Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

Nuclear needs to be cost competitive with alternative power generation to enable net zero

Despite policy support and market growth, urgent action required to prevent high costs hindering advanced nuclear uptake

4 minute read

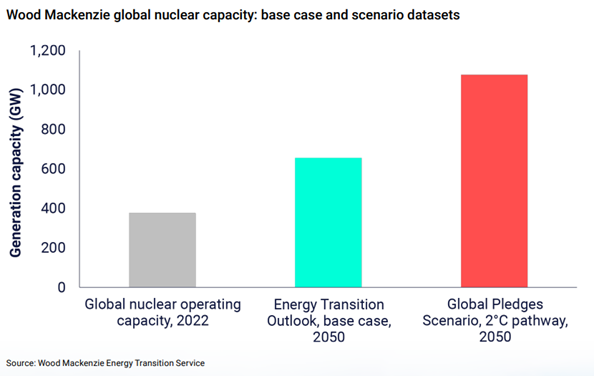

Nuclear capacity is set to increase by 280 gigawatts (GW) by 2050, as countries search for decarbonised electricity sources. Despite policy support and market growth, the biggest economic hurdle to the uptake of the latest nuclear and small modular reactors (SMRs) is cost, according to Wood Mackenzie report, ‘The nuclear option: Making new nuclear power viable in the energy transition’.

Nuclear is just one of several technologies, including hydrogen-fired power, gas or coal with carbon capture and storage, geothermal, and long-duration energy storage, vying to deliver reliable decarbonised electricity supply. All are expensive and need technological innovation to build a strong position in the market.

“The nuclear industry will have to address the cost challenge with urgency if it is to participate in the huge growth opportunity that low-carbon power presents. At current levels, the cost gap is just too great for nuclear to grow rapidly,” said David Brown, Director, Energy Transition Service at Wood Mackenzie, and lead author of the report.

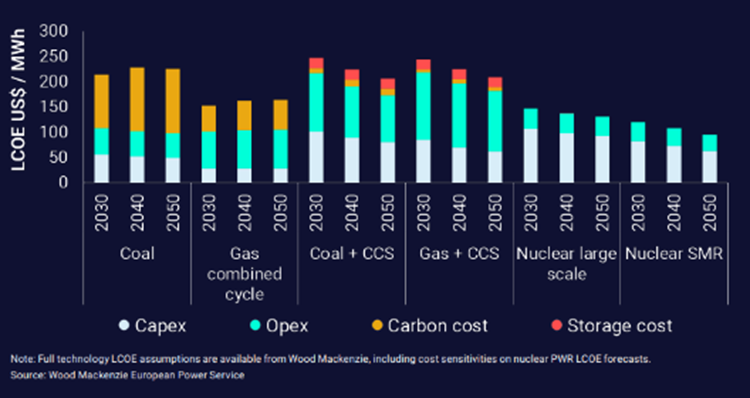

Scaling up the SMR market will depend on how fast costs fall to a level that’s competitive against other forms of low-carbon power generation. According to Wood Mackenzie estimates, conventional nuclear power currently has a levelised cost of electricity (LCOE) of at least four times that of wind and solar.

To get around cost concerns, SMRs are designed to be modular, factory assembled and scalable. They are expected to be quicker to market, with a target construction time of three to five years compared with the ‘nameplate’ 10 years needed to build a large-pressurised water reactor (PWR).

Wood Mackenzie’s modelling shows that if costs fall to US$120 per megawatt hour (MWh) by 2030*, SMRs will be competitive with nuclear PWRs, gas and coal – both abated and unabated – in some regions of the world. Further price declines are expected between 2040 and 2050 as SMRs realise economies of scale and improve market economics.

LCOE (US$/MWh) – selected technologies, average values for Europe:

Scaling up SMRs

SMRs will play a small part in the power market through to 2030, largely because high costs are holding back deployment, the decade is already passing by, and construction timelines mean at best only a few plants will be built. First of a kind (FOAK) SMR costs could be as high as US$8,000 per kilowatt (kW) and as low as US$6,000 per kW, according to industry estimates**. Wood Mackenzie analysts expect that FOAK costs will be at the high end of this range, and could be even higher, as developers build out early-stage projects.

According to Wood Mackenzie SMR project tracking, there are only six potential FOAK SMR projects in the pipeline between 2023-2030, ranging in size from 80MW to approximately 450MW.

The amount of FOAK SMR investment remains uncertain and will be influenced by multiple factors, such as financing terms, commodity costs, uranium availability and the political will to see projects succeed.

At least 10 to 15 projects – with a capacity between 3,000 and 4,500MW required for a standard 300MW SMR – need to be under development between 2030 and 2040 to support lower SMR costs, according to Wood Mackenzie analysis and policy estimates. This level of activity would help the nuclear industry start to regain the momentum it had during the last nuclear growth phase from 1970 to 1990.

What will it take to go nuclear?

According to the report, there are four key aspects of expanding nuclear that need greater focus:

- Governments must lay the groundwork. Policymakers need to set out clear rules for planning, permitting, regulation and safety. A middle ground around permitting timelines – one that allows public, industry, and government dialogue – is needed to produce predictable timescales.

- Expanding the uranium supply chain. Russia’s invasion of Ukraine should be a wake-up call for the nuclear industry. Wood Mackenzie projects uranium demand to double under its base-case scenario and triple under its Paris-compliant Global Pledges Scenario. Russia is currently a key supplier to both low and highly enriched uranium markets, especially to Eastern Europe and France.

- Developers need to establish and refine their skillset. SMRs will need to overcome nuclear’s challenging track record. No commercial, new-generation SMR plant is operating today. The expertise to build nuclear plants needs to be consistently re-applied; developers should prioritise a few technologies rather than a wide array of options. This will result in greater cost savings and faster deployment over time.

- Offtake agreements will need to be more creative than ever. Buyers will need to place a value on nuclear’s ability to deliver stable zero-carbon power, zero-carbon process heat, nuclear-based renewable energy credits and power supply for low-carbon hydrogen. The cost of lowering carbon emissions via nuclear should be compared with other abatement options.

“Overall, governments, developers and investors must work collaboratively to establish a new ecosystem for nuclear to flourish,” concluded Brown.

Read the full report here.

ENDS

Wood Mackenzie’s Energy Transition Outlook is consistent with 2.5 C warming trajectory by 2050. This will be driven by the advancement of current and nascent technologies, as well as the evolution of current policies. This dataset is aligned to our Strategic Planning Outlook (SPO) released in Q1 – Q2 2022.

* This analysis incorporates our carbon price forecast for Europe of US$140/tonne in 2030 and US$177/tonne in 2050.

** Based on disclosed estimates from developers, World Nuclear News and integrated resource plan estimates.