How the big Gulf producers are investing in 2019

OPEC committed to building new oil capacity

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

OPEC is being marginalised – or, more accurately, OPEC is allowing its volumes to be squeezed to protect price. Its share of global liquids supply has fallen steadily from 42% a decade ago to just over one-third today.

The decline, of course, mirrors the rise of US tight oil production. Yet on my latest visit to the Middle East in December, I was struck, once again, by the commitment to investing in upstream by three Gulf countries that together contribute half of OPEC production – Saudi Arabia, Kuwait and the UAE.

I talked through what’s going on with Jessica Brewer, our Dubai-based principal analyst.

How much is the industry spending in the Middle East?

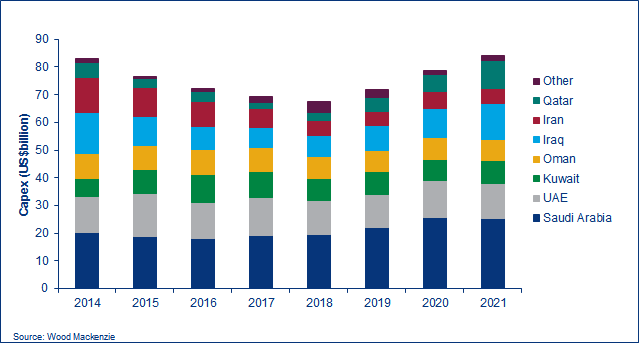

The region has been something of a haven for upstream investment through the downturn. Spend has fallen just 19% from US$83 billion in 2014 to US$67 billion in 2018, whereas global spend is down 40%. Most of the drop has been in Iraq, where government finances have been affected by lower oil prices, and Iran, where geopolitical uncertainty has cut inward flow of capital. Investment hasn’t fallen at all in Saudi Arabia, Kuwait and UAE – spend has been stable at US$40 billion a year. Given that service sector costs have fallen, this indicates activity levels are well up.

For a closer look at key events impacting the upstream industry in the Middle East and North Africa, purchase a copy of the MENA upstream in brief report.

Where’s the focus of spend?

The dominant theme in the region is the expansion of oil production capacity, which accounts for US$4 of every US$5 spent. Iran and Iraq have enormous undeveloped resources and significant growth potential in the longer term. Saudi Arabia, Kuwait and the UAE are focusing on brownfield projects with large-scale reserves around core fields already in production. Saudi Aramco’s Zuluf field is fairly typical. The next phase of development doubles reserves to over 16 bnbbls of oil and condensate, and doubles current production of 600,000 b/d by 2023.

Developing these resources will tend to be more expensive than in the past, but the projects will still be highly competitive in global terms. All-in costs of the incremental development of Zuluf are around US$17/bbl on our estimates, below those of best-in-class non-OPEC greenfield projects and well below the best of pre-drill Permian tight oil wells.

What are the strategic drivers?

The energy transition and threat that oil demand may peak in the next 20 years has concentrated minds. Even the lowest cost producers don’t want to run the risk of leaving low-cost oil in the ground. There’s a commercial incentive to develop reserves and be in a position to sell into a market where price is still supported by buoyant demand.

It’s also about regaining market hegemony. Kuwait is committed to increasing capacity from just over 3 million b/d today, to 4.75 million b/d in 2040. The UAE is similarly ambitious, aiming to lift capacity from just over 3 million b/d to 4 million b/d by 2020 and then 5 million b/d by 2030. Saudi Arabia has no plans to increase capacity but will invest to maintain the current 12 million b/d, which makes it OPEC’s biggest producer.

Does the world need more oil from the Gulf?

Yes, though not right now. The call on OPEC crude will edge lower for another year or two to just under 30 million b/d. Beyond 2020, we forecast the market needs more OPEC oil, perhaps an additional 5 million to 6 million b/d by the 2030s. Assuming decline from maturing OPEC countries, there’s potentially sizeable volume growth for Gulf producers to go for.

But there are risks in the strategy. Chief among these in the near term is from the US. We forecast US tight oil adds another 5 million b/d by 2023, taking volumes to a plateau of 10 million to 11 million b/d by 2023. What if the Permian continues to surprise on the upside? More tight oil volumes would push additional OPEC volumes out into the future.

The other pillar supporting investment in capacity is oil demand. We expect the rate of demand growth to slow in coming years but cumulative demand to increase by another 10 million b/d before peaking in the late 2030s. Tightening environmental policy and an accelerated penetration of electric vehicles beyond our aggressive base case are threats that could bring forward peak demand.

5 things to look for in MENA in 2019

Return to woodmac.com later this week to read the MENA team's five things to look for in the region in 2019, including the five projects that will drive gas production growth.