Discuss your challenges with our solutions experts

How real-time data and analytics inform trading decisions in major commodities

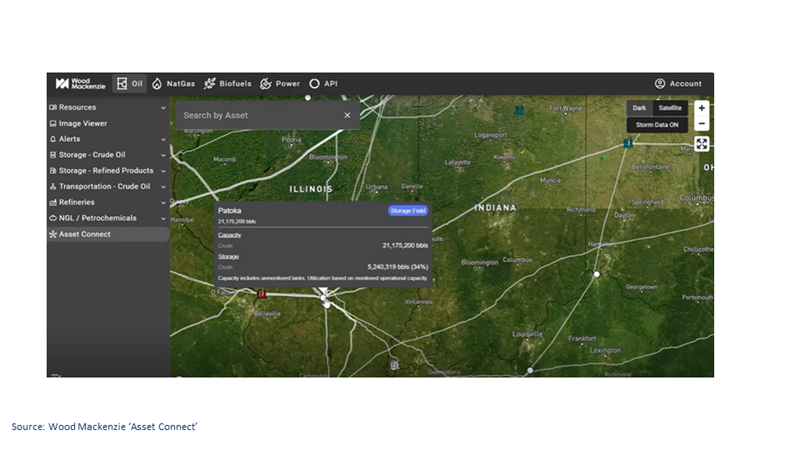

A demonstration of how Wood Mackenzie's Asset Connect product assessed the impacts of a power outage on the crude and refined products market.

Author: Jim Mitchell, Director, Trading SME Oil & Products

A demonstration of how Wood Mackenzie's Asset Connect product assessed the impacts of a power outage on the crude and refined products market.

On 15 July, between 7 PM and 10 PM CT, a large storm spread through the Chicago area, spawning over 30 tornadoes that lead to power outages. One of the tornadoes was just south of the Joliet Refinery.

Real-time data intelligence

Using our Asset Connect product, this is a demonstration of how data-driven intelligence can assist traders, analysts, and operators in making investment decisions in the crude and refined products market.

Although this demonstration took place some weeks after the event, the analyses could have taken place in real time.

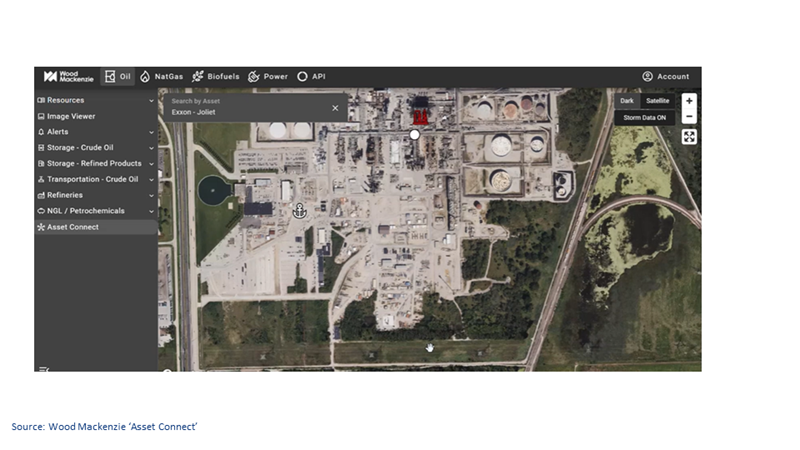

At the Joliet Refinery, subscribers to our product would have seen high voltage lines on the southern edge. Coupled with tornadoes, high voltage lines can indicate a multiweek power outage.

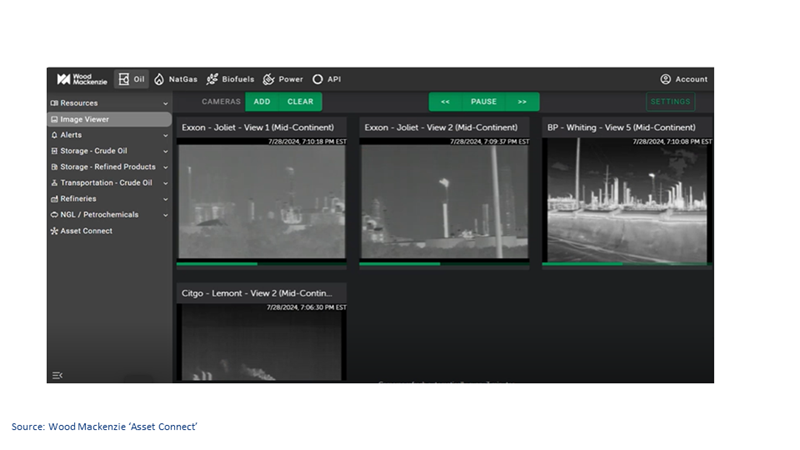

The image below shows two views of the Joliet Refinery. Note that the units are not white hot like the images on the two nearby refineries, which are operating normally:

