Sign up today to get the best of our expert insight in your inbox.

Three factors driving US liquids production to new heights

Shining a spotlight on the strength of the US upstream sector

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Upstream’s mounting challenge to deliver future oil supply

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

Ryan Duman

Director, Americas Upstream

Ryan Duman

Director, Americas Upstream

Ryan specialises in supply forecasting, basin characterisation, upstream decarbonisation and economic modeling.

Latest articles by Ryan

-

Opinion

Gas prices enter a bearish spring amid crude market volatility

-

The Edge

Three factors driving US liquids production to new heights

-

Opinion

A new tight oil powerhouse: Permian Resources and Earthstone create a new large-cap US E&P

Robert Clarke

Vice President, Upstream Research

Robert Clarke

Vice President, Upstream Research

Robert leads our US onshore research, with a particular focus on the evolution of the tight oil sector.

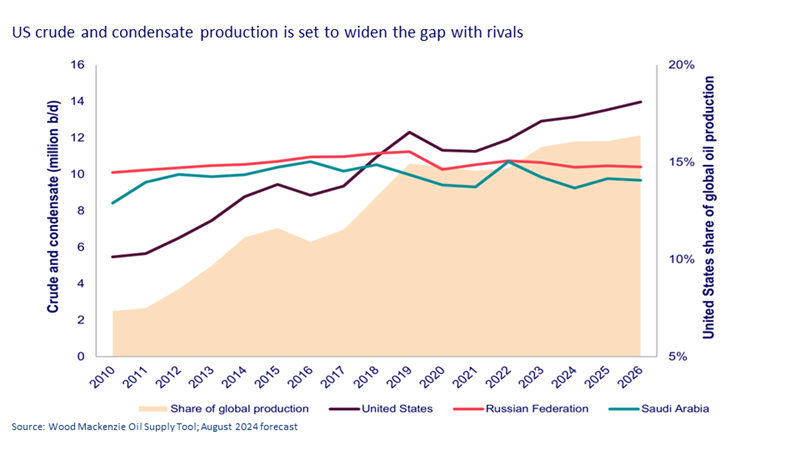

View Robert Clarke's full profileThe US set a new global liquids production record last year, surpassing 13 million b/d of crude and condensate. And there’s more to come – we forecast 14 million b/d by the end of 2026. The US industry is thriving, reflected in Big Oil’s moves to beef up its exposure. Just eight months into 2024, M&A deals in US upstream already exceed two-thirds of 2023’s record US$130 billion. With more big sellers weighing an exit by year-end, another new high could be on the cards.

Business models retooled, US E&P has matured from niche, capital-hungry cyclicals into big, resilient cash machines. The Independents alone collectively returned over US$90 billion in dividends and buybacks in the past two years, equivalent to 16% of their market cap.

Ryan Duman and Robert Clarke from our US upstream team identify three drivers of the US’ ascent to the top of the global supply league table and why it’s now the main growth engine for three of the four largest Majors.

Firstly, the US has all the ingredients investors look for, unlike many other oil and gas provinces

Huge resource potential? Tick. Access to acreage and relatively stable fiscal frameworks? Tick. Broad social licence to operate? Tick? Innovative and responsive supply chain? Tick. Access to capital? Better than elsewhere.

US institutions have provided debt and equity funding to the industry in a way their international counterparts can only dream of. The scale, the diversity and the sheer number of opportunities have made investing in US upstream oil and gas attractive, despite a few rocky years in the relationship between the sector and its backers.

The investibility of the Lower 48 is supported by quick payback periods for operator investments, and the flexibility of business models to adapt to an ever-changing external environment. Few sectors can respond so decisively in a downturn or step into a gap in global commodity markets and value chains such as global LNG like the US Lower 48.

Supportive regulatory frameworks in key states combine with top-quartile scope 1 and 2 emissions metrics. The US has shown the most improvement in upstream intensity of any top-producing nation.

The second success factor is the ruthless and relentless focus on innovation, reinvention and, most recently, operational efficiency

The entire upstream ecosystem has structurally reinvented itself. Producers, suppliers and shippers have aggressively stripped out the excesses of the last decade, today delivering more for less investment. Unlike many other upstream sectors, there have been some genuine win-win relationships between Lower 48 operators and service companies.

Corporate capital efficiency has had its hiccups though. Costs for some leading tight oil developments leapt by 25% from Q4 2021 to Q4 2022 as tight supply chains simply couldn’t respond to higher oil prices. Operators dealt with it by cutting spend and changing their contracting philosophy. The result? Higher capital efficiency of roughly 13% last year, with further gains in H1 2024 and more to come. Today, a US Lower 48 rig is 30% more efficient than two years ago.

Third, US operators leverage data and scale differently

The growing bounty of diagnostics available, many leveraging AI, is being tapped into in the US like never before. Investments in data science and process technologies are optimising resource recovery, while scaling up portfolios through M&A is finally creating the massive contiguous lease blocks shale players have chased for a decade. And with these huge footprints in place and new digital tools to perfect them, preferential supplier relationships and unit cost reductions are emerging.

These are among the main reasons over 50% of ExxonMobil and Chevron’s upstream value (PV10) is now attributable to the US. But it's not just the Lower 48. The US GoM and Alaskan sectors have also reinvented themselves, albeit to a smaller degree, via new play development.

Investors are seeing first oil from the long drawn-out development of ultra high-pressure reservoir (20 kpsi) projects in the US GoM’s Inboard Paleogene. Chevron’s Anchor field came online fresh off the heels of BP’s FID of another, Kaskida, this summer. Technology-enabled growth in the GoM keeps pushing its peak production higher and further into the future, and the new GoM barrels are winning in emissions benchmarks, too.

In Alaska, two major projects under construction, Willow and Pikka, will reverse a 35-year regional decline trend. Pikka construction is now nearly 60% complete. Now that the door has reopened and the appetite for exploration is returning, more project FIDs could come.

So what can we expect from US upstream next?

Some observers will continue to under-estimate an ever-evolving sector, but they do so at their peril. There’s more data, more emphasis on execution efficiency and far more scale and capability in the sector than ever before. Production growth won’t match the boom years, but cash generation has huge upside, and supply declines won’t be as soon or as steep as these same observers assume.

While it’s still much too early to call full success on the optimisation and data science aspirations of the major Permian aggregators, any uplift in recovery factor or cost efficiency improvements should be material, given the size of positions. We estimate ExxonMobil’s resource upside targets from its US$65 billion acquisition of Pioneer have a PV10 of over US$10 billion.

The November 2024 election results are important, but not critical for the unfolding of the US upstream success story. Operators’ ambitions to convert poorer-quality reservoirs and wells into economic opportunities should help shore up US supply, and put US energy security on even firmer ground.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.