Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Net zero scenario to require 9.7 Mt of new copper supply over next decade

US$23 billion investment per year needed over 30 years to deliver new copper projects to reach zero-carbon targets

4 minute read

How much copper is needed to successfully meet the climate targets set out by the Paris Agreement? Wood Mackenzie quantifies the scenario in its latest research report, ‘Red metal, green demand: copper’s critical role in achieving net zero’, finding that the global energy transition presents an almost unattainable mine supply challenge, with significant investment and price incentives required.

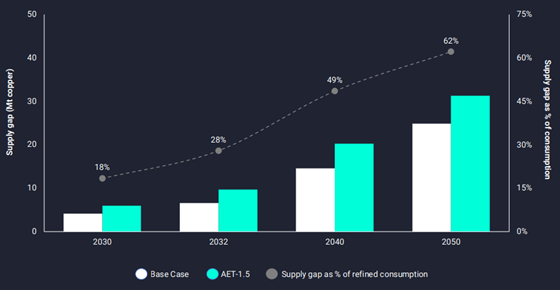

Under its 1.5 °C accelerated energy transition scenario, Wood Mackenzie, a Verisk business (Nasdaq:VRSK), analysis shows that 9.7 million tonnes (Mt) of new copper supply is needed over 10 years from projects yet to be sanctioned, equivalent to nearly a third of current refined consumption, if the industry is to meet the Paris Climate Agreement targets.

Nick Pickens, research director of copper markets at Wood Mackenzie, said: “Copper’s critical role in the energy transition is undisputed. It’s the significant pull on the metal’s existing and potential supplies, and the investment required that needs urgent attention.”

“To successfully meet zero-carbon targets, the mining industry needs to deliver new projects at a frequency and consistent level of financing never previously accomplished,” Pickens added.

Refined consumption that needs to be covered by mine supply to 2050

(Source: Wood Mackenzie’s Copper Outlook Q2 2022)

Supply challenge

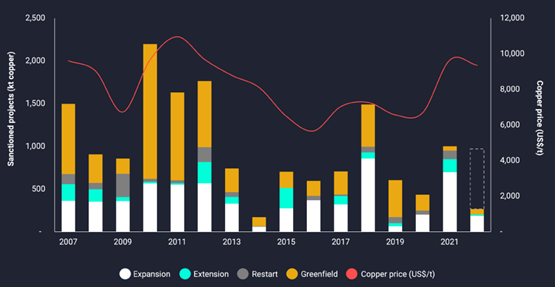

Approximately 17 Mt of annual copper production is in the project pipeline – nearly double the volume required to limit warming to 1.5 °C. In reality, some of these projects have not been developed because of poor economics, and even those that can offer an attractive return on investment have other hurdles to overcome prior to development.

Eleni Joannides, research director at Wood Mackenzie said: “In theory, higher prices should encourage project sanctioning and more supply. However, the conditions for delivering projects are challenging, with political, social, and environmental hurdles higher than ever. For example, social and environmental licences to operate are proving elusive in major producing countries, including Chile and Peru.”

Quantity of copper projects sanctioned since 2007

(Source: Wood Mackenzie’s Copper Outlook Q2 2022)

Investment required

Assuming an average capital intensity of the project pipeline and accounting for the volume of copper required to achieve climate targets, Wood Mackenzie estimates that more than US$23 billion a year will be needed over 30 years to deliver new projects under an accelerated energy transition scenario. This is a level of investment only previously seen for a limited period from 2012 to 2016, following the China-induced commodity super-cycle.

“Cost pressures and the larger volumes required for an accelerated energy transition have implications for the industry incentive price,” Pickens said.

Under this scenario, the copper price needed to meet demand rises substantially to US$9,370/t (US$4.25/lb) in constant 2022 US dollar terms, compared to US$7,716/t (US$3.50/lb) under the base-case. In theory, this price increase would be sufficient to close the supply gap and maintain market equilibrium.

Role of scrap copper

“Under Wood Mackenzie’s AET-1.5 scenario, there is a larger role for scrap to help meet future demand, but it won’t solve the overall supply challenge,” Bhavya Laul, principal analyst at Wood Mackenzie, said.

Copper already relies substantially on the circular economy, with over a third of consumption derived from secondary sources. Wood Mackenzie estimates that by 2050 this could rise to 45% and with higher recycling rates, the contribution could be even more.

Uptake of EVs and renewable power

Low-carbon copper demand over the next 20 years is the equivalent to 60% of the current market size. The uptake of electric vehicles (EVs) accounts for 55% of this demand – the largest single sector contributing to the rise in copper demand.

The offshore wind segment will grow sevenfold by 2040 under Wood Mackenzie’s AET-1.5 scenario, with wind power generation rising by an additional 1.0 Mt of copper a year.

Solar power will also see an increase in copper demand, with additional consumption of 1.1 Mt a year expected over the next 20 years under a net zero pathway.

Copper only one piece of the puzzle

“Great strides in the energy transition will continue to be made over the next decade. However, Wood Mackenzie modelling concludes that the scale and speed of the requirements for copper, a key enabler of electrification, are a stretch. Furthermore, copper is not the only participant in this race. A coordinated investment policy for critical minerals and metals is required if we are to be in with a chance of keeping global warming to 1.5 °C,” Pickens concluded.

ENDS

EDITOR’S NOTES

Close to 80% of copper’s use is related to its property as an electrical conductor. Consequently, future growth in global electricity demand as economies develop will also drive growth in copper consumption. However, the use of copper for EVs and renewable power generation is significantly more intensive than in their fossil-fuelled equivalents. Together with the related build-out of electrical networks, this compounds future expected demand for the metal.

For more information about Wood Mackenzie’s report:

Copper is a critical component in a zero-carbon economy. But new projects must be delivered at a frequency and consistent level of financing never before accomplished. This month’s Horizons explores the looming supply gap – and the action needed to close it. Read the report now: Red metal, green demand: copper’s critical role in achieving net zero’.