Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Record highs for global wind turbine order intake in 2023

China market ordered 100 GW, largest annual order intake on record, while a record-breaking 55 GW of demand seen in Western markets

1 minute read

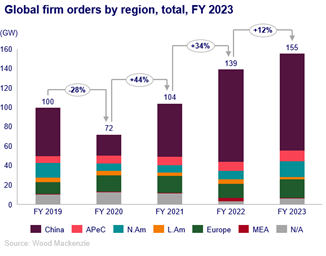

Global wind turbine order intake hit new highs in 2023 with 155 gigawatts (GW) procured for the year, an increase of 16 GW from 2022. As both China and Western markets broke records for order intake, annual investment reached an estimated US$ 83 billion, according to Wood Mackenzie’s ‘Global wind turbine order analysis: Q1 2024’ report.

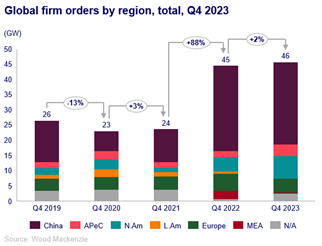

In Q4 of 2023, global order intake increased 2.5% and 12% year-over-year (YoY) for the full year, stated the report.

Developers in China ordered approximately 100 GW in 2023, the largest annual order intake on record and marks consecutive years of at least 90 GW of order intake in the country. Onshore demand from China’s wind bases has driven most of this growth.

Western markets contributed with record order intake levels in 2023, adding a record-breaking 55 GW in 2023, highlighted by YoY momentum in Europe (19 GW) and North America (17 GW).

“A record haul outside of China in Q4 and a near doubling of order capacity in North America throughout 2023 helped continue market recovery for Western markets, with a 26% increase in order intake YoY,” said Luke Lewandowski, Vice President, Global Renewables Research at Wood Mackenzie.

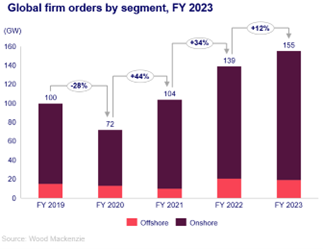

Global intake for offshore wind decreased by 61% in Q4 of 2023, a 3.1 GW drop YoY, and 7.2% overall, a fall of 1.5 GW YoY. This decrease was counterbalanced by an increase in global onshore wind orders, up 4.2 GW (+11%) in Q4 YoY and 17.7 GW (+15%) for the full year.

“Despite high-profile offtake cancellations and industry headwinds for offshore wind, firm order intake for the offshore sector tripled for markets outside China in 2023. A 56% drop in orders from China due to a pause in procurement decisions resulted in a modest drop globally from the record set in 2022. In total, developers globally ordered 19 GW of offshore wind turbine capacity in 2023,” added Lewandowski.

Envision led the way with 22 GW of order intake in FY 2023, followed by Vestas (19 GW), and Goldwind (18 GW). Vestas led all OEMs in Q4 for the second quarter in a row with 8 GW, powered by 5 GW in the US.

According to the report, demand for onshore models rated 7-9.9 MW exploded in 2023, seeing a sevenfold increase YoY.

Global wind turbine order analysis: Q1 2024

Wood Mackenzie's Q1 2024 Global Wind Turbine Order Analysis report presents an analysis of global and regional wind turbine order activity in the fourth quarter of 2023.

Click here for more information