Discuss your challenges with our solutions experts

Russian refining outages surge on Ukraine drone attacks: three key questions answered

Russian waterborne product exports see substantial cuts, will crude loadings be next?

4 minute read

Emma Howsham

Senior Research Analyst, Short-Term Refining and Oils Markets

Emma Howsham

Senior Research Analyst, Short-Term Refining and Oils Markets

Emma specialises in short-term refining markets for both Europe and Russia markets.

Latest articles by Emma

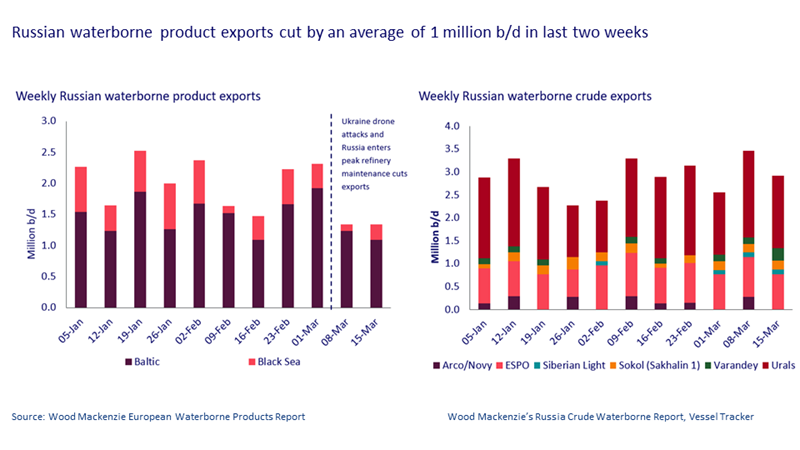

View Emma Howsham's full profileThe latest wave of Ukraine drone attacks on the Russian refinery system is likely to have a more meaningful impact on Russian refinery production than the ones in January and February, but ultimately are still unlikely to move the needle or impact sentiment around the softening global diesel/gasoil market. The latest attacks targeted primary refining processing units resulting in Russian waterborne product exports decreasing by an average 1 million b/d over the last two weeks.

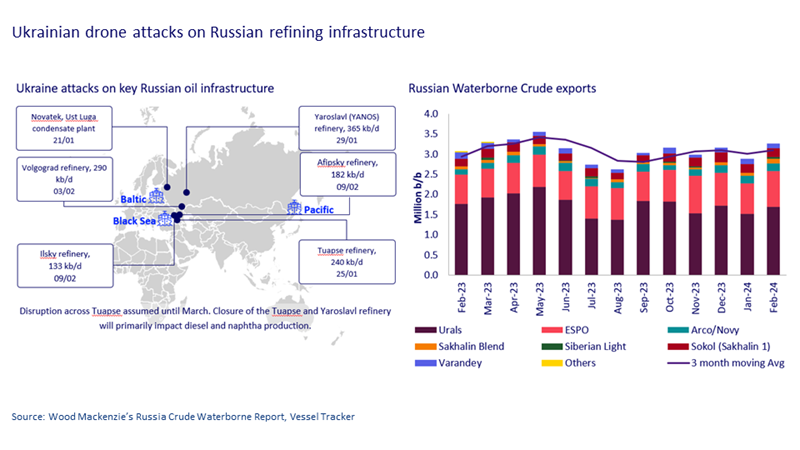

At a Wood Mackenzie briefing in February, we presented our data indicating there remained a substantial risk to Russian refinery supply if attacks were to continue or escalate. We highlighted that over 3 million b/d of refining capacity was estimated to be within range of Ukraine strikes and that crude exports from Western ports could see further upside while refined product exports cut. The chart below maps out the attacks as of 29 February.

Since then, there has been another flurry of drone attacks across a further five refining sites, resulting in primary processing capacity outages and lower refined product exports. Read on for answers to three key questions on the impact of these attacks on Russian refineries and trade flows using our real time data and analytics.

1. What is the potential loss of Russia's crude refining capacities?

The recent wave of Ukraine drone attacks on Russian refinery infrastructure has been focused on primary processing capacity and is expected to have a more substantial impact than the attacks earlier this year. The January and February attacks targeted secondary processing capacity and tank storage allowing refiners to remain largely operational with limited impact to refining throughput or exports.

