Cost challenges in a US$20/bbl world

A new approach is needed to ensure supply sector resilience

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

How will US$20/bbl affect the oil and gas supply chain? It’s going to get tough, very tough. The service sector is already on the ropes but will be first port of call when operators look to save money. IOCs and NOCs need to recognise they’ll want a functioning, reliable service sector when things pick up, as they will. I talked it all through with Andy Tidey, Head of our Performance Improvement team.

Covid-19 has already disrupted the supply chain. The ability of service companies to manufacture and deliver equipment and supply personnel to industry sites is seriously compromised by restrictions on travel and movement of people.

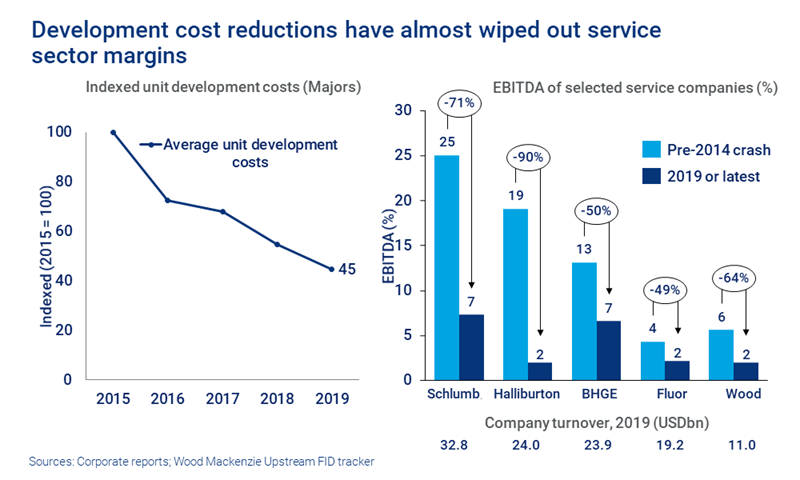

Last downturn, the service sector did its bit in getting costs down. The Majors reduced unit development costs by 55% between 2014 and 2019; our Upstream Cost Survey shows that almost half was rate cuts by suppliers.

It’s taken its toll on service sector finances. Margins for five leading service companies fell by an average of 65% between 2014 and 2019. EBITDA margins (earnings before interest, tax, depreciation and amortisation) for the wider sector have shrunk close to zero.

IOCs will look to cut more to get their own finances on an even keel and reassure shareholders. Cash flow breakevens for the Majors averaged US$55/bbl pre-crisis. BP said this week it aims to reduce underlying breakeven to below US$35/bbl in 2021, and others are heading in the same direction. The primary lever is to cut investment – discretionary spend by IOCs will all but dry up in 2020.

Operators are signalling cuts of up to 50% to expenditure in the US Lower 48. Only a handful of the 53 conventional pre-FID projects we expected to get sanctioned in 2020 will get the green light. These cuts make up a big chunk of the 20% to 25% reduction in spend the Majors have announced.

What drives NOC decisions isn’t quite so straightforward. Their stakeholder is the government, and the NOC may be central to their national economy – big employer, investor and a source of revenue through dividends and taxation. US$20/bbl oil isn’t just a problem for the NOC, it’s a national problem. We estimate that, pre-crisis, Angola needed US$75/bbl to fund its 2020 budget, Saudi Arabia US$85/bbl and Nigeria US$131/bbl – prices of a long-gone era.

Overall cuts in spend by NOCs so far are more muted, averaging 10% to 15%. Chinese NOCs are prioritising domestic investment to maintain production and employment. In the Middle East, ADNOC and Qatar Petroleum will likely proceed with big new gas projects where the scale and economics will win investment from the big IOCs. There have been concerns about market tightness in certain segments in the Middle East.

Many others face an investment drought. Ten higher cost projects at pre-sanction stage in Nigeria, Mexico, Libya and Angola won’t get the support they need from IOC partners. Combined spend will be pushed out indefinitely into the future along with 0.4 million boe/d of new production.

NOCs have to perform a tricky balancing act. To keep investment moving, costs need to come down. The service sector is the easy target; but the service companies are sizeable employers, too. They may be bound into the domestic economy through local obligation requirements and, in certain cases, may even be government-owned.

So, where do NOCs go from here? The adversarial approach between operator and suppliers is counterproductive and could end badly – for both sides. What’s needed is a change in relationship, built on openness, transparency and trust. We are starting to see alliances and partnerships emerging between mid-sized operators and service companies. That could be the template for a win-win – more competitive prices for the operator, and acceptable returns for the supplier. It’s a model NOCs need to consider if they are to foster and preserve a strong supply chain through the coming challenges.

NOCs need to take a strategic view of how they address the cost challenge of US$20/bbl oil. As operator and "national champion", many NOCs can shape the service sector, in ways not open to the IOCs. There are opportunities to change the commercial model with individual suppliers and bring in practices from other sectors, such as true open-book pricing. Many NOCs could also act as an aggregator of plans, providing the service sector with an aggregated demand profile.