 GW globally and 133.65 tWh annually, with the US making up 7.24% of the global hash rate. This again is an estimate based on assumptions of US miners having average efficiency and computational power relative to the global fleet of bitcoin miners. The upper and lower bounds can also vary significantly.

***There is a foreseeable instance where a sudden and dramatic increase in bitcoin prices could cause these miners to be willing to mine bitcoin regardless of the variability in electricity pricing. Given the volatility of bitcoin this scenario would likely make up a small fraction of total operating hours of the year but could challenge the predictability of these assets.