Challenges to tight oil’s growth as spend tapers

Capital discipline drives rig count down

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

Tight oil’s emergence has emboldened US foreign policy these last three years. Without the security of its resurgent domestic oil supply, the US could not have imposed sanctions on crude exports from Venezuela and Iran. Nor would oil markets have all but shrugged off the attack on Saudi Arabia. So how is US tight oil performing in this febrile environment? I asked Robert Clarke and R.T. Dukes of our Lower 48 Upstream Research team.

Read on to get the answers to the following questions:

- Why did we turn more bullish on tight oil this summer?

- What are the risks to the forecasts?

- How is tight oil performing in 2019?

- But aren’t the Majors cranking up tight oil investment?

- Why the slowdown?

- What needs to happen to get to our 13 million b/d forecast?

1. We turned more bullish on tight oil this summer – why?

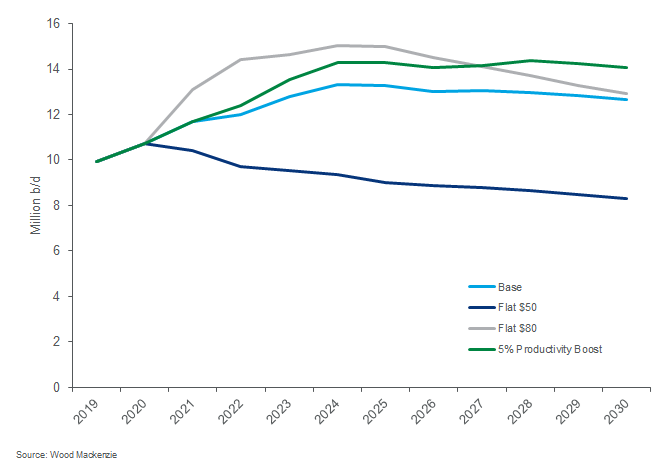

We upgraded US L48 production by 1.3 million b/d. That’s about 10% higher than before and takes the peak to over 13 million b/d in 2025. Breakevens are lower across the board. Permian horizontal wells, where tight oil is growing fastest, show a 10% drop with drilling and completion costs the biggest driver. Lower breakevens bring more low-cost inventory into play. We now think tight oil’s growth trajectory is more prolonged and that production plateaus just below peak through the 2020s. It’ll take continuous spending and a progressive price deck to stay there though.

2. What are the risks to the forecasts?

On the upside, better productivity. Gains have stalled and reverting to past positive trends could lift peak production to 14 million b/d in 2025. Besides weaker oil prices, on the downside the industry is still getting to grips with the limitations posed by parent/child wells and spacing. There’s only one widespread solution so far: lower density drilling i.e. drill fewer wells. Parent/child interactions become almost unavoidable as plays mature and we’ve seen this in every other unconventional play.

3. How is tight oil performing in 2019?

Growth is slowing. The 2016 oil price rally spurred a ramp-up of new projects and annual volumes grew by as much as 1.6 million b/d in 2018. We expect another 1.2 million b/d this year, taking US L48 production to 10 million b/d – eclipsing Saudi Arabia for the first time in decades. But the tide is ebbing – growth will be just 0.5 million b/d in 2020 and the exit rate (monthly year-on-year growth rate) could fall close to zero.

4. But aren’t the Majors cranking up tight oil investment?

They are, and they might crank up even more. ExxonMobil and Chevron are the two biggest players in the Permian, holding millions of prize acres laden with low breakeven inventory. They came later to the party, just as some Independents’ Wolfcamp portfolios were maturing. Each has high ambitions, and both are on target – ExxonMobil to lift production to 1 million boe/d in 2024, Chevron to 0.9 million boe/d in 2023. They are drilling faster than offset operators, spacing wells more closely, and adopting a sophisticated approach to project management and integration. The goals are to maximise well NPV and returns, and to generate cash flow quickly. They have the capital and will invest what’s needed in the coming years to deliver on their targets.

5. Why, then, the slowdown?

The Independents, which produce 80% of Permian volumes, are scaling back spend. They’re being forced by investors to generate cash flow and pay dividends. Capital discipline is reflected in the rig count – total Permian rigs are down nearly 60 units this year despite ExxonMobil’s aggressive roll-out. If Independents overrun on costs in Q3 earnings, they’ll cut more rigs at the end of the year and tight oil growth will slow more in 2020. We doubt that the brief rally in oil price after the Saudi attack will change tight oil investment much, if at all. Investors are calling the shots. For some management teams, it’s proving tough to change the ‘grow at all costs’ mindset.

6. What needs to happen to get to our 13 million b/d forecast?

The current, slowing growth rate shows how tight oil is sensitive both to price and investment. Our number implies 3 million b/d of additional volumes between 2020 and 2025. It’s achievable with a robust price deck, if Independents regain investors’ confidence by generating free cash flow to spend more, and if the Majors deliver on their targets.

Get weekly hot takes on tight oil with R.T. Dukes and guests

Listen to the Crude for Thought podcast where R.T. Dukes and his expert guests share their sometimes unconventional views on unconventionals.