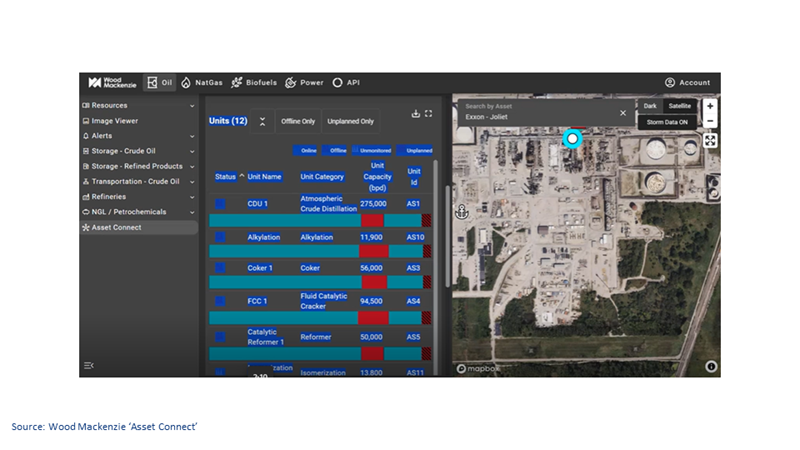

On Asset Connect, market participants would have seen the unit outages appear as shown below:

The potential impacts of the storm

As a consequence of the crude units being down (as shown above), the 275,000 barrels a day of crude oil produced at the Joliet Refinery will not be going to the refinery or its tank farm and could back up in the pipelines servicing the area.

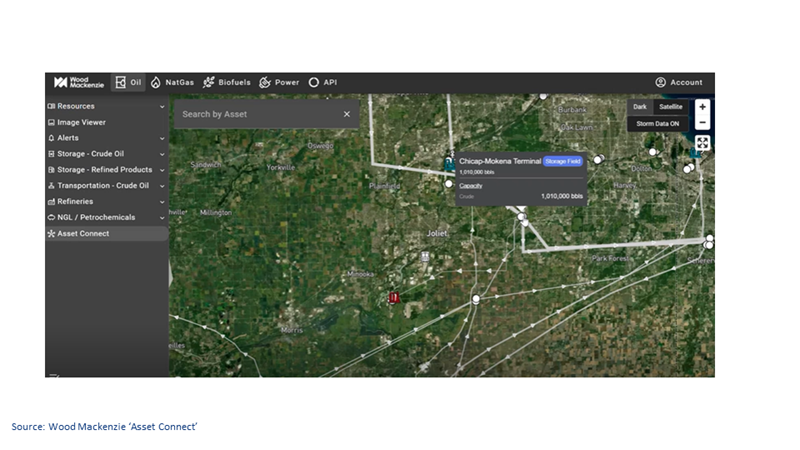

For storage, Asset Connect displays the pipelines, the interconnects and the utilisation. The image below shows the pipeline that connects the Joliet Refinery to the Mokena terminal:

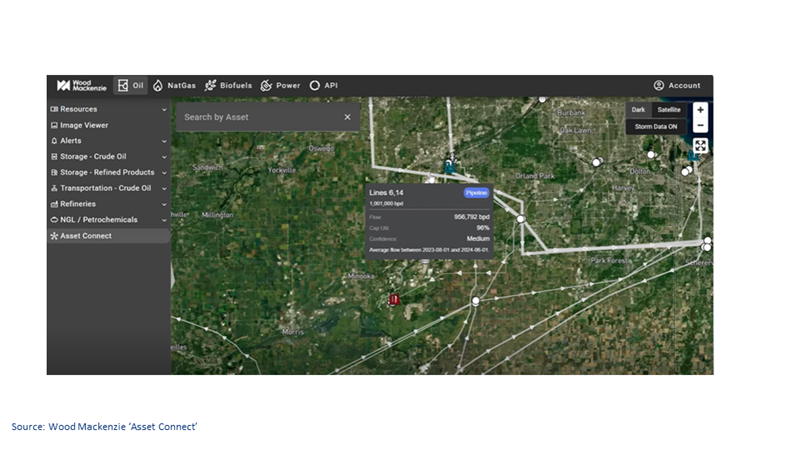

Focusing on the Mokena terminal, we see line 6 and line 14 have a very high utilisation rate:

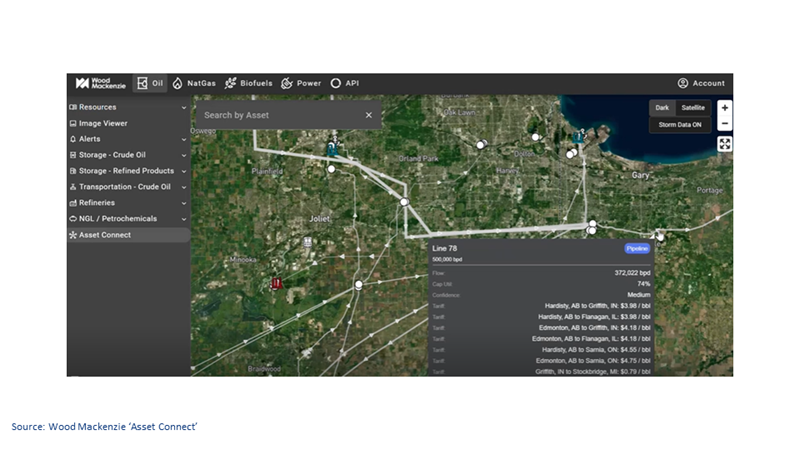

And when we look beyond the Griffith Terminal on line 78, we see that although utilisation is lower, it remains relatively high for that area:

Analysing crude storage capacity

The crude market had been in backwardation, with prompt month prices presenting higher than deferred month prices, indicating a lack of incentive to store crude.

