Navigating the impact of President Trump's tariffs on utility supply chains

How should utilities update their 2025 project budgets or risk mitigation strategies in light of new US tariffs?

2 minute read

Isabel Schwartz

Vice President, Supply Chain Consulting

Isabel Schwartz

Vice President, Supply Chain Consulting

Isabel is a leader in the supply chain consulting practice.

Latest articles by Isabel

-

Opinion

Supply chain call to action: navigating tariff uncertainty today

-

Opinion

Navigating the impact of President Trump's tariffs on utility supply chains

-

Opinion

4 years into a difficult transformers market in the US, is there a potential end in sight?

-

Opinion

Supplier diversity programs: a new source of competitiveness and innovation for utilities in North America?

Benjamin Boucher

Senior Analyst

Benjamin Boucher

Senior Analyst

Ben is focused on supply chain research within the utility and renewables space.

Latest articles by Benjamin

-

Opinion

Navigating the impact of President Trump's tariffs on utility supply chains

-

Opinion

The challenge of growing electricity demand in the US and the shortage of critical electrical equipment

-

Opinion

Supply shortages and an inflexible market give rise to high power transformer lead times

Elysia Sheu

Principal Consultant, Supply Chain

Elysia Sheu

Principal Consultant, Supply Chain

Elysia focuses on supply chain strategy, O&M savings and energy industry operations.

Latest articles by Elysia

View Elysia Sheu's full profileAdam Pearson

Vice President Consulting

Adam Pearson

Vice President Consulting

Adam specialises in leading transformative initiatives with energy operators that deliver bottom-line impact.

Latest articles by Adam

View Adam Pearson's full profileAs a professional services outfit specialising in supply chain risk management and procurement cost management, our team has heard a chorus of interest around the US President-elect’s proposed 25% tariffs on all items from Canada and Mexico, along with additional tariffs on items from China.

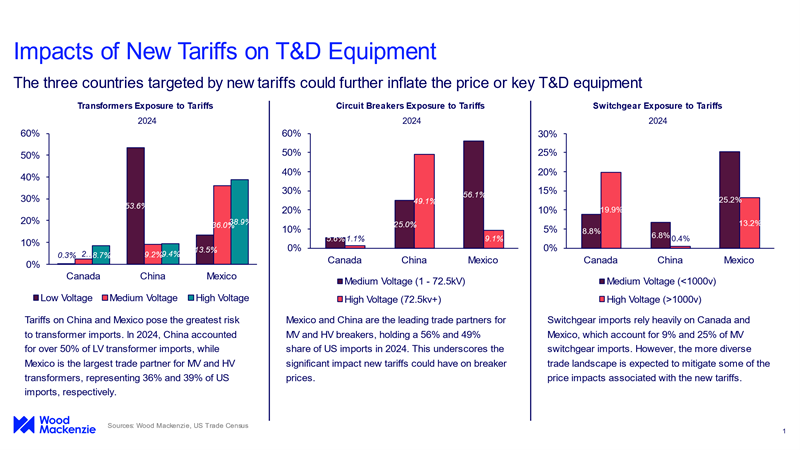

These tariffs could significantly impact the cost structures and operations of many businesses, particularly businesses with US utilities as end customers. Our recent analysis of supply chain spend profiles among utility clients who have commissioned work on this topic has identified key equipment items that have price risk both in terms of direct suppliers and sub-suppliers, especially from suppliers with facilities in Canada and Mexico.

We anticipate that suppliers may seek to qualify and utilise new sub-suppliers for cost reasons, which may also indirectly cause delays and equipment scarcity.

For one of our clients, the largest impact was with respect to electrical equipment. This critical path aspect of transmission and distribution projects has already faced tremendous security of supply and cost pressure the past five years with increased competition for the materials with the rise of renewables and transmission & distribution construction, increased storm response and volatile metals markets.

In fact, many utilities shifted to overseas suppliers of electrical equipment to achieve supply surety, a strategy which may now have unforeseen costs. The additional cost pressure from tariffs coupled with supply pressure via new electric generation assets to support AI data centres, and a shift of federal investments from renewables builds to T&D infrastructure may exacerbate what the last five years have been.

Given the potential financial and capital project execution implications of these tariffs, it is crucial for businesses to proactively assess their exposure via scenario analysis and develop robust action plans. Supply chains have become more global and more complex in the last decades, underscoring the challenge of identifying exposure in this situation without the right information.

Download a sample of our Wood Mackenzie Tariff Exposure Analysis

Fill out the form at the top of the page to download your complimentary redacted copy of our recent Tariff Exposure Analysis.

Learn more about Wood Mackenzie’s Consulting offering

Our team is equipped with the expertise and data to help you navigate the above challenges. We can assist in reviewing your exposure profile and quantifying the magnitude of exposure, identifying at-risk equipment/components/suppliers, and formulating strategies to mitigate the impact. The wisest leaders will be proactive and develop action plans before tariffs take effect. Click here to learn more about how we can help you build the right strategy for this changing landscape.