Power of Siberia begins gas supply to China (and why it’s ok for LNG)

1 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

Upside pressure mounts on US gas prices

-

The Edge

The coming geothermal age

China finally says ‘Приве́т’ (hello) to Power of Siberia gas

On December 2 Russian gas officially flowed into China with the start-up of the Power of Siberia (PoS) pipeline. The project, which will ultimately see 38 bcm a year delivered under a US$400 billion, 30-year contract, will elevate China to become Gazprom’s second largest export market and support Beijing’s goals of energy import diversification and security.

But for new gas pipelines, timing is everything. With concerns over the pace of domestic gas demand growth and lots of competitive supply options, does China really need (or want) a quick ramp-up of Russian pipeline gas? I’m not convinced. China is a big country and PoS gas needs major investment in pipeline capacity to bring it from the Russian border as far south as Shanghai. This will impact competitiveness as transportation tariffs rise. Throw in rising domestic gas production, dirt cheap spot LNG and ample new regas capacity and Siberian gas could well be in for a frosty reception in China.

Gas demand growth facing headwinds

In 2020 we’ll all be looking very closely at China's economic growth, particularly after last week’s phase one in principle trade agreement with the US. I still find it difficult to get overly optimistic about any breakthrough, particularly as we enter an election year and with White House hawks such as senior trade adviser Peter Navarro still pushing President Trump to go further with tariffs on China. And while I remain confident in the long-term prospects for China’s gas market, economic uncertainties are impacting the pace of demand growth through the short-term.

At the same time, domestic coal consumption and investment in new coal-fired power plants continue to rise, slowing the rate of coal-to-gas switching and putting the pace of gas demand creation at risk over the next few years. Improving energy security can work both ways for gas, and Premier Li Keqiang’s address to the National Energy Commission in October notably re-emphasised the importance of coal to the Chinese economy.

Supply competition also rising

Concerns over demand growth isn’t the only challenge for PoS gas. Under the direct guidance of President Xi, China’s National Oil Companies have been pumping investment into domestic gas production over the past two years, which will see supply rise by 9% in 2020 and increase the average annual growth above 7% over the next five years. This is higher than our previous expectations and it is competitive gas supply that will always find market share.

Read more:

Should LNG fear Power of Siberia gas?

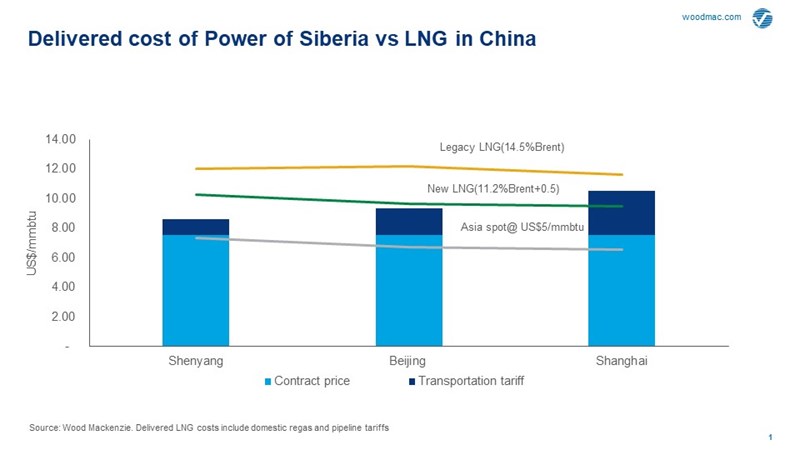

While diversifying gas supply is a pragmatic policy, the cost of any new supply option matters. As mentioned, the competitiveness of PoS gas in China is entirely dependent on where it is sold. In the northeast, tariffs from the Russian border will only be around US$1/mmbtu to reach a city such as Shenyang, making PoS attractive against LNG. But to take gas further south to Shanghai will increase tariffs to around US$3/mmbtu.

LNG doesn’t have this problem. And the world is awash with dirt cheap LNG right now. This will continue over the next couple of years as more projects come onstream. In addition, China is rapidly expanding regas capacity and pushing third-party access policies to encourage more participants. While legacy LNG contracts are the marginal source of supply into China, recent LNG contracting trends are seeing term deals signed around 11% of oil. At this level of oil indexation, should new LNG projects really fear Russian pipeline gas into China? As shown below, it’s all about location.

A frosty welcome for Power of Siberia?

Clearly, 38 bcm a year is a lot of gas and won’t all be consumed within a single region in China. At full capacity, we expect the northeast region will consume around 15 bcm a year, the Beijing-Tianjin-Hebei (BTH) and Shandong markets will consume a further 13-15 bcm a year and the Yangtze River Delta area (including Shanghai) around 8-10 bcm per annum.

For LNG suppliers this is mostly good news. Look at the cost of PoS gas into the Yangtze River Delta versus recent LNG contracts. Not a major competitive threat. And this is a region that already has six regas terminals, with a further three greenfield projects under construction and two more proposed. In addition, all existing terminals have brownfield expansions underway or planned.

What does this mean for the ramp up of PoS gas? Gazprom is targeting a five-year build-up to full contractual levels and markets in northeast China and, likely, the BTH region look promising for PoS gas. But the Yangtze River Delta will be a challenge, with the real prospect of pipeline ramp-up being more gradual given both costs and provincial demand growth uncertainties. In their excellent recent insight How will Power of Siberia shape China’s gas market, our China gas team argues that PoS takes 7-9 years to reach full capacity.

This analysis is based on what we have visibility on – current costs, Chinese gas demand, competing supply alternatives. What most of us have is only limited understanding of how the Power of Siberia gas contract is priced and what future pipeline tariffs will be following the establishment of China’s new national pipeline company in early December. China’s recent proposals to exclude city-gate prices from national regulations, mean Russian gas prices will be deregulated, potentially encouraging PetroChina to raise wholesale prices (which would also benefit LNG).

But what we do know for sure is that even with Russian pipeline gas now in China, LNG is increasingly competitive into China and should continue to play a key role in supplying cleaner energy into this most critical of markets.

APAC Energy Buzz is a blog by Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.