Discuss your challenges with our solutions experts

Seven key questions on the CCUS outlook

Exploring the CCUS outlook: addressing the 'what,' 'why,' 'where,' 'which,' 'who,' 'how,' and 'when'

6 minute read

Peter Findlay

Director of CCUS Economics

Peter Findlay

Director of CCUS Economics

Peter leads the economics and project valuation function for CCUS projects globally.

Latest articles by Peter

-

Opinion

5 key ways to decarbonise cement production

-

The Edge

COP29 key takeaways

-

Opinion

Can CCUS help achieve Net Zero?

-

Opinion

Can CCUS momentum overcome headwinds to the industry?

-

Opinion

Enhanced oil recovery with captured CO2: insights on CCS-EOR

-

Opinion

Carbon management frequently asked questions part 3: CCUS

As the global population burgeons and the average standard of living increases through mid-century, how will our fragile climate and, indeed, humanity deal with the billions of tonnes of carbon and other emissions we produce each year? Climate change impacts that are harmful to plants, animals and humans are compelling governments and industry to act to curb emissions, albeit quite slowly and inefficiently.

Whatever way you cut it, carbon capture, utilisation and storage (CCUS) will play an integral role in decarbonisation and will proliferate over the coming decades. This has prompted us to explore the role CCUS is likely to play, exploring the ‘what’, ‘why’, ‘where’, ‘which’, ‘who’, ‘how’ and ‘when’ of the CCUS outlook.

What role will CCUS play in global decarbonisation?

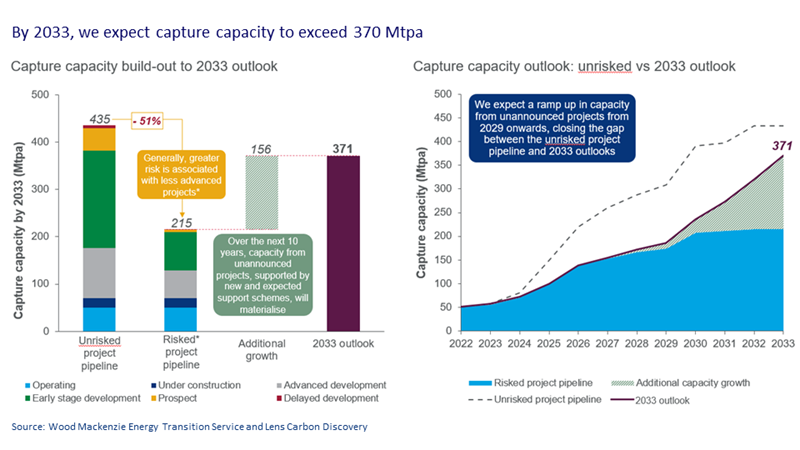

Our Energy Transition Outlook scenario projects a global operational capture capacity increase from 50 million tonnes per annum (Mtpa) today to over 370 Mtpa in 2033, with a concomitant capital spend of just over US$150 billion during that time.

Our accelerated energy transition (AET-1.5) scenario, in contrast, in which global warming is limited to 1.5°C of pre-industrial levels, would require 2.0 Btpa of capture capacity to be operational by 2033 — 40 times 2023’s operational capacity. This would require roughly US$ 1 trillion in CCUS capex alone over the next ten years. This looks highly unlikely to be reached.

Most of the capture capacity we project is still in early-stage development — before material money is spent on front-end engineering and design. Therefore, we apply a considerable risk factor to most projects. Conservatively, we calculated that even if all currently announced projects were built, it would take 1.5 Btpa of additional growth (above the 0.16 Btpa we project) to stay on track for our AET-1.5 scenario.

Why build a CCUS project?

CCUS is mostly not economic. Consequently, its raison d’être is primarily waste management, at least for now.

Beyond the actual commercial value of the CO2, CCUS depends on governments incentivising CO2 removal, emitters willing to reduce their emissions as a voluntary measure and customers prepared to pay a premium for products with low greenhouse gas (GHG) footprints. Is this enough to cover CCUS capital, operating and financing costs? By and large, it is not. Added to this, the costs and complexity of CCUS are mostly still too high.

This is why most announced projects are stuck in early-stage development and the CCUS industry as a whole is not on track to meet the expected CCUS contribution of our AET-1.5 net-zero scenario.

Despite all these headwinds, there is much to be bullish about, however. For many emission sources, CCUS can offer some of the lowest abatement costs. Hard-to-abate sources like cement, hydrogen, waste-to-energy, biomass, petrochemical and steel are especially strong candidates. Almost all long-term net-zero scenarios, including Wood Mackenzie’s, explicitly state that substantial carbon capture will be imperative.

