Tracking the trajectory of the global energy storage market

Last year was a bumper year for energy storage deployment and the market is set to grow further

1 minute read

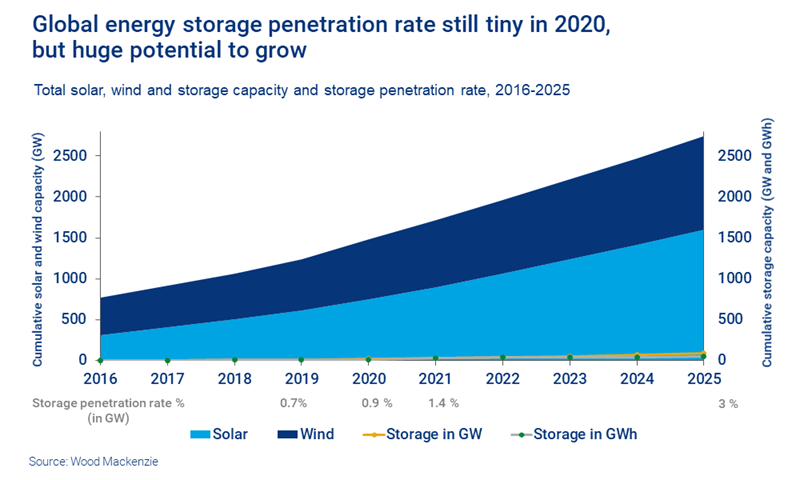

Global energy storage deployment surged a remarkable 62% in 2020, with 5 GW/9 GWh of new capacity added. This brought the total energy storage market to more than 27 GWh. Furthermore, we expect the global market to grow 27-fold by 2030.

But where will the growth come from? What technologies will triumph? And what will it all cost?

Our Global Energy Storage Outlook H1 2021 takes an in-depth look at the drivers of energy storage worldwide, the storage supply chain and price and technology trends, providing a comprehensive regional breakdown of forecasts to 2030. Fill in the form for a complimentary extract or read on for an outline of some of our key themes.

Growth in storage investment set to continue after a bumper year in 2020

Around US$ 5.4 billion in new investment was committed to energy storage projects globally in 2020, increasing overall investment in the energy storage market to an estimated US$22 billion. By 2025, the total investment pot is likely to reach US$86 billion – that’s a 24% compound annual growth rate (CAGR) – despite the economic slowdown induced by the COVID-19 pandemic.

Front-of-the-meter (FTM) storage continued to dominate the market, with 5 GWh added in 2020. US FTM battery storage soared 373% in 2020, while China and the UK saw remarkable growth, boosted by grid-related policy and regulation.

The market started to move from small-scale, short-duration batteries to four-hour batteries in 2020. By 2030, we expect the average lithium-ion project size to grow significantly. Visit our store to buy the full report, which includes forecasts by market, country and technology, or fill in the form for an extract.

COVID-19 and other forces are shifting storage market patterns

Asia Pacific led the storage market in 2020. However, the Americas is poised to overtake by 2025. Most of this growth will come from the US, where capacity is growing fast – storage installations tripled in 2020, accounting for 38% of total new capacity.

Storage installations in Asia Pacific will slow in the face of challenges from market incentives and business cases. The region is relying on the ramp-up of cell production to reduce costs.

Covid-19 has made its presence felt over the last year, to varying degrees in different regions. The pandemic’s main impact on the non-residential market was a fall in industrial and commercial power demand, though certain countries bucked the trend and reported growth. The ‘new normal’ of working from home, meanwhile, encouraged households with high energy costs to install rooftop solar batteries to lower their electricity bills. Electric vehicle uptake and a rooftop solar upswing made Germany the global residential market leader in 2020.

How will the global market shift over the coming decade? Read the full report to see detailed developments by market and region and the outlook through to 2030, or download the extract for a complimentary chart of market size by region.

Storage could have an important role to play in resiliency

Storage has proved it has role to play in blackouts and resiliency events. When California experienced blackout events in August 2020, the power remained off for 30 minutes to two-and-a-half hours. As rolling blackouts ended and power came back online, those with storage or solar-paired storage found themselves able to weather the event in relatively good shape, enduring limited outages depending on the timing of the blackout and the size of their storage solution.

The outages in Texas, by comparison, lasted more than 70 hours, presenting a far more complex problem and one in which storage’s role is not quite so clear. In a fundamentally resilient grid, storage has tremendous opportunity to mitigate extreme events. However, in a black-swan event, such as that in Texas, storage relies on the fundamentals of generation and transmission to function.

Our Global Energy Storage Outlook H1 2021 explores the role that storage plays in blackouts and resiliency events and looks at the potential of storage to mitigate a California- or Texas-style event.

Fill in the form at the top of the page for a complimentary extract that includes:

- Comparing CAISO and ERCOT outages: a tale of two weather events

- Analysis of the potential of storage to mitigate a CAISO or ERCOT style event

- And more.