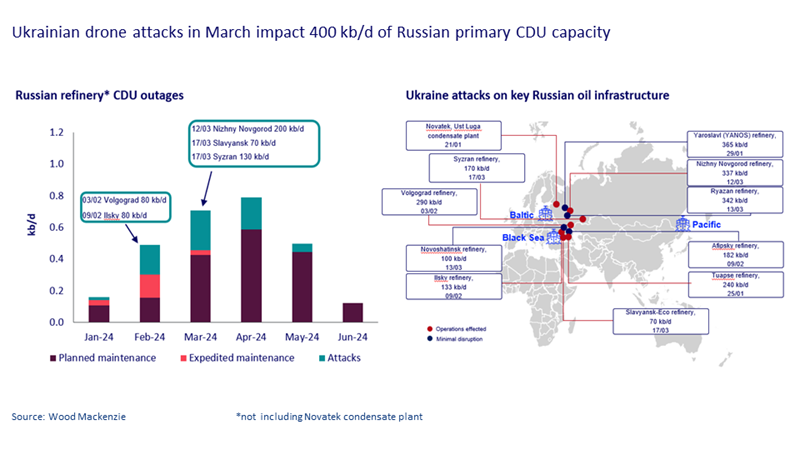

The three refineries directly impacted in the March attacks (Nizhny Novgorod, Slavyansk-Eco, Syzran) are estimated to remove 400 kb/d of primary processing capacity. Slavyansk-Eco refinery is considered completely offline while there remains some operational processing units at the much larger refineries, Nizhny Novgorod and Syzran.

2. How could the loss of these capabilities affect crude and refined product exports?

We expect the average utilisation across the remaining operational Russian refineries to increase given stronger domestic product prices and higher refining margins. However, given increasing maintenance and the impact of attacks we expect average runs end of March into April to average nearer 5.0 million b/d, which is 370kb/d lower than the January-February average. Russian runs have hit lows not seen since April-22 just after the start of the Russia invasion, which will have an impact on both domestic product prices but also on international markets.

At present we are yet to see an increase in crude exports but with an estimated 0.8-1.0 million b/d of refinery capacity offline over the coming months exports could see a material increase. The forecasted offline capacity includes both outages due to the drone attacks and planned maintenance, however, some planned maintenance could be deferred to ensure sufficient refined product supply to the domestic market.

In the last two weeks our data shows total Russian refined product exports decreased an average 1 million b/d – this is driven by a combination of Russian refiners entering planned maintenance as well as the recent attacks. Diesel/gasoil exports are down 400 kb/d while fuel oil loadings are down 300kb/d. Maintenance is forecast to peak in May which could see up to a further 200kb/d decrease in product exports. There has been no major shift in global diesel or fuel oil cracks yet, however a sustained drop in these product exports would imply cracks could increase as the global balances tightens.

3. When will crude processing capacity be restored in Russia, assuming no further attacks?

We anticipate the current primary processing outages to be resolved by May, although a substantial risk remains that the Ukraine attacks escalate. These latest strikes highlight Ukraine's increasing capabilities and the accuracy at which it can hit critical targets. A strike on key product export terminal infrastructure at the ports of Primorsk or Novorossiysk would further escalate the pressure on Russian oil refining revenue – but also on the relationship with Ukraine’s Western allies as the impact on global oil and refined product prices would be substantial.

Refiners impacted by the attacks will opt to keep their secondary refining units running, despite minimal operational primary processing capacity. These refiners will run out of available secondary feedstocks relatively quickly. They will look to source feedstocks from other domestic refineries to allow the secondary units to continue to run at a minimum operational rate. There will likely be a yield shift towards fuel oil as secondary unit utilisation rates will fall across both Nizhny Novgorod and Syzran. This could limit VGO exports in particular at a time when global heavy resid feedstock availability is already tight, given OPEC+ supply cuts and refiners running lighter crude slates.

The global commodities market is changing rapidly and to make quick and informed decisions, you need access to real-time and historical data, forecasts, analytical insight, tools and software solutions. Our real-time data analytics services leverage a combination of unique data collection techniques, data science and a team of experienced energy market analysts to help maintain your competitive edge.