Discuss your challenges with our solutions experts

Big in Japan? The impact of Typhoon Shanshan on oil

The threat from tropical cyclones makes real-time intelligence essential to anticipating Japanese oil markets

3 minute read

Dylan White

Principal Analyst, North American Crude Markets

Dylan White

Principal Analyst, North American Crude Markets

Dylan leverages cutting-edge data to offer real-time insight into the oil industry.

Latest articles by Dylan

-

Opinion

Reduced flow on several US-bound Canadian pipelines following introduction of tariffs

-

Opinion

7 questions about Trump tariffs and their impact on the North American oil market answered

-

Opinion

ARA Gasoil Inventories

-

Opinion

Big in Japan? The impact of Typhoon Shanshan on oil

-

Opinion

TMX: first insights

-

Opinion

New York Harbor gasoline and ULSD inventories guide markets through a relatively tight 2023

Jim Mitchell

Director of Oil Trading Analytics

Jim Mitchell

Director of Oil Trading Analytics

Jim has 29 years of commodity market experience in crude oil, refined products, shipping, Natural gas, power and grains.

Latest articles by Jim

-

Opinion

Oil and refined products in 2025: a commodity trader’s guide

-

Opinion

The impact of tariffs on Canada’s export market

-

Opinion

Canada’s oil export future: what’s next?

-

Opinion

International Energy Week 2025: our key takeaways for oil & gas

-

Featured

Oil, power, gas trading 2025 outlook

-

Opinion

What is the market impact of Czech refineries shifting away from Druzhba?

Jake Eubank

Senior Research Manager, Downstream Assets

Jake Eubank

Senior Research Manager, Downstream Assets

Latest articles by Jake

View Jake Eubank's full profileViolent tropical storms are nothing new in Japan, but climate change is making the country’s typhoon season both longer and more intense. Typhoon Shanshan, which blew through Japan in late August 2024, was one of the strongest to hit the country in decades. So, how hard did it hit Japanese oil?

Using data from the remote sensors and advanced technologies that inform our proprietary APAC Refinery Intelligence service, we tracked the real-time impact of Typhoon Shanshan on the Japanese oil industry, including shipping, refining and storage.

A vulnerable sector

Constant typhoon threats can cause significant uncertainty and create major challenges for a wide range of industries. Domestic oil production in Japan is negligible and there are no pipelines into the country – instead, oil is shipped in from abroad. Despite this, Japan is the world’s fourth-largest oil refiner, as well as the fifth-biggest crude importer globally. However, its dependence on imported crude makes the country’s oil sector particularly vulnerable to disruption.

A threat emerges

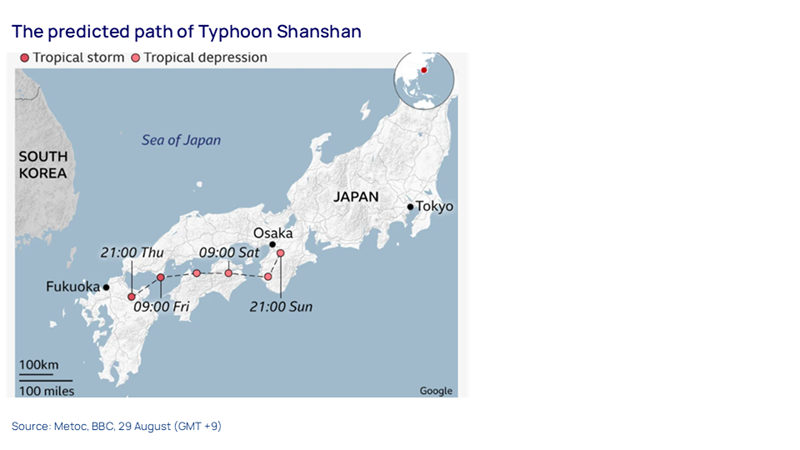

First noted as a tropical depression on 20 August, Shanshan was named and upgraded to a tropical storm on 21 August, then to a typhoon on 24 August. It made landfall on 29 August, bringing heavy rainfall and winds of at least 100 miles per hour. By that point, the Japanese Ministry of Land, Infrastructure, Transport and Tourism was warning of high waves and potential disruption to crude import operations at various strategic petroleum reserve sites in southwestern Japan.

