What does a stalling auto sector mean for polymer markets?

Coronavirus has hit automotive sales and demand, and plastics will feel the impact

1 minute read

Coronavirus containment measures have introduced major restrictions on travel and mobility around the world. The impact on transportation has been immediate, and the effect on the automotive sector far-reaching. Andrew Brown, Senior Analyst, Polymer Demand and Timur Zilbershteyn, Principal Analyst, Thermoplastics, explore the challenge this poses for the polymers industry.

This article is an excerpt from our latest coronavirus and polymers weekly update. Fill in the form for a complimentary copy of the full insight or read on for some of the highlights.

The automotive sector is a key driver of polymer demand

The automotive sector is a significant source of polymer demand, and a key source of growth for the next 20 years. Automotive trends, such as the lightweighting of vehicles to achieve better fuel efficiency, are driving increases in the use of plastic. Between 5% and 10% of all polymers produced each year currently go into the industry.

So, it is a serious concern for the chemicals industry when the automotive sector goes into a downturn. And coronavirus has hit the sector fast and hard, driven by hits to both production and demand. Strict interventions to restrict the spread of the virus have led to shuttered factories and showrooms around the world.

Automotive production has been hit hard

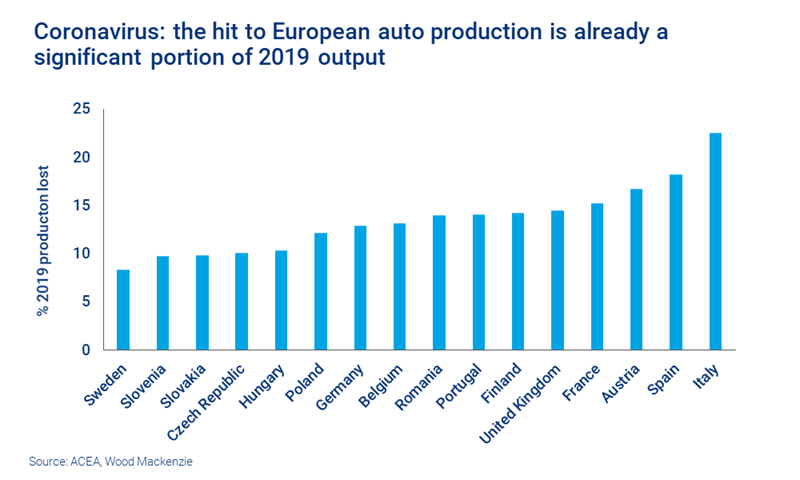

Drawing out a detailed view of the impact of coronavirus on the sector is challenging due to the different timing of interventions by governments, but the big picture is easy to see.

On the production side, China produced 49% fewer cars in March 2020 than in the same month in 2019. In Europe, factory shutdowns from late March have stopped the production of more than 2 million units – equivalent to more than 14% of cars produced in the same facilities in 2019.

Sales have seen even steeper falls. This is not surprising – people can’t start or complete the process of buying a car when showrooms were closed, and the threat of recession will further influence consumer behaviour. In the first month of lockdown, car sales declined by between 70-90% in countries such as China, Italy and France.

Which polymers are most at risk of an automotive slowdown?

The good news for producers of PET resin or polystyrene (PS), is that none of this matters much. These polymers – primarily focused on packaging – are not exposed to the automotive sector. However, other polymers are bearing the burden.

Polypropylene (PP) is the most prevalent polymer in cars. It’s used in large components, such as bumpers and interior panels. However, PP is a versatile polymer with exposure to many applications in different industries – so ‘only’ 8% of demand comes from the automotive sector.

Much more exposed are engineering plastics that go into the higher-value parts that require more specialist chemical or thermal properties. For PA66, nearly half of its demand is in various high-temperature resistant and flame-retardant car plastics, and in fibres used to produce airbags. Broader thermoplastics and polyurethane are the other big losers from a crash in the demand for cars.

How bumpy is the road ahead?

The good news is that (from the limited evidence we can review to date) factories and showrooms can fire up again fairly quickly when lockdowns unwind. In China, for example, one major parts producer in Wuhan reported operating at 80% of capacity by the middle of April in response to demand from their automotive customers.

While further behind in the pandemic timetable, automotive producers in other countries are also restarting production, albeit at reduced rates. Volkswagen restarted its main plant in Wolfsburg, Germany on 27 April, at about 10% of the previous production level, with the expectation to reach 40% in the coming weeks. In the US, Detroit car companies (GM, Ford, Fiat Chrysler) are reportedly planning to restart on 18 May.

So, while some disruptions along the automotive supply chain may continue, the industry will likely be able to serve prospective buyers. But how many will come? Will postponed purchases be realised or will demand remain depressed?

To find out more, fill in the form at the top of this page to receive a complimentary copy of this week’s coronavirus and polymers update.