Discuss your challenges with our solutions experts

Author: Rebecca Miller, Power Market Analyst

As the energy transition takes shape across North America, states and countries are adopting new technologies, often at vastly different paces than their neighbours. In some instances, regions in close geographical proximity have very distinct fuel mixes, putting additional pressure on physical infrastructure. One example of this is the border of Michigan and Ontario, where regional generation differences and recent impacts from COVID-19 have contributed to more frequent enactment of NERC reliability procedures.

The reliability procedures impacting the Ontario-Michigan Interface are known as Transmission Loading Relief (TLR). According to the North American Electric Reliability Corporation (NERC), responsible for issuing these procedures, a TLR is an Eastern Interconnection-wide process that allows reliability coordinators to mitigate potential or actual operating security limit violations while respecting transmission service reservation priorities. Effectively, TLR procedures allow reliability coordinators to address threats to physical infrastructure that cannot be solved by dispatching generation within the market.

Often, a reliability coordinator requests a TLR procedure due to unscheduled flows over an interface between two markets. Historically, unscheduled flows at the Ontario-Michigan Interface have resulted from transactions between MISO and IESO that do not flow over their assigned contract path due to the grid's nature. This flow pattern is typically referred to as Lake Erie Loop Flow.

Lake Erie loop flow

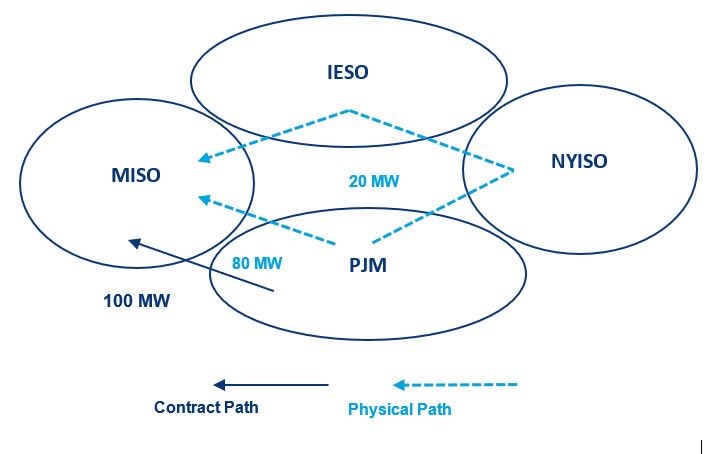

The transmission system around Lake Erie creates several potential pathways for power to flow between MISO, PJM, NYISO, and IESO, often elevating risk for unscheduled flows over the interfaces between Ontario and the US markets. For example, power scheduled to flow from PJM to MISO over the western PJM border will sometimes flow through NYISO, IESO, and then into Michigan over the Ontario-Michigan Interface shown in figure 1 below.

Figure 1. Difference between scheduled and actual power flows around Lake Erie

Source: Ontario Energy Board

In this example above, 20 MW of “unscheduled flows” are now passing over the Ontario-Michigan Interface. Similarly, exports scheduled from Ontario to PJM will generally flow through Michigan and NYISO, regardless of which path was originally scheduled. Some power that is meant to remain internal to Ontario may leave over the Michigan border and re-enter through the New York border, resulting in additional unscheduled power flows over the Ontario-Michigan Interface.

TLR impacts

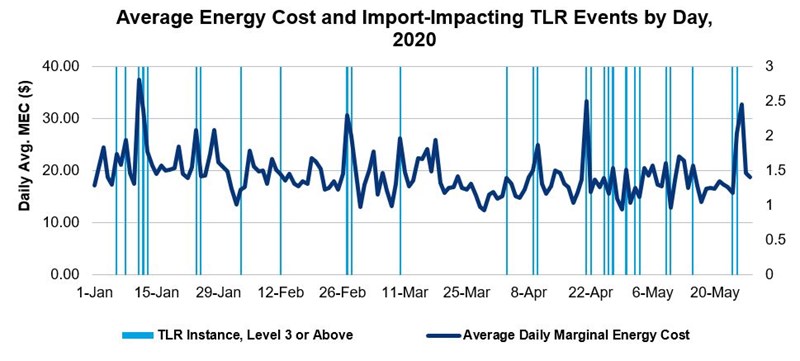

Since surrounding markets influence the amount of power travelling over the Ontario-Michigan Interface, TLR procedures over this path ultimately curtail flows from PJM into MISO. In the first half of 2020, curtailed PJM imports resulted in significant price spikes in MISO on several occasions as multiple gigawatts of expected power imports were cut over a very short period. Due to the sudden shortage of power flowing into the footprint in these instances, more expensive units within MISO were forced to ramp up, resulting in sudden, sharp increases in energy prices.