Consequences

Typhoon Shanshan was noted as being one of the most powerful storms to make landfall in Japan since 1960. More than five million people received evacuation notices, hundreds of flights were cancelled, and ferry and rail services were suspended. Eight people died and well over a hundred were injured, and the cyclone caused extensive damage to buildings, trees and cars.

Impact on shipping

Our Refinery Intelligence shows that most oil tankers had rerouted to avoid the centre of the storm as it travelled northwards towards Kyushu prefecture, the third largest and most south-westerly of Japan’s main islands. One of Japan’s key crude oil storage hubs, the 31.63-million-barrel capacity Shibushi National Petroleum Stockpiling Base, is located on Kyushu. As the storm approached, anchoring restrictions were imposed in the waters around the site.

Impact on refining facilities

A summer lull due to maintenance had seen refinery utilisation hovering below the five-year average in early August. Crude oil throughput saw a jump in the week ending 17 August, with refineries processing over 2.21 million barrels per day – the highest level in three months. However, as the storm approached, crude runs were at risk.

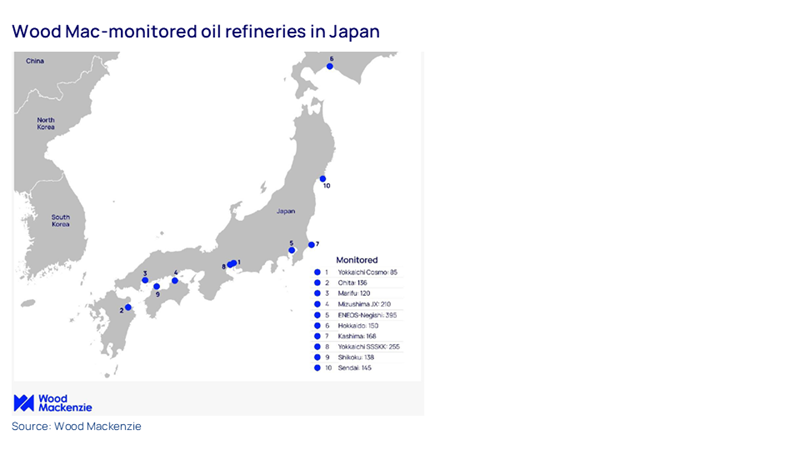

The first refining facility in the path of Shanshan was ENEOS’ Oita integrated refinery on Kyushu (marked with a ‘2’ on the map above). Increased activity at the plant on 19 August indicated the company was beginning to restart the 136,000 barrel per day (bpd) crude oil distillation unit (CDU), along with the 26,000-bpd fluid catalytic cracking (FCC) unit and the 30,000-bpd reformer. However, our infrared data indicated activity stopped again some hours later on 20 August. Restart activity began at the CDU and reformer on 29 August, with the units fully restarted early in the morning of 3 September. The FCC was restarted later the same day. Third-party sources have confirmed to us that the delay was due to the storm.

The other facility affected was ENEOS’ Negishi refinery much further east, near Yokohama on Japan’s main island of Honshu. On the morning of 30 August, we detected that the 43,000-bpd vacuum distillation unit (VDU), 36,000-bpd residual hydrotreater and an unmonitored gasification unit at the site had been shut down. The company began restarting the VDU and residual hydrotreater during the morning of 1 September, and the units returned to normal activity two days later.

Impact on markets

Despite extensive media coverage and rampant speculation about potential market effects, Wood Mackenzie’s real-time data correctly predicted that disruption was limited and unlikely to have a major impact. Subscribers to our APAC Refinery Intelligence service were able to anticipate this and take advantage of the gap between market expectations and reality.

If, on the other hand, the impact of the typhoon had been more significant, our insight would would have quickly informed subscribers of the magnitude of impact on crude consumption and products supply in the Japanese market, providing them with early indications of ensuing changes to prices and trade flows .

Learn more about our Refinery Intelligence product suite. It offers unparalleled access to refining operations around the world, providing unique, actionable insights into crude demand and refined products supply.