The key takeaways from our PJM, MISO and ERCOT seasonal outlook webinars

What are the current topics creating a buzz for major US electricity grid operators?

5 minute read

Tien Tong

Market Associate, MISO

Tien Tong

Market Associate, MISO

Tien joined Wood Mackenzie in August 2022 as an analyst in the MISO team.

Latest articles by Tien

-

Opinion

US seasonal outlook webinars: hot topics for MISO and SPP in Spring 2025

-

Opinion

US seasonal outlook webinars: hot topics for ERCOT and MISO in summer 2024

-

Opinion

The key takeaways from our PJM, MISO and ERCOT seasonal outlook webinars

Benjamin Hoog

Market Analyst, PJM

Benjamin Hoog

Market Analyst, PJM

Benji focuses on power price forecasting, congestion analysis and consulting.

Latest articles by Benjamin

View Benjamin Hoog's full profileJessalyn Chuang

Lead Analyst, Power Market Intelligence

Jessalyn Chuang

Lead Analyst, Power Market Intelligence

Jessalyn is a wholesale power industry analyst with a focus on the Midwestern US region.

Latest articles by Jessalyn

-

Opinion

The biggest takeaways from our PJM and ERCOT spring outlook webinars

-

Opinion

The key takeaways from our PJM, MISO and ERCOT seasonal outlook webinars

-

Opinion

Power rush in the Wild West: tracking the progress of US regional power market pioneers

Taoxuan Luo

Market Analyst, Power & Renewables

Taoxuan Luo

Market Analyst, Power & Renewables

Latest articles by Taoxuan

-

Opinion

US seasonal power outlooks Summer 2025: hot topics for ERCOT, MISO and PJM

-

Opinion

US seasonal outlook webinars: hot topics for ERCOT and MISO in summer 2024

-

Opinion

The biggest takeaways from our PJM and ERCOT spring outlook webinars

-

Opinion

The key takeaways from our PJM, MISO and ERCOT seasonal outlook webinars

-

Opinion

How the ERCOT grid has changed over time, and the obstacles ahead

US regional transmission organizations (RTOs) fulfill a vital role. As well as ensuring the safe, reliable and cost-efficient provision of electricity to millions of American homes and businesses, RTOs must constantly adapt and innovate to meet anticipated future demand.

Our power and renewables short-term analysts recently presented a series of webinars providing seasonal outlooks and forward-looking insights for three key RTOs – PJM, ERCOT and MISO. Read on for a quick overview of the some of the highlights from each outlook, and fill out the form to get complimentary access to the full slide decks and webinar recordings.

PJM

Canadian wildfire smoke affects PJM’s electricity market

For PJM, which operates in 13 states in the northeast of the country as well as the District of Columbia, a burning issue has been the impact of smoke from wildfires in Canada.

Smoke partially blocks the sun’s rays, limiting the amount of electricity generated by solar arrays while also keeping temperatures and structures cooler than they otherwise would be. "This creates disparity between both the amount of electricity generated from solar and the amount of cooling load present on comparable historical days, leading to uncertainty in load forecasting.

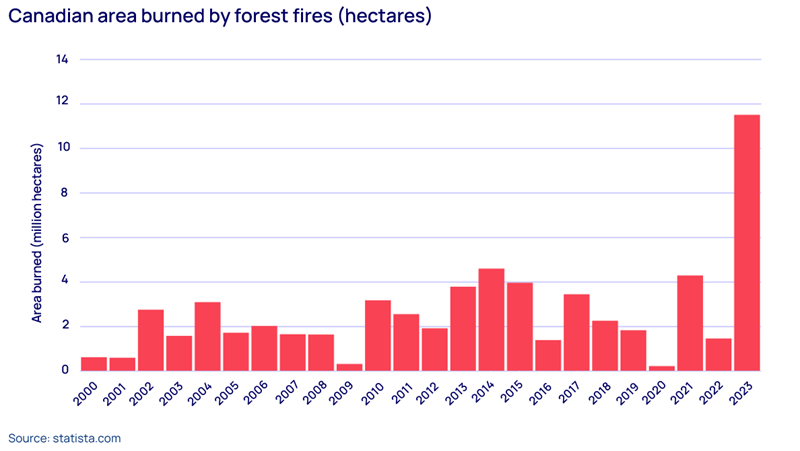

Unusually dry conditions and high temperatures mean 2023 is already the worst year on record for Canadian wildfires, with over 11 million hectares having gone up in smoke so far. The Canadian wildfire season runs from May to October, so with the Canadian Forest Service warning of an ongoing heightened risk of fire activity, the problems aren’t over yet.

