The Edge: Downstream’s role in the energy transition

Asian growth markets beckon to NOC crude exporters

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

How to stay relevant? Every oil and gas company is pondering the energy transition, and how to adapt a business model that’s served well for the last century to be fit-for-purpose through the 21st and beyond.

Resource-rich NOC crude exporters, even those at the low end of the cost curve, are weighing up the options as intently as any IOC. In some cases it’s not just the company’s future in their hands but the national economy too.

In a future of waning oil demand, securing a market for crude volumes becomes a critical strategic goal for NOC exporters to avert the risk of resource stranding.

Alan Gelder, Head of Refining, argues vertical integration can lessen these risks. Securing access to the most competitive refining capacity will increase an NOCs’ abilities to place crude in an increasingly difficult market.

Some are already integrated. The typical model has been domestically focused, building refineries to meet product demand in the home market to monetize upstream resources in their own facilities. This provides a platform for industrialisation as part of a broader national development policy.

Kuwait, Oman and Saudi Arabia have also invested in overseas refineries or taken minority shareholdings in refining companies. Much more capital needs to be deployed internationally to balance crude export volumes.

Eyes naturally turn toward the East. Asia has been the axis of global oil demand growth since OECD demand peaked in 2005. Asia-Pacific countries – minus Japan – have been contributing 70% of the non-OECD’s 14 million b/d of demand growth over that time. We expect another 8 million b/d by 2035, comfortably ahead of any other region. It’s where all roads lead in the quest to build exposure to downstream over the next 20 years and beyond.

The practical problem is exactly where in Asia to invest. The ideal location has three main characteristics: a big oil market, strong demand growth and a deficit in refined products.

Easier said than done. China is the biggest market in the region and is growing, but is structurally long of refining capacity. Any new investment would only feed into export markets. A number of South and North Asian markets short of capacity have modest demand growth prospects.

India ticks all the boxes. Oil consumption is 5 million b/d – less than half China’s 12 million b/d but big enough. Refining capacity exceeds domestic needs at present. But that will quickly change – much more capacity will be needed in the coming years. Annual demand growth is set for sustained growth, accelerating beyond China’s growth rate by the mid-2020s.

Sushant Gupta, Research Director, Asia Pacific Refining, expects India’s oil consumption to rise by over 3 million b/d by the mid-2030s, and won’t likely stop then. No other country on the planet can match that volume growth over this period.

This is the backdrop to Rosneft’s entry into the market in 2016, and Saudi Aramco’s announcement of an MOU earlier this month. Rosneft’s acquisition of a 49% stake in Essar in 2016 gives it access to a 400kbd refinery built in 2006. Saudi Aramco envisages a 50% stake in a new, 1.2 million b/d refinery which will be the biggest in Asia.

These investments will arm these companies, which are already low on the supply cost curve, with highly competitive refining assets capable of weathering changing product consumption as India’s economy grows and the energy transition starts to take effect.

A risk is India diversifying away from oil in the energy mix. For the time being, this seems unlikely.

Oil is the only practical solution for India to meet its transportation needs as it develops infrastructure and a burgeoning middle-class embraces more motorcycles and cars.

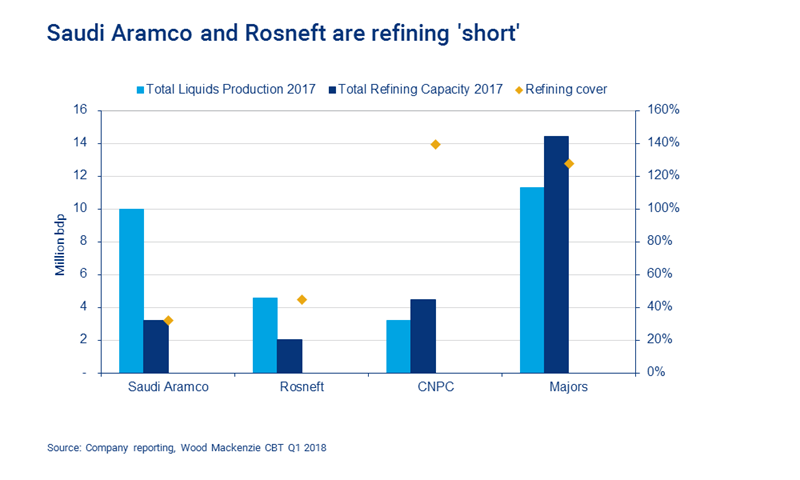

Saudi Aramco and Rosneft are already better placed than some peers, yet are very short of refining capacity at less than 50% of crude production. The Majors, in contrast, are very ‘long’. More acquisitions and new builds will be needed in the Asian region if crude-exporting NOCs are to secure offtake for their oil and become fully integrated. And these companies, in turn, are the natural partners for Asian NOCs that need to invest in new refining capacity and access crude.