Sign up today to get the best of our expert insight in your inbox.

Japan pulls no punches on risks to Australian LNG exports

Business leaders see confidence in Australia’s investment climate at risk

5 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

Upside pressure mounts on US gas prices

-

The Edge

The coming geothermal age

Angus Rodger

Vice President, SME Upstream APAC & Middle East

Angus Rodger

Vice President, SME Upstream APAC & Middle East

Angus leads our benchmark analysis of global Pre-FID delays, and deep water developments.

View Angus Rodger's full profileAustralian politics is rarely a polite affair. Described by one journalist as “bloody and brutal – like a soap opera directed by Quentin Tarantino,” it is fair to say politicians rarely mince their words in Parliament House.

This was apparent at the end of March in a speech in Canberra that pulled no punches. In it, the speaker decried an Australian investment climate that “appears to be deteriorating” and how the “sinister consequences” of the country “quiet quitting” the LNG business would play into the hands of Russia, China and Iran.

But these were not the words of an agitated parliamentarian. The speaker was Takayuki Ueda, CEO of INPEX, operator of the giant Ichthys LNG project and the largest Japanese investor in Australia. Hailing from a country famed for its civility, the significance of a senior Japanese executive directly calling out the unintended consequences of Australia’s ever-more chaotic energy policy should not be underestimated.

Energy security alarm bells are ringing at the highest levels in Tokyo.

Australian east coast market in turmoil

How we got here was the subject of a previous Buzz. In a nutshell, the Australian East Coast market has been thrown into turmoil by underperforming coal-fired generation, insufficient renewables, and a long-predicted gas supply crunch. Gas prices spiked and the government’s response was intervention. The first move was a 12-month price cap on a minor part of the overall gas market.

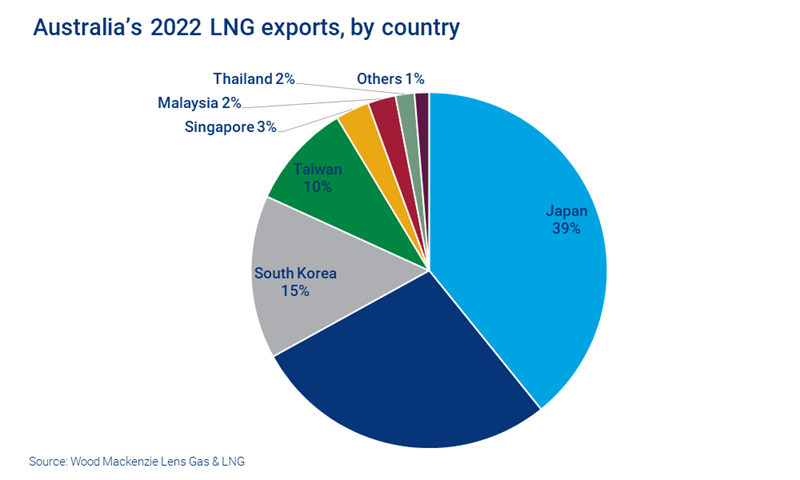

By itself, this is small beer. But what really worries the industry is that this is just the tip of the iceberg. Ministers have already suggested the next step will be to alter Australian regulation to make it more straightforward to divert gas intended to meet LNG contracted as exports into the domestic market. This has inevitably panicked all importers of Australian LNG, but none more so than its biggest customer, Japan.

Australia supplies 40% of Japan’s LNG (as well as 70% of its coal imports). Would it really renege on long-term LNG sales contracts – with all the legal and sovereign risk implications – and at a time when so few alternative sources of supply are available?

What makes Ueda-san’s speech so interesting is its directness. It would have been sanctioned at the highest ministerial level, which means the warning was fully intended to be heard and heeded: if Australia curtails LNG exports, confidence in Australia will evaporate.

A near-term solution seems clear and obvious

A rational voice stating the consequences of diverting contracted LNG to the domestic market has long been needed. The near-term solution to the east coast market crisis, as Ueda-san pointed out, is clear and obvious – encourage additional supply. But that is the one step the Australian government seems reluctant to take.

This is compounding the challenges of financing new gas supply and stoking rising opposition to gas. The big domestic banks have already responded to criticism by bringing in stringent lending rules targeting ‘fossil fuels’, effectively phasing out most support for new oil, gas and coal projects. Activism is widespread and rising. In a recent court hearing, one group brought a case against 12 Australian and international banks urging them to withdraw loans to Santos for its Barossa gas project.

To reduce emissions by phasing out coal and ramping up renewables, Australia still needs gas as a reliable backstop.

Angus Rodger

Vice President, SME Upstream APAC & Middle East

Angus leads our benchmark analysis of global Pre-FID delays, and deep water developments.

View Angus Rodger's full profileBut this ignores the complexities of the energy transition. To reduce emissions by phasing out coal and ramping up renewables, Australia still needs gas as a reliable backstop. It is required in power and energy-intensive industries that cannot switch to renewables. Explicitly placing gas and coal in the same ‘fossil fuel’ bucket has failed to make Australian energy cheaper, more reliable, or cleaner. And it goes without saying that the alternative to Australia's LNG for Japan and other major Asian economies is higher emissions from burning more coal.

Yet the hurdles for new projects keep coming. Last month, Australia’s coalition government released changes to its Safeguard Mechanism which aims to expedite reductions in greenhouse gas emissions.

These include two headline changes for existing and future gas producers that fit into the category of ‘big emitters’. First is that all new gas projects are required to abate or offset all reservoir CO2 from first production. For some of Australia’s biggest pre-FID and under-development projects – Browse, Barossa, Crux, Evans Shoal/Verus (all containing relatively high levels of reservoir CO2), investing in an effective CCS solution that can operate from day one now looks necessary.

Secondly, all new and existing oil and gas facilities that are significant emitters will be required to reduce their (Scope 1) emissions intensity by an average 4.9% per year to 2030 (for more details read this excellent analysis by Australasia upstream analyst, Dr Anne Forbes).

Time to fast-track CCS in Australia?

These changes mean Australia’s CCS industry urgently needs to speed up the roll-out of new investment. Yet while CCS isn’t a panacea for Australian LNG projects’ carbon challenges, you would still expect Canberra to back up the demands of these new rules with reassurance the right incentives and regulatory structures are coming to fast-track CCS.

Here again INPEX’s Ueda-san called out the mixed messages from Australian energy policy, arguing the government seems hesitant to “lean in” to the CCS sector. He pointed out that Japan’s government-backed JOGMEC has committed A$55 million in funding for INPEX’s Bonaparte Basin CCS project, while the Australian government withdrew its funding support.

Which brings us back to the start. Japan, South Korea and other North Asian markets not only rely on Australian LNG for a substantial portion of their energy supply, but longer-term see the country as their best hope and partner to achieve net zero, primarily through CCS/CCUS and hydrogen. The mixed messages they are receiving on Australia’s commitment to this relationship is provoking some very strong responses.

APAC Energy Buzz is a weekly blog by Wood Mackenzie Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.

This edition of the APAC Energy Buzz was guest authored by Angus Rodger, Director, Asia Pacific Upstream.

Lens Gas & LNG

Our powerful data analytics solution for exploring industry data alongside leading expertise, analyses, and modelling insights to enable faster, more accurate operational and strategic planning and portfolio management decisions.

Learn More