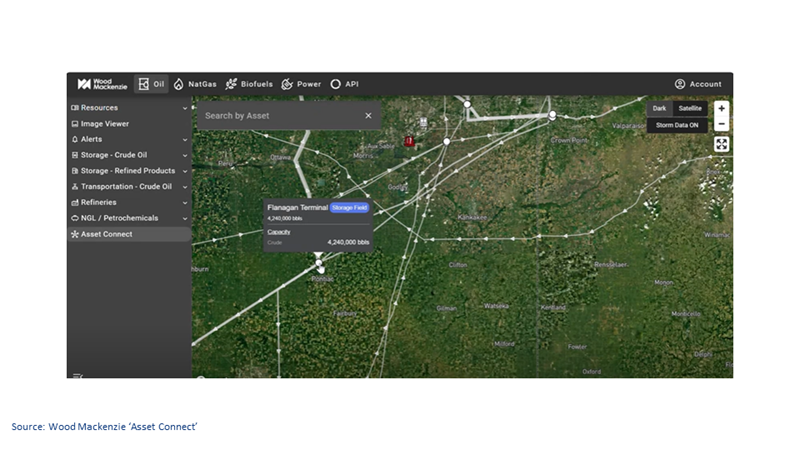

Analysing some alternative routes, in line 61 we look down at the Flannigan terminal and see a significant amount of storage:

High utilisation in the pipelines will cause differential oil price pressure upstream from Joliet, however, this will be mitigated by the available storage capacity.

Identifying issues with refined supply

The real issue arises on the refined product side. Asset Connect shows three large problems.

Firstly, the alkalisation unit produces octane additives for high octane gasoline. The industry is noticeably short, so this additive and the outage of 11,900 barrels a day will not help the situation.

Secondly, cokers do not like cold shutdowns, such as power outages. This could be the unit that delays the refinery running at full capacity. Our refinery product has a camera on the coker, so subscribers would know in real time when that unit is up and running:

Finally, the Fluid catalytic cracking (FCC), and the reformer outage shows that there are approximately 145,000 barrels a day of gasoline off the market. This suggests that the shortage will put upward pressure on gasoline prices and refinery cracks in the area, which it has.

Navigate the crude oil supply chain

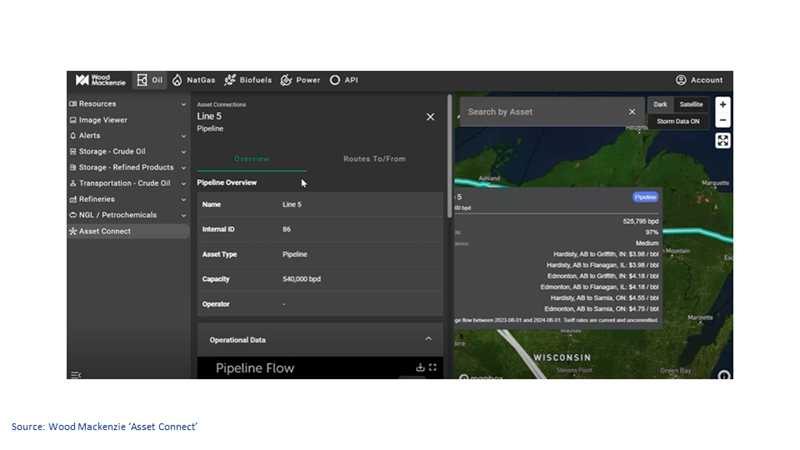

In the event of a disruption to the crude oil supply chain, traders can use Asset Connect to quickly assess their options by viewing utilisation rates and costs associated with alternative routes.

As an analyst, Asset Connect can be used as a discovery tool. It evaluates various assets, their historical performance, and connectivity to produce accurate market assessments and forecasts. It provides access data to generate balances, anticipate constraints, analyse impacts, and optimise flow routes.

Asset Connect can also assess where spare capacity might exist and determine the optimal transportation route based on cost from pipeline flow data and tariff rates.

Get in touch at the top of the page to learn more about how Wood Mackenzie’s Asset Connect product can enhance your understanding of short-term supply and demand fundamentals.

Find out more about Asset Connect

Explore the interconnectivity of the crude oil supply chain with data-driven intelligence

Distil the vast and complex crude oil supply chain down into queryable, actionable intelligence. Access data to generate balances, anticipate constraints, analyse impacts and quickly assess optionality from supply chain disruptions, and optimise flow routes.

Assess where spare capacity might exist, and determine the optimal transportation route based on cost by integrating any other Woodmac data like pipeline flow data and tariff rates.