North Sea decommissioning: a turning point lies ahead

£16 billion will be spent on offshore decommissioning in the coming decade – how can costs be planned and managed effectively?

1 minute read

By Romana Adamcikova, Senior Research Analyst, Upstream Research – North Sea, and Nouran Ezzat, Senior Manager EMEA Growth Strategy, PowerAdvocate.

Decommissioning spend in the North Sea is set to top £16 billion over the next decade as facilities and reservoirs cease production. But in the wake of the oil price crash, the need to make cost savings and preserve cash flow has never been greater.

Wood Mackenzie and sister company PowerAdvocate have collaborated to identify the major costs in decommissioning projects and where operators can make material savings. To read the full insight fill in the form on this page. Or read on for an introduction.

A turning point for decommissioning

Capital intensive, with no inherent financial return, decommissioning projects are often pushed down the priority list by operators in favour of cash flow – even if it means producing at a loss.

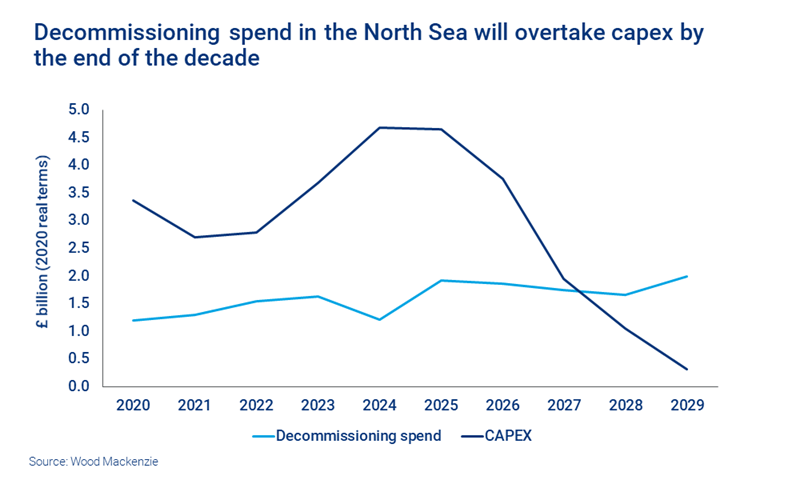

But these projects can’t be put off forever. The next decade will be a turning point, as decommissioning spend is expected to exceed capital expenditure in the North Sea as more platforms wind down operations due to technical, safety and cost factors.

As more fields are depleted, supply of vessels and services will tighten, increasing costs and causing delays. The industry has already driven down decommissioning cost estimates in the last two years, but to project their margins, operators are looking for more.

Knowing where the money goes

A typical decommissioning project spans 10 years or more, so it’s easy for them to overrun. To improve cost management, operators need more detail about the spending hotspots over the course of a project.

The key is in the data. Analysing project lifetime spend, from cessation of production (CoP) through to site remediation, gives vital up clues.

The greatest proportion of costs by far goes on well plugging and abandoning (P&A) activities, which make up nearly half of a typical budget, according to PowerAdvocate’s proprietary spend data. But other areas see significant spending too. Operators can expect to spend on average 12% on removing topside structures, and around the same proportion on running costs from CoP onwards.

Getting a clearer picture on risk

How should operators manage costs over a project lifetime? Ever-present risks, such as potential delays from environmental challenges on subsea work or discovery of hazardous material are combined with those which are harder to forecast, like a fall in the oil price or global pandemic.

Again, operators can look towards the data for insight. Deeper analysis and modelling of individual cost drivers means it is easier to learn lessons from previous strategies and identify cost savings.

This goes for live decommissioning projects, which can include bundling decommissioning and non-decommissioning operations, but also enables more efficient advanced planning, as operators calculate the timing and work breakdown structure well ahead of CoP.

Ultimately, following the data gives operators a clearer picture of what’s over the horizon and allows them to adopt a more dynamic and proactive approach. This will be essential as decommissioning in the North Sea gathers pace.

Decommissioning in the UK: the cash flow vs. cost savings operator dilemma

Fill in the form at the top of the page to read the full insight, combining the proprietary datasets and analysis of sister companies Wood Mackenzie and PowerAdvocate.

Find out how we:

- Track potential budget movements by creating a ‘project-should-cost trend’

- Create cost hierarchies and detailed cost breakdowns for each service area

- Use cost-modelling tools to target live projects and long-term planning.