Onshore wind: tackling cost escalation in operations and maintenance

Industry-wide effort is needed to accelerate the march to cheaper onshore wind

1 minute read

Competitive bidding has become the norm in the onshore wind operations and maintenance (O&M) market, pushing price-points down. Meanwhile, operational costs have escalated. How will the industry combat the cost challenge and secure cheaper onshore wind?

Our report 2021 O&M Economics and Cost Data for Onshore Wind Power Markets explores cost trends in 11 key regional markets. Fill in the form for a complimentary extract, and read on for a brief introduction.

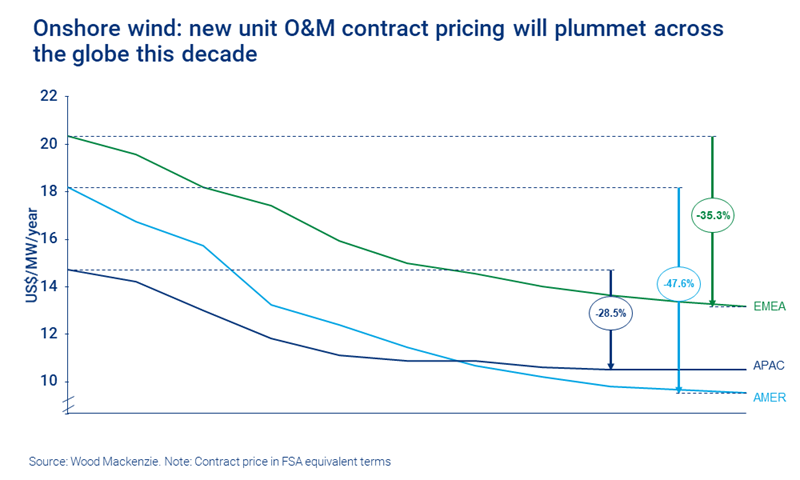

Auction tenders forcing declines on new unit O&M contract pricing

Benchmark prices for onshore wind have continued a downward trend in many regional markets. Price-points are roughly a third of the level they were when competitive auction tenders were introduced.

To remain cost-competitive, developers and operators demand ever-cheaper per MW operational costs on new equipment. The resulting pressure has seen significant decline in new unit O&M contract pricing; global contract prices are expected to decrease as much as 47% by the end of the decade.

For more detail, fill in the form to access the report extract.

Onshore wind O&M cost escalation adds to the challenge

If declining bid prices for onshore wind wasn’t enough, operational cost escalation has heightened the challenge.

Operational costs can be largely broken down into labour, equipment and spares costs. All three segments face cost escalation risk in the near-term, due to a combination of skyrocketing equipment and technician demand, raw materials price increases and real wages growth. Coupled with age related equipment failure, lifetime average operational costs could see increases in real dollar terms.

This is particularly challenging for the services industry, especially considering diminishing new unit O&M contract prices and competition to sign service agreements. Cost escalation threatens service agreement profit margins. Even with cost efficiencies realised from larger rating turbines, with agreement prices tracking ever downward, service providers may have less room to manoeuvre if cost escalation continues.

Strategies to combat rising onshore wind O&M costs

It should be noted that cost escalation has unequal impact on different parts of the O&M value chain. ‘Operationally risky’ segments – specifically unplanned failure repair and component spare parts – are more susceptible to cost escalation. That said, several avenues exist for service providers to offset the potential impact of cost escalation on their profit margins:

- Contract scope. Tiered service contracts levels have become the norm – with clearly defined scope of work delineating the level of O&M coverage. Higher tiers allow asset owners to offload more operational risk but come at a higher price. Increasingly, contracts also come with a price-indexation to protect providers against cost escalation.

- Controlling operational risk. Reliability improvements from new turbine design should help mitigate the risk of unplanned repairs, as should the introduction of prognostic maintenance practices and digital technology.

- Operational logistics. Improvement in logistics practices, automation and technician resources should all realise further operational cost efficiencies.

Eventually, the combined impact of cost efficiencies and reliability improvements from larger rating turbines, as well as diminishing contract prices, should see overall fleetwide average O&M costs decline. But consolidated, industry-wide effort is needed to head off operational cost escalation and accelerate the march to cheaper onshore wind.

The full report contains detailed information on cost trends in 11 key onshore wind markets, as well as the underlying cost drivers and data on lifetime average costs by rating class. Our complimentary extract includes charts on:

- Fleetwide lifetime average annual O&M costs for most widely installed platforms versus estimated new build O&M contract price

- Five-year trend in OEM services revenues

- Five-year trend in OEM order backlog.