Record areas of Canada have been burned by wildfires in 2023, reducing solar generation

MISO

Midwest Independent System Operator (MISO) manages the flow of electricity across 15 states in the US Midwest and South, as well as in the Canadian province of Manitoba. For MISO, an important focus is the reduction of emissions.

EPA Good Neighbor Plan

The US Environmental Protection Agency (EPA) is mandated to address pollution by federal law in the form of the Clean Air Act. Its Good Neighbor Plan (GNP) aims to significantly reduce nitrogen oxide (NOx) emissions from power plants and other industrial facilities, which are a major cause of ground-level ozone, or smog. The GNP sets an annual ozone ‘budget’, as well as a daily emission limit to ensure electricity generating units (EGUs) full operate controls.

Greenhouse Gas Standards

In May 2023 the EPA announced proposed new greenhouse gas emission standards designed to limit CO2 emissions from fossil fuel-fired powerplants. These rules would require nearly all existing fossil-fuel EGUs to either implement carbon capture and storage (CCS), substantially replace fossil fuel with hydrogen, or shut down altogether.

For MISO, the new rules would mean that 9 GW of existing generation would be forced to retire early by 2032 (of these, Germantown is the only non-coal-fired plant). Overall, 38.2 GW of natural-gas-fired combustion turbine and coal-fired generation capacity will be retired between 2024 and 2035. The MISO slide deck includes a full state-by-state breakdown of projected retirements and the resulting impacts on market dynamics.

ERCOT

For the Electric Reliability Council of Texas, the key questions revolve around whether renewables and new ancillary services can help avoid future disaster, as demand continues to surpass all-time records.

ERCOT Contingency Reserve Service

The organisation’s newest ancillary service product in over a decade, the ERCOT Contingency Reserve Service (ECRS) was implemented at the start of the summer. With solar and wind generation providing more and more of the state’s electricity, ECRS is a much-needed tool aimed at improving grid flexibility and reliability.

The service will be deployed in situations where there is between 1,098 and 3,038 MW of available electricity reserves. Any generation resource with online or offline capacity that can be converted to energy within 10 minutes of receiving the signal can participate in the scheme. As well as providing capacity during net load ramping hours, it will help to recover frequency following a unit trip.

Model Unit Output

Modelled Unit Output (MUO) is a set of predictive models that are constantly retrained using both public and proprietary Wood Mackenzie data. These models make it possible for us to estimate real-time plant generation in situations where output cannot be monitored using EMF sensors or infrared cameras. As a result, we can provide close to 100% coverage of ERCOT generation to subscribers. By allowing you to monitor activity from ‘peaker’ EGUs that kick in when demand is high, MUO allows you to better assess the possibility of price spikes driven by supply-demand imbalances.

Bitcoin mining impact

We recently conducted research in conjunction with our Grid Edge team into the impact of electricity use for Bitcoin mining on non-mining ratepayers. Creating new Bitcoin mining load requires ever larger amounts of computing power and is increasingly conducted in huge, purpose-built data centres (essentially, warehouses containing banks of high-powered computers and cooling equipment).

Bitcoin mining is booming in Texas. Based on operational capacity confirmed by a New York Times investigation, the activity uses at least 1,787 MW of electricity, or 2.2% of baseload, in ERCOT. Our study found that during typical autumn conditions, subtracting the load due to mining reduces locational marginal pricing (LMP) by US$5 per megawatt hour (MWh), on average. This means that mining effectively raises prices by US$5/MWh, due to the need for more and more expensive generators to be dispatched.

Overall, by our calculations Bitcoin mining already raises electricity costs for non-mining Texans by US$1.8 billion per year, or 4.7%. These figures are conservative, accounting only for mining during ‘blue sky’ hours when prices are under US$150/MWh. Bitcoin mining is likely to have stronger impacts on the grid over time as the number of larger and more power-hungry mining facilities is likely to grow.

Find out more

Don’t forget to fill in the form at the top of the page to get complimentary access to the slide decks and webinar recordings, which explore the above topics in more detail. They also include reviews of the summer period and outlooks for fall weather, demand and generation.