There’s still life in China’s shale gas

Production has surprised to the upside, but a Chinese shale revolution seems a distant prospect

1 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

Upside pressure mounts on US gas prices

-

The Edge

The coming geothermal age

Looking back over a decade as the US shale gas boom began to dramatically transform the country’s energy balance, driving down gas prices and ultimately creating one of the world’s largest LNG exporters, many speculated whether China could replicate this success. Optimism was bolstered by studies indicating China held massive shale gas resources: a 2013 US EIA study estimated China’s total shale gas resource at over 1,160 tcf, the world's largest.

The reality is that since then China’s shale gas sector has disappointed. Complex geology, significant above ground challenges – including topography, high population density and water access – and weak fiscal and regulatory support kept costs high and returns marginal. Numerous IOCs with cutting edge shale experience looked at the sector, but few liked what they saw. Today, the only material players are Sinopec and PetroChina, with almost all activity limited to the Sichuan basin in central China.

Despite this, there are reasons to be optimistic. China’s shale gas production climbed to over 20 bcm (1.9 bcfd) in 2020, an impressive 30% year-on-year jump. And while this was only two thirds of the government’s 2020 target of 30 bcm, it remains a credible performance (and nearly 10% higher than we expected). More is still to come: motivated by government directives, increasing technical knowledge and China’s super-charged gas market, PetroChina and Sinopec are reinventing domestic shale gas development by chasing shale formations far deeper than those in the US.

Where could China’s shale sector go next? To understand more I spoke to Xianhui Zhang from our China upstream research team.

How are China’s NOCs overcoming the challenges that define their domestic shale sector?

With the government seeking both to enhance energy security and increase the share of gas in the energy mix, the NOCs were never going to be able to put shale gas in the ‘too difficult’ bucket indefinitely. And this doesn’t just apply to shale, with the government also demanding progress with tight gas and super-deep high-pressure high-temperature formations in China’s most remote basins.

The lion’s share of current shale production comes from what we call the Sichuan basin’s ‘middle shale’ plays (2,000-3,500 metres depth). The NOCs have made real progress here understanding the rocks and building the supply chains that have driven current production growth. Appraisal and development activities are now turning to deeper resources to ensure longer-term output, located at depths ranging from 3,500 to over 4,500 metres. Given this is roughly double the depth of most Marcellus shale wells in the US, results, perhaps unsurprisingly, have been mixed. But this is where we believe the Chinese NOCs see their shale future – going ultradeep to unlock new gas resources.

You might be interested in: The Edge - The prize for China from decarbonisation

How is this impacting the economics of Chinese shale?

For all the need to meet government targets, the NOCs also want to make money. And that gets more difficult the deeper they drill, with inevitably higher well costs from deep shale making returns marginal. We estimate a deep shale development well costs US$9 million (2021 terms) to drill and complete, US$2 million more than a middle shale well.

Bringing these costs down will require innovation. Many of the technologies used in ‘middle shale’ are not necessarily fit for purpose for more challenging depths and need improvement. Secondly, reliance on imported equipment – mostly HP/HT related - must be reduced to lower breakeven costs. Neither challenge will be straightforward to overcome.

Can China quickly grow its domestic shale gas sector?

Total shale spend by PetroChina and Sinopec is expected to remain steady at current levels of around US$3 billion a year through to at least 2023. On top of this, well performance is improving, and we see this continuing through continued progress in reservoir management. Undoubtedly some imported skills and equipment will be required, but through innovative home-grown technology and equipment to cut costs, commercially attractive production will rise.

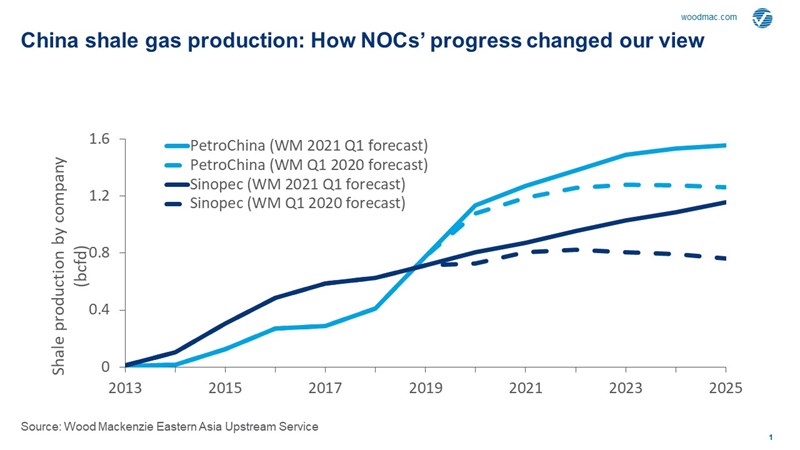

That sounds positive and we have upgraded our forecasts as a result (see below). But positivity by itself won’t get the NOCs to their 2025 targets. PetroChina is aiming for up to 2.6 bcfd, versus 1.1 bcfd today, yet our modelling suggests something like 1.6 bcfd looks more realistic. Meanwhile, Sinopec aims to hit almost 1 bcfd from its flagship Fuling project by 2025, but again we see this falling short. Without a revolution in well performance – and those highly complex above- and underground challenges aren’t going away - these growth targets simply don’t jive with plans to keep spend relatively flat.

Further out, the future of China’s shale sector really depends upon whether the NOCs can crack the deep shale in the southern Sichuan basin. It’s undoubtedly a huge potential prize if the technical challenges of sweet spot identification, fracturing operations and effectiveness can be overcome. It’s also some of the most expensive gas in China to produce, currently around twice the cost on a boe basis versus Sichuan conventional gas.

Dominated by the Sichuan basin, WoodMac expects China will produce 30 bcm (2.9 bcfd) of shale gas by 2025, making up around 14% of the domestic gas supply at that point. But looking further out, much more still needs to be done. For the Chinese NOCs, hitting the 7.7 to 9.7 bcfd (80 to 100 bcm) 2030 target already set by the Chinese government is a huge ask!

Can other companies be tempted into the shale sector?

We’re aware that the Chinese government would like to see more companies participating across the domestic upstream space. And while this doesn’t necessarily mean efforts to attract IOCs, we are seeing encouragement for local state-owned and private companies. Unfortunately, the scorecard on this hasn’t been great.

Some players are emerging, including Guizhou Wujiang Energy Group (GWEG), which recently won all six blocks offered in Guizhou province in China’s 2020 shale gas licensing round. But we need to keep our feet on the ground. GWEG is backed by its provincial government, unlike most domestic non-NOCs. Going up against the big NOCs has been tried before by smaller players in China and for many this has been a bruising experience.

Read also: The role of NOCs on the road to net zero

And how about the IOCs?

I think it’s fair to say that most of those IOCs who ventured into Chinese shale in the past are not queuing up to repeat the experience. It’s not impossible that some might consider opportunities in future license rounds if high-quality acreage is on offer, but don’t count on it.

APAC Energy Buzz is a weekly blog by Wood Mackenzie Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.