Nuclear – the cleanest dirty word

Can Northeast Asia’s carbon neutral targets really be met without nuclear power?

1 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

Upside pressure mounts on US gas prices

-

The Edge

The coming geothermal age

For the first time, over half of global carbon emissions now come from countries that have set time-bound carbon neutral targets. The massive economies of Northeast Asia are critical to this. China alone contributes 32% of global carbon emissions and Japan and South Korea around 3% and 2%, respectively. In 2020, each announced their commitment to reach future carbon neutrality.

These are the world’s biggest oil, gas and coal importers, and carbon neutrality will necessitate a fundamental redesign of their entire energy systems. Capital flows into renewables will be huge, but money will also move into green hydrogen, fuel cells and CCS/CCUS projects, energy storage and end-user consumer management.

But will this be enough? The reality is that Northeast Asia’s carbon neutral targets will be very difficult to meet by renewables alone, given the need to massively increase electrification. With the size of its future economy, the scale of the challenge is up to 10 times greater in China than Japan or South Korea.

Given this, what will be the role of nuclear? Maligned, misunderstood and feared, nuclear divides opinion like no other source of energy. The Fukushima Daiichi nuclear disaster in 2011 fuelled widespread hostility to nuclear power, not only in Japan but also in South Korea, while the accident noticeably tempered China’s nuclear power ambitions. But despite the challenges, Frank Yu from our APAC Power & Renewables team talked to me about how if carbon neutrality is to be achieved, Northeast Asia will need significantly more nuclear power.

Does nuclear have a future in Northeast Asia?

Absolutely. But it’s important to make a clear distinction between the future role of nuclear in China and that in Japan and South Korea. Public sentiment in China is more ambivalent, with less opposition to nuclear and therefore a more supportive environment for government and developers to get projects approved and constructed. I’d say the role of nuclear in China’s energy transition looks far more assured.

For Japan and South Korea, anti-nuclear sentiment is widespread, with relatively high levels of opposition to both existing and proposed plants. This makes the carbon neutral goals in these countries even more challenging given that geographical and climatic conditions are less supportive of the large-scale rollout of competitive renewable power. Japan especially, with the highest energy costs, will struggle to build sufficient renewables capacity to allow for the widescale shutdown of coal.

How can China become carbon neutral by 2060?

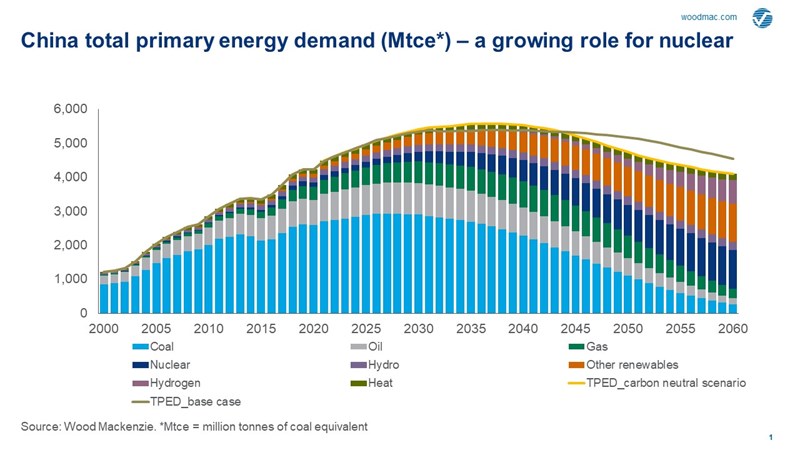

In our base case, China does not reach carbon neutrality by 2060, so here I will talk about our carbon neutral scenario. China would have to reduce emissions by a further 4.7 billion tCO2 or 76% from the base case by 2060 to meet its carbon neutral pledge. It’s a mammoth undertaking.

The share of fossil fuels shrinks dramatically in our carbon neutral scenario. Coal’s share in the total primary energy mix needs to drop from 60% in 2020 to less than 5% by 2060. The share of non-fossil fuels will surge to 90% on a coal equivalent basis. Renewable energy and green hydrogen will make up almost 45% of total primary energy demand, up from 18% in the base case.

Looking at the power sector, meeting the carbon neutral target would require 71% more electricity by 2060 to replace fossil fuels compared to our base case. This requires something like 6,800 GW of additional generation capacity from the base case to meet the all-round electrification requirement. Most of this comes from wind, solar and storage, but this is still insufficient. Our carbon neutral scenario needs an additional 620 GW of nuclear capacity by 2060, some 340 GW above our base case. Current capacity is only around 50 GW.

Read also: How will dynamics shift in Asia Pacific’s power markets?

Is this level of nuclear capacity growth feasible?

This level of growth in nuclear reactor builds will be exceptionally challenging. China needs to expand surveying of suitable plant sites and accelerate R&D in next generation nuclear reactors, including small modular reactors that are more efficient with far less radioactive waste and less dependent on limited siting resources. China also needs to establish a secure uranium supply chain to manage any supply or price risks and build up its spent-fuel storage and recycling capability to match the scale of reactor builds. And importantly, China needs to attract more young people and train them as skilled workers to operate those nuclear power plants. None of these are easy tasks and will require comprehensive planning and decades of continuous resource commitment.

Could Japan and South Korea follow the same path with nuclear?

Highly unlikely given opposition to nuclear, which compounds the challenges. Even though both countries have already reached peak emissions, each needs to reduce emissions by over 80% lower than our base case by 2050 to meet carbon neutral pledges. In terms of meeting the higher electricity demand in our carbon neutral scenario, Japan would need to double its power output, while South Korea’s would triple.

This will be particularly difficult for Japan given its high generation costs from renewables. Aggressive policies such as subsidies will be needed given that, with the most expensive power generation in Asia Pacific, Japan will not see renewables compete with coal-fired power until beyond 2030. As such, our carbon neutral scenario can only be realised with an expanded role for nuclear in Japan – a contentious position. We estimate that Japan will need to add an additional 25 GW of nuclear capacity by 2050, equal to over US$150 billion of investment, to meet emissions goals. In the current environment, this is a very big ask.

In South Korea, where we see renewable power falling to around 10-60% cheaper than fossil fuels by 2050, a more limited role for nuclear is required.

Couldn’t Northeast Asia simply build more renewables?

Through the medium-term, the rollout of renewables looks achievable. Hitting 20% of wind and solar in power supply by around 2030 will be the easy part (from 9% today).

The challenge will be moving from 20% to 80% renewables by 2050/60, which is needed in our carbon neutral scenario. Going even further than this looks exceptionally difficult, and hence the continued role for nuclear. This may not always be the popular choice, but remains critical to reaching carbon neutrality.

You might be interested in: Renewables in most of Asia Pacific to be cheaper than coal power by 2030

APAC Energy Buzz is a blog by Wood Mackenzie Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.