Overcapacity puts pressure on polypropylene markets

We highlight which assets are best placed to weather the storm

2 minute read

A downturn is looming in the global polypropylene market.

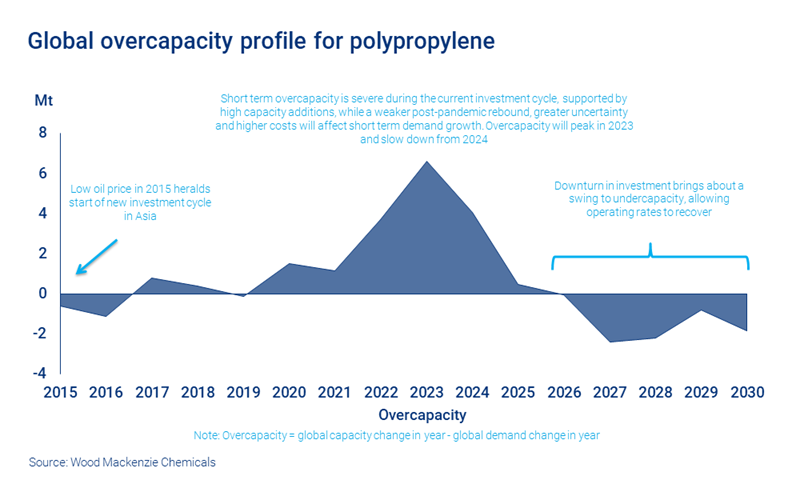

Short-term overcapacity during the current investment cycle is severe. Between 2022 and 2026, new additions in the market will total 35 Mt, which will far outpace demand growth. As is the case for propylene, the majority of the new facilities will be in China.

The low oil price in 2015 prompted a new wave of investment in polypropylene facilities, predominantly in Asia. Post-pandemic, the market has been slow to rebound. Add to that greater uncertainty and higher costs: all of which will affect short-term demand growth.

The market will reach a low point in 2024. After that, capacity growth will slow, and there will be a recovery towards 2030.

How can the industry prepare for the cycle? And which polypropylene producers are best placed to withstand the market’s peaks and troughs?

We use our newly developed polypropylene asset benchmarking tool to analyse and compare assets and highlight which we think will come out on top over the next few years. Fill in the form for a complimentary insight, and read on for an introduction.

Explore the similar dynamics that are at play in the propylene market in our insights ‘Propylene: Picking the winners and losers’ and ‘Propylene: Through the downcycle and beyond’.

Asset portfolios will be under the microscope

With the downturn looming, producers will be looking closely at each of the assets in their portfolios.

Assets with high feed costs and smaller units are expected to be rationalised, while successful companies are likely to be integrated. Alternatively, they will offer value added products or will be speciality polypropylene producers.

To survive the downturn, industry players are likely to focus on proactive negotiation, creating synergies with upstream assets and developing better contracting options.

Polypropylene assets that are integrated with low-cost propylene sources, have world-scale facilities and optimise logistics costs will be best placed to withstand the downturn.

Integration is key, but delivered cash costs and scale will be vital

Integration is critical if producers are to successfully weather the downturn: integrated assets are significantly more competitive than those that are standalone.

However, delivered costs and scale are equally important, as they play a pivotal role in optimising polypropylene trade flows.

There is plenty of room for the industry to fine tune trade routes and improve cost efficiency. Optimised trade flows can significantly change competitiveness. For example, assets in the Middle East and Asia (excluding China) could have the advantage over China when exporting to Europe.

For global players, understanding and benchmarking the efficiency of their logistics and supply chains against industry peers can unlock further cash savings.

Fill in the form at the top of the page to access the complimentary insight.

Identify assets that are best positioned for the downturn

This analysis draws insight from our newly developed polypropylene asset benchmarking tool, which offers the ability to identify markets with lower duty and logistics fees to help producers optimise their cash costs.

Learn more about how to pick which assets are best placed to weather the storm. And read more about the dynamics at play in the feedstock propylene market in our insights ‘Propylene: Picking the winners and losers’ and ‘Propylene: Through the downcycle and beyond’.