Market outlook - opportunities for East Coast gas

The East Coast of Australia is facing a precarious gas supply/demand crunch. With new sources of domestic gas in high demand from buyers, what upstream opportunities could this present?

2 minute read

John Gibb

Research Director, Australasia Upstream

John Gibb

Research Director, Australasia Upstream

John brings more than 25 years of international oil and gas industry experience to his role.

Latest articles by John

-

Opinion

A two-decade decline in exploration is driving the need for carbon neutral investment in Australia’s upstream sector

-

Opinion

Market outlook - opportunities for East Coast gas

-

Opinion

Asia Pacific upstream: 5 things to look for in 2024

In our latest Australia Upstream insight, our focus shifts to the East Coast gas landscape, investigating the market outlook, as well as the opportunities and blockers it presents.

Crisis in winter 2022, a repeat avoided in 2023 but what will winter 2024 bring?

The energy market in Australia's East Coast has been a focal point of attention, marked by its turbulent journey from crisis to cautious stability. The factors behind the East Coast winter 2022 energy included cold weather, coal shortages, low renewable generatio and under-investment in new supply . But in winter 2023 the market avoided extreme tightness and price spikes. The pressing question lingers - what will the forthcoming winter of 2024 bring?

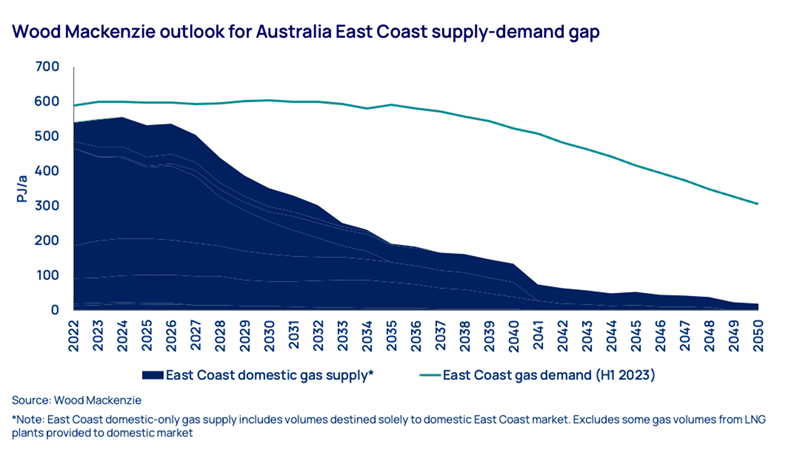

Forecasts indicate an impending shortfall in gas market supply in winter 2024. This anticipation is further heightened by the timing and uncertainty of new supply sources such as Narrabri and Beetaloo. While holding both resource and potential, a volatile regulatory and fiscal backdrop and environmental activism has led to more delays in their commercialisation.

But for smaller E&P players, slowing momentum behind the bigger projects opens the door for more nimble players to get their gas into the market. And this is exactly what we are seeing – companies like Comet Ridge, Denison Gas, Elixir Energy and others are trying new approaches in gas-rich plays to meet demand. Whether its exploring deeper gas plays in the Surat, or partnering with pipeline companies to unlock long-stranded resources, we are seeing a sector bring innovative ideas into play to create value.

Regulatory and fiscal uncertainty

However, while demand dynamics are strong, complex regulatory frameworks and fiscal uncertainty has thrown significant hurdles into the path of timely project development, impacting returns. This challenging domestic environment has in turn catalysed an alternative avenue for new supply - LNG regasification terminals. Expectations are ripe for the first terminal to become operational, potentially by the winter of 2025.

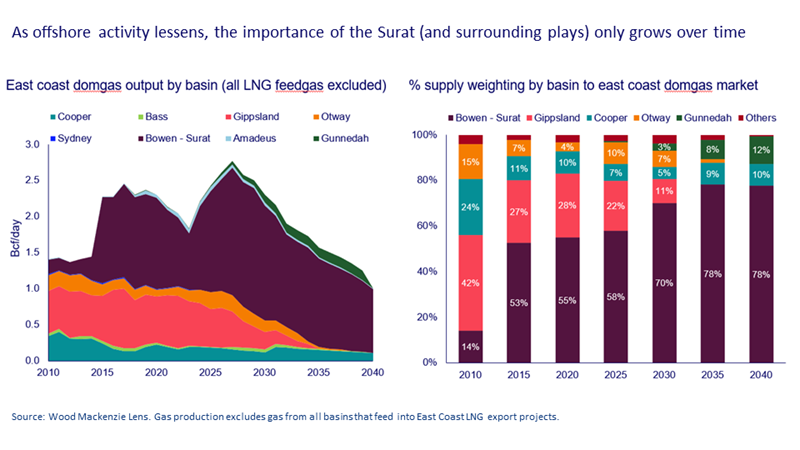

The longer-term transformation in supply dynamics is evident, with a decline in volumes from traditional sources like the Gippsland and Otway basins and the emergence of the Bowen-Surat basins as the future powerhouse, expected to supply approximately 70% of gas volumes by 2030. This transition underscores the changing landscape of the East Coast gas market, paving the way for a strategic realignment in the energy sector.

To plug the supply-demand gap forecasted, we see four options:

- Development of new domestic gas supply: with Narrabri and other smaller developments already included in the forecast, outside of developing new plays such as the Taroom Trough, the only material project currently with potential to move the needle is the Beetaloo

- Reduce demand: not within upstream industry control, and difficult to achieve dramatic reductions in the near-term.

- Diversion of LNG feedgas: already regulated under the Australian Domestic Gas Security Mechanism (ADGSM), this is one of the many regulatory changes that have caused great concern to industry and investors alike.

- LNG imports: given the limited opportunities above to ‘narrow/close the gap’, we expect LNG imports will be needed to balance the market, and forecast that LNG imports will start on a seasonal basis from the mid-2020s

Seizing the opportunity

The road ahead is not without challenges, yet it also brims with opportunities. As the East Coast gas market evolves, the message is that for exploration and production operators, there is opportunity available if you can get your gas to market and overcome the fiscal and regulatory blockers currently in place in Australia.

Bespoke packages for E&Ps in Australia

Find out more about our upstream reports and products tailored to your specific needs.

Find out more