Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

The global energy transition and country-level decarbonisation targets will create new markets for non-ferrous metals in the coming years.

According to a new report from Wood Mackenzie, a Verisk business (Nasdaq:VRSK), solar power will have a significant impact on demand for aluminium, copper, and zinc, with the usage of all three metals in the sector set to double by 2040. However, as governments fulfil their commitments to limit global warming to 2 °C and beyond, the need for solar power will become greater and demand for several base metals is expected to surge.

Kamil Wlazly, Wood Mackenzie Senior Research Analyst, said: “Base metals are an integral component of solar power systems. A typical solar panel installation requires aluminium for the front frame and a combination of aluminium and galvanised steel (zinc) for structural parts. Copper is used in high and low voltage transmission cables and thermal solar collectors.

“Falling production costs and efficiency gains have driven down the price of solar power around the world. As a result, solar has become cheaper than any other technology in many parts of the US and several other countries across the globe. As costs continue to fall, solar’s share of power supply will rise and begin to displace other forms of generation. This presents a huge opportunity for the base metals sector.”

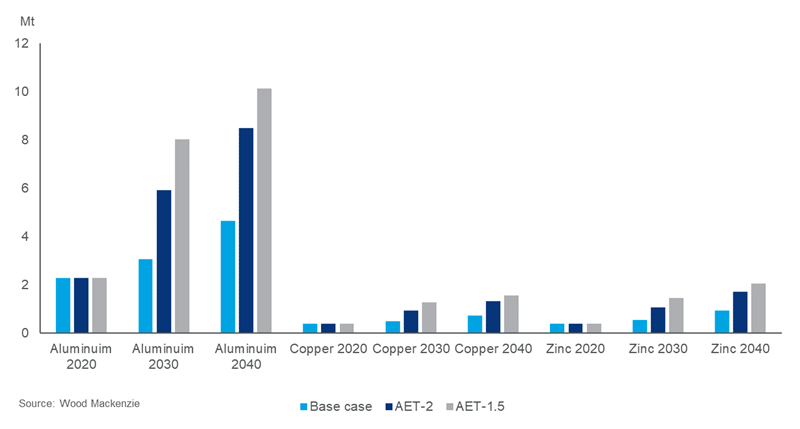

In Wood Mackenzie’s base case scenario, which is broadly consistent with a 2.8-3˚C global warming view, aluminium demand from solar technologies sits at around 2.4 million tonnes (Mt) for 2020. This is expected to rise to 4.6 Mt by 2040. However, under Wood Mackenzie’s proprietary Accelerated Energy Transition-2 (AET-2) and Accelerated Energy Transition-1.5 (AET-1.5) scenarios, consumption growth will range from 8.5 Mt to 10 Mt by 2040. To put this into perspective, in Wood Mackenzie’s AET-1.5 scenario, demand from the solar sector would increase from just under 3% of total aluminium consumption in 2020 to a considerable 12.6% in 2040.

Copper consumption is also expected to register notable gains from solar power generation, particularly photovoltaic (PV) systems. Wood Mackenzie’s base case scenario puts copper demand from solar at 0.4 Mt in 2020, and this is expected to rise to almost 0.7 Mt by 2040. Meanwhile, under Wood Mackenzie’s AET-2 and AET-1.5 scenarios, copper consumption from solar is expected to increase to around 1.3 Mt and 1.6 Mt, respectively, by 2040.

With large-scale solar power plants estimated to have a workable life of at least 30 years, only zinc coatings can offer low-cost corrosion protection for such lengthy periods. Wood Mackenzie estimates that solar power installations currently account for approximately 0.4 Mt of global zinc consumption, with this number projected to grow to 0.8 Mt by 2040 in Wood Mackenzie’s base case. Under Wood Mackenzie’s AET-2 and AET-1.5 scenarios, consumption growth will range from 1.7 Mt to 2.1 Mt, respectively, by 2040.

For those metals stepping into the limelight, decarbonisation creates as many risks as it does opportunities.

Wlazly added: “Concentrating solar power (CSP) plants provide considerable opportunities for base metals. Elevation structures and collectors heavily rely on steel, but there is the potential to switch to aluminium-based designs. That said, steel will always have a cost advantage in applications where weight is not an issue, therefore the degree of substitution is uncertain.

“Given the rising price of copper, there is also the potential for aluminium to penetrate wire and cable applications in installations where copper is currently the favoured metal choice.”

The trend towards manufacturing larger solar modules will also have a mixed impact on metal intensity, according to Wood Mackenzie.

Wlazly said: “As the module's surface and tracker area increase, we expect the use of structural components to scale at a similar rate to maintain strength and rigidity. As a result, the use of aluminium and zinc (galvanised steel) per module will increase, leaving the intensity (kg/kW) broadly unchanged.

“In contrast, the use of copper is expected to decline as larger modules will cause a reduction in the number of panels per given capacity of the plant, resulting in a drop in the overall number and length of cables.

“However, the overall decline in intensity will be marginal as panel size will not affect the diameter of the cable or transformer, both of which account for a significant proportion of copper use. Additionally, the impact on metal demand by the increase in module size will be limited to utility-scale solar plants, which currently only account for a third of installed capacity.”