New York Harbor gasoline and ULSD inventories guide markets through a relatively tight 2023

New York Harbor gasoline and ULSD prices: 2023 highlights

2 minute read

Claire Lominick

Research Associate, Commodity Trading Data & Analytics

Claire Lominick

Research Associate, Commodity Trading Data & Analytics

Claire leverages cutting-edge data to offer real-time insight into the oil industry.

Latest articles by Claire

View Claire Lominick's full profileDylan White

Principal Analyst, North American Crude Markets

Dylan White

Principal Analyst, North American Crude Markets

Dylan leverages cutting-edge data to offer real-time insight into the oil industry.

Latest articles by Dylan

-

Opinion

Price swings ripple through North American oil markets

-

Opinion

Reduced flow on several US-bound Canadian pipelines following introduction of tariffs

-

Opinion

7 questions about Trump tariffs and their impact on the North American oil market answered

-

Opinion

ARA Gasoil Inventories

-

Opinion

Big in Japan? The impact of Typhoon Shanshan on oil

-

Opinion

TMX: first insights

Due to ongoing volatility in the global oil markets, traders need quick insight and prompt indication of changes. Storage levels in New York Harbor (NYH) serve as an essential indicator of the supply and demand balance in US refined products markets. Since NYH is the delivery point of the NYMEX RBOB and ULSD contracts and has extensive connectivity to domestic and global refined products markets, large inventory changes and trend reversals at the hub can influence prices. Market participants looked to NYH gasoline and ULSD inventories as an early indicator of supply/demand changes through 2023 as regional balances were affected by refinery outages, shipment disruptions, and shifting demand.

Wood Mackenzie’s New York Harbor Product Storage Report has frequently contributed to upward or downward pressure on RBOB gasoline and ULSD prices since it was first published in 2014. This trend continued in 2023.

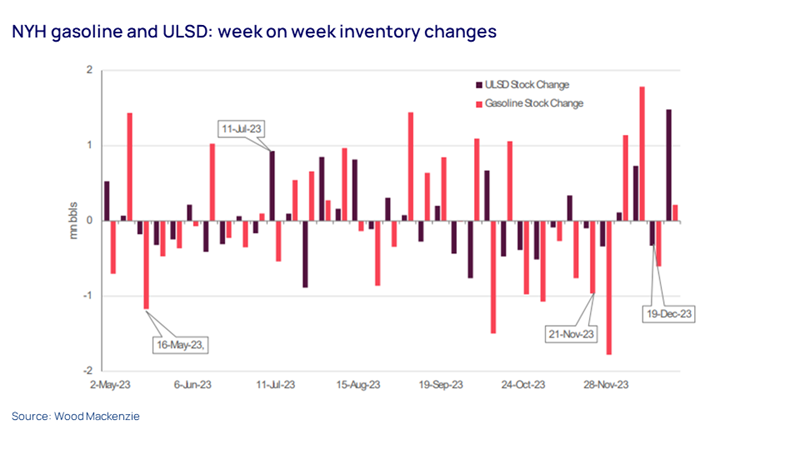

The chart below shows weekly gasoline and ULSD inventory changes in NYH as reported by Wood Mackenzie in 2023.

The call-out boxes in the chart highlight examples of significant price events that are discussed in detail in the full report. Fill in the form to learn more about the inventory changes highlighted above and the price movements related to them or read on for a brief introduction to two of these key events.

NYH gasoline and ULSD inventories posted draws amid colonial pipeline disruption

On December 19, 2023, Wood Mackenzie reported that New York Harbor (NYH) stocks fell 604,000 oil barrels (bbls) to 12.53mn bbls, while ULSD inventories fell 329,000 bbls to 4.91mn bbls for the week ending December 15. The drop in inventories occurred when NYH refined product stocks were already relatively low. ULSD stocks in the region had been hovering near their operational floor since late-October 2023.

The draws occurred despite regional refineries being back online and low seasonal demand for gasoline. Disrupted shipments from the Gulf Coast likely contributed to the storge draws. Domestic refined product flows into the region were impeded at that time by colonial pipeline scheduling issues and the cost of line space.

New York Harbor ULSD stocks post largest build in nearly a year

On July 11, 2023, Wood Mackenzie reported that NYH ULSD inventories jumped 929,000 bbls to 5.2mn bbls for the week ending July 7. The build was the largest weekly increase since August 2022. The rise in inventories occurred during a period of low stocks, as NYH ULSD inventories remained low throughout much of 2023 – with the average storage level for the year sitting 1.6mn bbls below the five-year average. After regional ULSD stocks dipped below the five-year average in March they did not return to that level for the remainder of the year.