Over the past six months, a sharp uptick in the number of TLR procedures issued has resulted in significant financial losses for MISO market participants (Figure 2). Potomac Economics, the Independent Market Monitor for MISO, estimates that in Winter 2020, market participants that scheduled imports to MISO from PJM experienced losses of nearly $3.5 million. As a result of the notable increase in TLR risk and the financial ramifications of the procedure in MISO, many market participants have prioritized pinpointing drivers and assessing risk for these procedures.

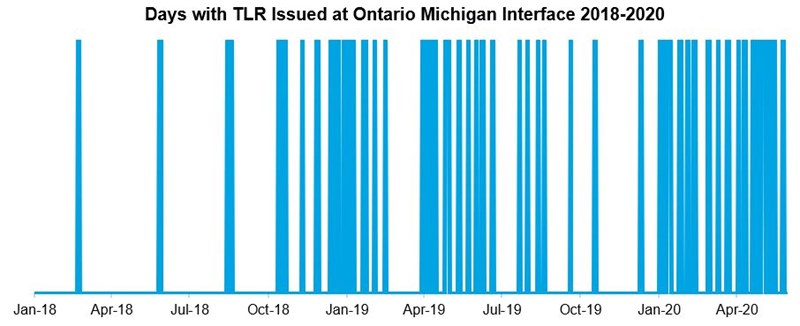

The frequency of TLR procedures has increased since Winter 2018, with a notable uptick in Winter 2020 and additional increases after the onset of COVID-19 restrictions in March of this year (Figure 3). Our MISO analyst team has identified several recent changes contributing to an increase in unscheduled flows over the Ontario-Michigan Interface. The recent adoption of new generation technologies within IESO alongside declining coal generation in Michigan has elevated the risk of unscheduled flows over the interface. Implementation of COVID-19 response measures and corresponding demand destruction in Ontario have further aggravated concerns in the region.

Supply-side differences

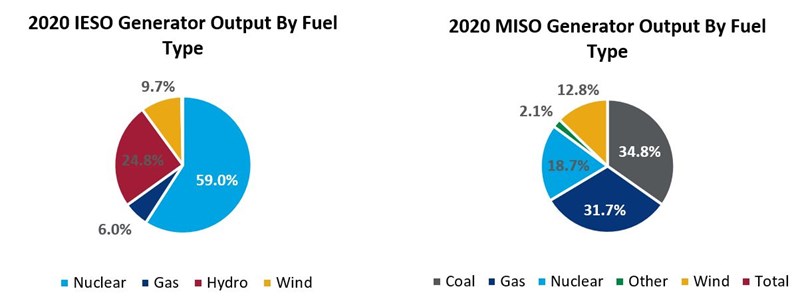

From a power supply standpoint, Ontario maintains a fairly low carbon fuel mix, amplified by an increase in installed wind capacity over the past five years. The IESO fuel mix in the winter and spring is dominated by nuclear power with significant contributions from hydro and wind. This means the primary modes of power generation in Ontario are less responsive to changes in demand and pricing, which occasionally results in surplus baseload generation. During periods of surplus generation, more power is generated than there is demand for electricity, which typically results in increased exports from Ontario to surrounding markets.

Differences in actual fuel mix between IESO and MISO January through April 2020 (Figure 4).

In MISO, the fuel mix looks quite different as the US Midwest continues to rely heavily on coal-fired generation. As a result, the fuel mix remains dominated by coal, gas, and nuclear, with significant wind generation contributions over the past several years. The coal and gas units that account for most MISO power generation are more likely to adjust behaviour in response to changes in demand and pricing than the nuclear and hydro-powered units in Ontario.

