Low risk resource-capture strategies

The timely boom in access to giant oil and gas discoveries

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

How to replenish depleting oil and gas reserves in a downturn? IOCs and NOCs conserved cash, shed assets and minimised risk over the last few years. A lucky few found they could live off their inheritance, with tight oil emerging as the new growth theme for US companies. Conventional exploration, central to organic growth for decades, took a back seat.

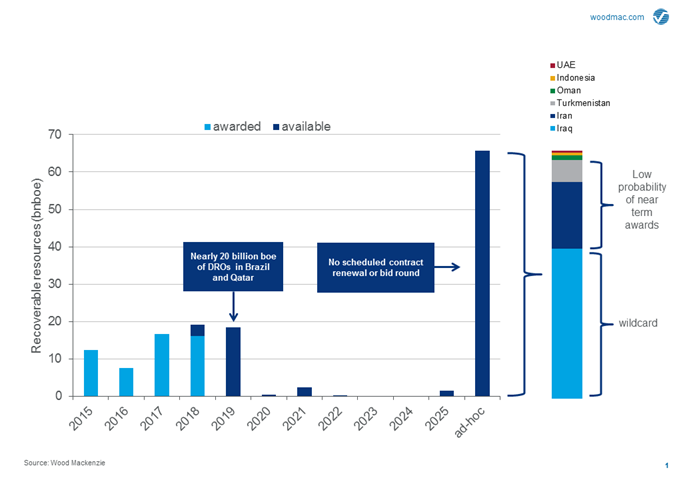

Enter discovered resource opportunities, or DROs, to save the day. We are right the middle of a golden period of access to giant oil and gas discoveries, the best since Iraq opened up a decade ago. Over 50 billion boe of resources have been awarded by host governments to IOCs and NOCs since 2015. These volumes have matched the resource delivered by conventional exploration over the same period. Most have been oil (91%), in the Middle East (Abu Dhabi 82%, with Iran, Qatar and Oman also players), and conventional resource (95%). I posed a few questions to Ian Thom, Principal Analyst Upstream, about the allure of the DRO.

Why do host governments outsource development of these giant resources?

First, cash up front. The ADNOC (Abu Dhabi) renewals that have dominated the DRO scene these last few years raised US$16.5 billion in signature bonuses. Second, it stimulates investment and puts the long-term strategic development of the country’s resource into the most capable and eager hands. Third, new partnerships are forged, notably with growing Asian markets.

What’s the attraction of a DRO to the bidder?

Access to a very large resource, typically long life, and discovered so it’s low risk. In many cases, they are already developed. For these brownfield projects, risk is particularly low, while production and cash flow are immediate. The resource is invariably low cost, capable of generating a margin even at very low oil prices, boosting portfolio resilience.

Who are the bidders?

The list of winning bidders reads like a who’s who of the industry’s leaders. But it’s almost exclusively made up of tight oil ‘have nots’ – NOCs including CNPC/PetroChina, Inpex and ONGC; Total, Eni, OMV and Cepsa, among the IOCs. It’s no coincidence that Shell, ExxonMobil and Chevron, all with scale exposure to Permian growth, have been conspicuous by their absence.

The negatives?

Rampant demand for these opportunities has driven down returns. We think IRRs on the ADNOC contract renewals are in single digits, and that put off some bidders. With a guaranteed stream of crude production, integrated companies can enhance returns in trading or refining. Iran has been offering returns on the South Pars gas field approaching 20% on our calculation. But greenfield projects like this need development capital and come with inherently higher above-ground risk, and Total has since exited.

Are there more DROs to come?

Yes, and 2019 may be the biggest year yet – there’s almost 20 billion of low breakeven resource up for grabs. Brazil could raise US$30 billion from the government’s four deepwater licences, which hold 9 billion boe of low breakeven pre-salt resource. Petrobras, the Majors and Asian NOCs will lead the bidding. Qatar will offer 8 billion boe of liquids-rich gas resource to meet its plans to scale up LNG capacity. The Majors that already operate there will be queuing up to bid, as well as other IOCs and LNG buyers.

Is acquiring DROs a sustainable business model?

No. The opportunities are sporadic, so it can only be part of a resource capture strategy. After 2019, there are potentially 60 billion boe of resource that could come to market. But it’s mostly in Iraq, Iran and Turkmenistan so each has its challenges. There’s very low visibility on timing.

So what next for resource capture strategies?

M&A will always play a part as companies build for the future. The latest reserve upgrade in Guyana is yet more evidence that exploration is making a comeback. Tighter capital discipline, improved prospect selection and lower costs are dragging exploration out of a disturbing period of value destruction. We calculate industry full-cycle returns are back in double digits for 2017 and likely will be in 2018 too.