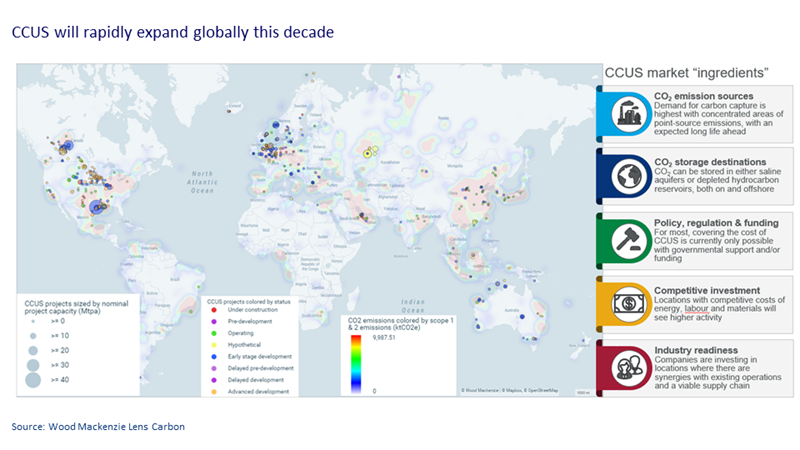

Where is CCUS likely to grow?

We see the largest growth continuing as shown on the map, though we do project a significant increase in projects announced in the Middle East and, potentially, China. Both regions have been relatively quiet on announcements but seem to have grand ambitions for carbon capture.

How might the CCUS market build out?

Amid a smattering of small-scale pilot projects built as first-of-a-kind commercial endeavours with government largesse, there are almost no large-scale global projects driven by solely commercial incentives operating today.

This is about to change. The Inflation Reduction Act in the US and increasingly investible incentives for CCUS in Canada, the United Kingdom, Norway and the European Union are emerging as polestar demand and price signals.

In many cases, CCUS will only be economic if there are sizeable hubs for transport and storage and if capture can be performed at sufficient scale. So, governments and investors are figuring they need to give additional capital boosts. Even so, projects grapple with commercial terms. Owners do not yet have any sort of standardised archetype to follow for commercial structuring, negotiating and liability sharing.

Myriad business-model permutations and combinations have already been proposed among global projects. The most common is where the emitter performs the capture. After all, the emitter’s willingness to sanction capture is normally the green light for CCUS to proceed.

Which emission sources are best suited to CCUS?

In the near term, companies will continue to tackle the low-hanging fruit — mostly pre-combustion or otherwise low-cost and highly incentivised capture in natural gas processing, ethanol, fertiliser and blue hydrogen. We project blue hydrogen to be the dominant emissions source, by capacity anyway, through 2033, primarily due to the vast opportunity to capture carbon from steam-methane reformers, mainly in the US, but also globally.

Hard-to-abate sectors with high capture costs, such as cement, refining and steel, will need additional policy support and easier access to CO2 storage destinations. However, we expect these sectors to bolster capacity growth towards the end of the decade as they pass some of the price of decarbonisation on to customers.

Who will be the central players in the CCUS value chain?

Supermajors are considering investing in all steps of the CCUS process, from capture to storage, as are traditional midstream operators. Even some large emitters are looking to develop, operate and own storage assets, despite not having any prior experience of working in the subsurface. Traditionally above-ground engineering, procurement and construction firms (EPCs) are venturing further into the subsurface or collaborating with firms with geological expertise. Global private equity, pension, and sovereign wealth funds, as well as investment banks, are trying to decipher how CCUS can be profitable and are starting to invest accordingly.

The most active firms are those that are bullish long term on the increasing cost of carbon, have the capability or an existing asset portfolio that lends itself to capture, transport or storage, and see CCUS as their only option to reduce their emissions amid increasing shareholder pressure to decarbonise. Perhaps more critical however, is whether EPC and technology firms can develop quickly enough to deliver CCUS at decreasing costs and global scale.

If not now, then when?

If we assume that the world is actively seeking to decarbonise, the effective cost of emitting GHGs, known as carbon pricing, will need to grow in magnitude, coverage and applicability.

Unfortunately, many regions claiming to have carbon pricing have failed to impose it on much of their emissions ‒ though government subsidies for carbon-abating alternatives, such as electric vehicles, could have an equivalent effect. Such measures will, almost unavoidably, if unintentionally, bias one decarbonisation initiative over another, distorting markets and making them more expensive for the consumer.

Regardless of the specific fiscal policy tools used, consumers in both the developed and developing worlds are price sensitive to energy and other industrial consumption. Inflation and the cost of living are major concerns, and the cost of debt is no longer cheap. Neither is energy. Policymakers are under pressure to minimise the cost of decarbonisation.

CCUS offers cost-competitive carbon abatement in many niches and a few large tranches of global heavy industry. Regrettably, however, it struggles with public acceptance in many regions. This sentiment will impact policy and permitting, slow critical investments in government subsurface expertise, and potentially hamstring CCUS growth.