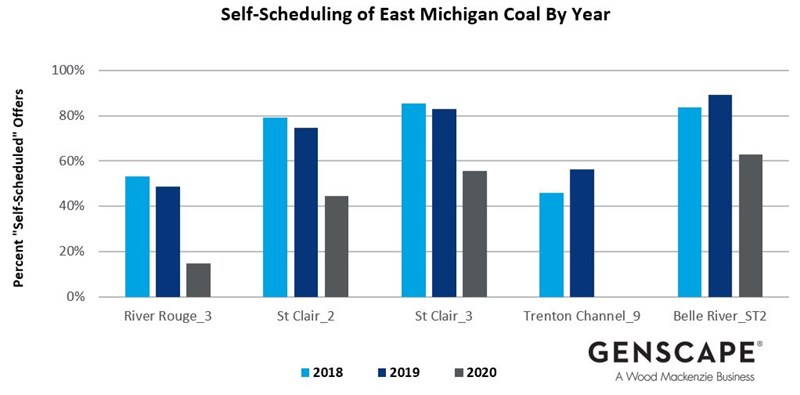

Coal-fired power plants largely dominate the supply-stack on the eastern border of Michigan. Due to cheap fuel prices and mild demand so far in 2020, these units have remained uneconomic for significant portions of 2020. In the past, these units have typically relied on a practice known as self-scheduling to generate power while uneconomic for efficiency and reliability. In late 2019, the Michigan Public Utility Commission raised concerns around utility DTE’s self-scheduling of coal generation due to financial losses often passed on to ratepayers. So far in 2020, the units in question have self-scheduled power less than they have in years past, likely resulting in conventional generation weakness on the western half of the Ontario-Michigan Interface.

Figure 5. Decline in self-scheduled power at Michigan Coal units

Source: Wood Mackenzie Bid Data

Self-scheduled power at Michigan coal units has declined in early 2020 compared to previous years (Figure 5). Recent challenges to scheduling practices of coal-fired power plants in the Midwest have further aggravated the supply-side gradient between Ontario and eastern Michigan. In addition, MISO coal retirements and a decline in self-scheduled generation in Michigan have increased the market’s reliance on imports from surrounding markets, such as PJM. When these imports are restricted because of TLR procedures, price increases become even more dramatic due to this baseload weakness.

Demand destruction

Demand also plays a role in driving risk for unscheduled flows over the Ontario-Michigan Interface. In Ontario, surplus baseload generation levels increase during periods when actual demand verifies below IESO expectations. In early 2020, the COVID-19 outbreak resulted in widespread restrictions around public gatherings, resulting in rapid changes to human behaviour and electric load. IESO estimates demand destruction of as much as 18% due to the virus. Forecasting demand during these unprecedented times proved difficult for many reliability coordinators. It frequently resulted in actual demand levels underperforming expectations, elevating the risk for unscheduled power flows from Ontario into Michigan.

The future of the Ontario-Michigan interface

While the lifting of COVID-19 restrictions and elevated summer load levels reduce pressure on the Ontario-Michigan Interface, generation differences on either side of the interface indicate on-going risk for unscheduled flows and TLR procedures. MISO’s 2020-2021 Planned Resource Auction highlighted the potential for continued supply weakness in Michigan. The state's load zone fell 336 MW short of its load-clearing requirement in this year’s auction, following a 311 MW decline in coal capacity year-over-year. For the next year, IESO will be working to manage surplus generation, while MISO must address generation weakness in the Michigan area, potentially increasing the risk for TLR procedures at the interface.

Due to the acute financial impacts of these reliability procedures, MISO is participating in discussions with PJM, NYISO, and IESO regarding appropriate criteria for requesting TLR. MISO also launched a study in February 2020 to explore the feasibility and benefits of upgrading the transmission system along the Ontario-Michigan border to increase import limits by as much as 3 GW. At Wood Mackenzie, MISO analysts continue to monitor risk over the interface to help market participants navigate these uncertain times. Find out more about Wood Mackenzie's offerings.