Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

US energy storage market shatters records in Q3 2020

764 MWh of storage deployed in Q3, more than twice the previous high

1 minute read

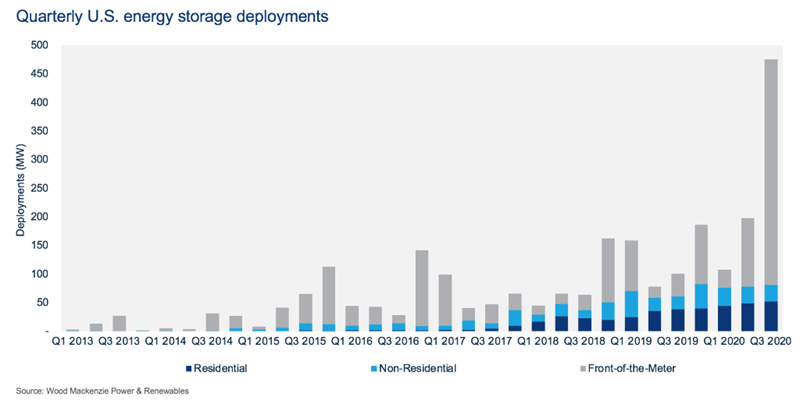

According to Wood Mackenzie and the U.S. Energy Storage Association’s (ESA) latest 'US Energy Storage Monitor' report, 476 megawatts (MW) of storage were deployed in Q3 2020. This is an increase of 240% over the previous high, set last quarter.

As noted in the research, the new record for storage is not an anomaly but rather a sign of things to come as front-of-the-meter (FTM) storage procurements, particularly in California, grow dramatically in number and size.

While the residential segment grew as well, the major growth was in the FTM market segment.

Nearly 400 MW and 578 MWh were deployed in Q3, surpassing previous records of 133 MW and 296 MWh for this sector. More FTM storage was installed in Q3 than was installed across all segments during any other quarter over the past seven years.

Despite relatively low durations for systems deployed this quarter, FTM MWh deployments beat the previous record set in Q1 2017 by nearly 200%.

“Energy storage deployments continue to grow, despite the economic downturn and COVID-related slowdowns,” said Kelly Speakes-Backman, U.S. Energy Storage Association CEO. “The signs are pointing toward an unprecedented increase in energy storage in the coming months, moving us closer toward achieving our 100 GW by 2030 vision. With continued policy support and regulatory reform at the state and federal levels, energy storage is poised to continue this trajectory and enable a more resilient, efficient, sustainable, and affordable electric grid for all.”

“These eye-catching deployment totals represent only the beginning of a long-anticipated scale up for the US storage market. Massive price declines and efforts to ensure eligibility have set the stage for exponential growth, and the curtain has only just risen on Act One. Considering the scale of systems anticipated for 2021 we do not expect this record, as remarkable as it is, to stand for long,” added Dan Finn-Foley, Wood Mackenzie Head of Energy Storage.

The residential storage market has grown steadily for six quarters in a row, hitting 52 MW (119 MWh) in Q3 2020, with resilience as the key driver.

“Although the residential storage market has hovered at around 7,000 deployments per quarter in 2020, the sector is now set to expand by 6x through 2025, with increasingly active markets in New York, Massachusetts, PJM, Texas and Florida, among other states.

“Potential upside from landmark FERC Order 2222 could start to become clear next year as market operators and utilities make plans for implementation. These decisions will impact where and how quickly storage companies will be able to center grid services and the wholesale market in their strategic growth,” said Chloe Holden, Wood Mackenzie Energy Storage Analyst.

Massachusetts continued its strong showing in the non-residential segment through its SMART program, topping Hawaii’s deployment totals to take second place in the segment. Non-residential deployment has slowed in recent quarters, adding around 30 MW each quarter of this year, in contrast with the segment’s 40+ MW quarterly highs in Q1 and Q4 of 2019.

The U.S. battery energy storage market is set to grow from 1.2 GW in 2020 to nearly 7.5 GW (and 26.5 GWh) in 2025, driven primarily by large-scale utility procurements. Solar-paired storage will account for a large majority of these installations, and potentially the vast majority, as developers aim to capture value from the Investment Tax Credit.