Discuss your challenges with our solutions experts

A new tight oil powerhouse: Permian Resources and Earthstone create a new large-cap US E&P

Over the course of just one year, US$6.6 billion of deals have culminated in the twelfth-largest oil-focused US E&P

3 minute read

David Clark

Vice President, Corporate Research

David Clark

Vice President, Corporate Research

Latest articles by David

-

The Edge

What comes after the Permian for IOCs?

-

Opinion

What does the Chevron-Hess deal mean for oil and gas?

-

The Edge

Big Oil: upstream M&A gets serious

-

Opinion

The making of a Megamajor – ExxonMobil acquires Pioneer Natural Resources

-

Opinion

A new tight oil powerhouse: Permian Resources and Earthstone create a new large-cap US E&P

-

Editorial

US Independents: cash is king in “stay flat” mode

Ryan Duman

Director, Americas Upstream

Ryan Duman

Director, Americas Upstream

Ryan specialises in supply forecasting, basin characterisation, upstream decarbonisation and economic modeling.

Latest articles by Ryan

-

Opinion

Gas prices enter a bearish spring amid crude market volatility

-

The Edge

Three factors driving US liquids production to new heights

-

Opinion

A new tight oil powerhouse: Permian Resources and Earthstone create a new large-cap US E&P

Jack Christian

Research Analyst, US Lower 48

Jack Christian

Research Analyst, US Lower 48

Latest articles by Jack

View Jack Christian's full profileMatt Woodson

Principal Analyst, US Lower 48

Matt Woodson

Principal Analyst, US Lower 48

Matt works on the US Upstream research team with a focus on company asset modelling.

Latest articles by Matt

-

Opinion

US Lower 48: 4 things to look for in 2024

-

Opinion

The making of a Megamajor – ExxonMobil acquires Pioneer Natural Resources

-

Opinion

A new tight oil powerhouse: Permian Resources and Earthstone create a new large-cap US E&P

On Monday 21 August Permian Resources (PR) announced the acquisition of Earthstone Energy (ESTE) for US$4.5 billion. The combined enterprise value of the two Permian-focused companies is over US$14 billion, with pro forma equity market cap of close to US$10 billion and production of over 300 kboe/d. The deal is expected to close by the end of the year.

This acquisition effectively creates a new member of the US Large E&P peer group, the first addition to that club in quite some time. It also adds a third Permian pure play, joining Pioneer Natural Resources and Diamondback Energy. The deal illustrates the pace at which relatively small, nimble companies can quickly combine into a formidable player in the most important basin in the US.

The PR/ESTE deal creates the twelfth-largest oil-focused US E&P

It has been quite a year for both ESTE and PR. ESTE just closed on its US$1.5 billion Novo acquisition, and it was only last August that it absorbed Titus for US$575 million. And the Colgate-Centennial combination that created PR occurred just a year ago. Twelve months, five combined companies and US$6.6 billion of deals have culminated in the twelfth-largest oil-focused US E&P – and one that expects to grow about 10% year-over-year.

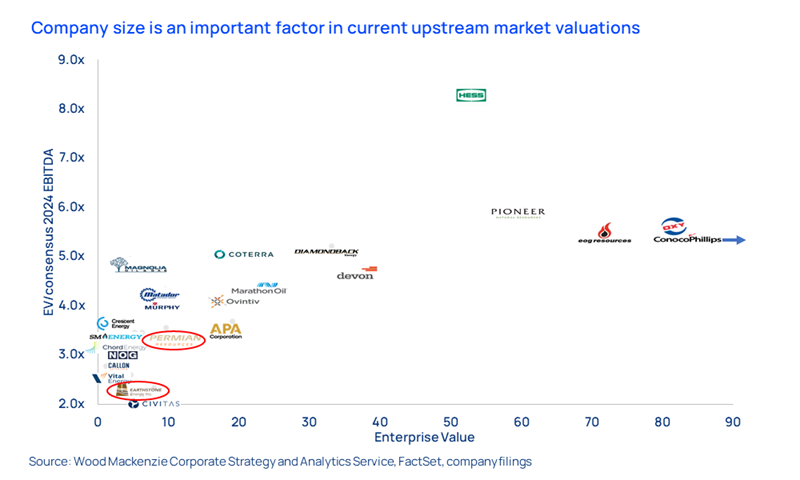

We identify a number of key takeaways in an Inform we published for clients earlier this week. One is the growing acknowledgement that scale matters in public valuations. Other factors influence valuation, like balance sheet, portfolio quality and diversification/concentration risk – each of which can be addressed through other means like hedging. But there is nothing you can do about a lack of scale, other than M&A and/or aggressive growth.

It will be interesting to see if PR’s forward multiple climbs towards similarly sized peers, and if other small- and mid-cap names, currently stuck in the 2x-4x forward EV/EBITDA range, consider similar scale-climbing moves.

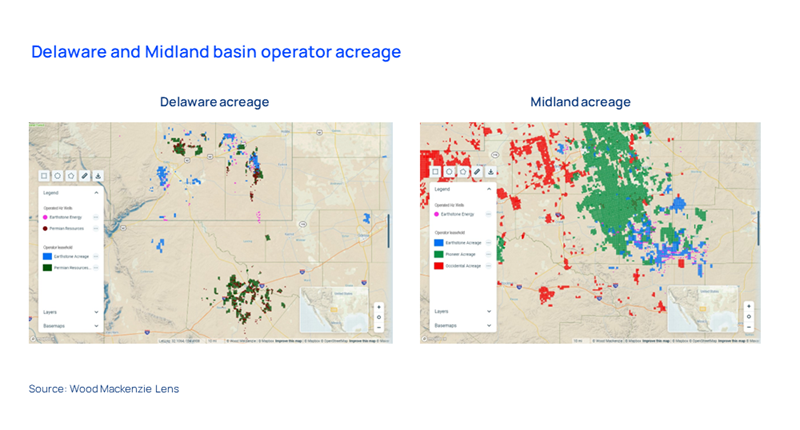

Asset-wise, the next 12 months of Bone Spring wells in New Mexico will be in the spotlight. We cannot recall ever seeing so much callout of the Bone Spring in deal collateral as we did when the transaction was announced. But it makes sense here. The Bone Spring outperforms the Wolfcamp for both companies.

And while Delaware well performance trends have been waning for some operators, ESTE and PR have showcased robust rates relative to earlier vintages. Our latest Bone Spring modelling shows that the combined acreage – almost entirely in the lucrative Core North sub-play – is the only area where all three benches have sub US$40/bbl half-cycle breakevens.

On a call with investors, PR management was also clear that although the acquisition adds Midland Basin acreage, the company is a steadfast Delaware player. They commented that ESTE’s own M&A-fueled growth included, “…three favorite Delaware acquisitions that we didn’t buy.”

So, what could come of PR’s new Midland position in Reagan and Irion counties? It provides cash flow today and with PR running one less rig there than ESTE did, the asset will help fund Delaware growth. Neighbouring Midland players could be hoping the package hits the market, though. Smaller adjacent E&Ps are looking to scale up and larger competitors might value the offset acreage for longer lateral development.

For further analysis of this deal, including our fundamental valuation of Earthstone and PDP/PUD splits, read the full report. And if you have any questions for our US Lower 48 experts, get in touch using the form at the top of the page.

Looking for more Lower 48 perspectives?

Catch Robert Clarke, Vice President, Upstream Research, at the SPE Dallas Meeting on September 20, where he will lead an interactive discussion on US production growth, spending trends, M&A, and investment efficiency.

Visit the event page to find out more.