Big Oil and climate change: the long road

*Please note that this report only includes an Excel data file if this is indicated in "What's included" below

What’s the key takeaway from this report?

Investor pressure on Big Oil to address climate-related risk has ratcheted up since the Paris Agreement of 2015. Over the past five years – faced with the reality of tight oil and looming peak demand – the Majors have focused on ‘future-proofing’ oil and gas businesses.

But are the Majors doing enough to transition to business models that are aligned with the goals of the Paris Agreement? This analysis has our take.

What’s inside this report?

- The problem with industry oil demand projections

- The journey ahead for oil companies and investors

- Possible futures for the Majors at the extremes

This report explores the broader theme of how Big Oil will respond to decarbonisation. Get our thoughts on the industry issues that matter.

Report summary

Table of contents

-

The fundamentals problem

- The demand problem

- The supply problem

- Oil price uncertainty

- The fundamentals problem

-

The Majors’ perspective

- Progress to date

- The pitch

- The investor quandary

- The journey

- Final destination?

Tables and charts

This report includes the following images and tables:

- The Majors liquids production vs. global demand scenarios (million b/d)

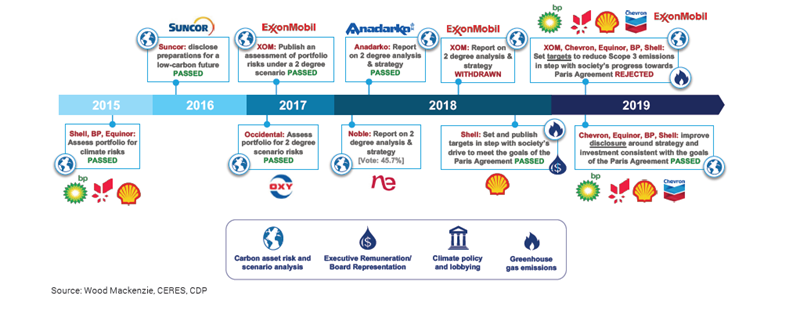

- Climate and sustainability investor motions (selected), 2015-2019

- The journey for oil companies and investors, from today’s vantage point

- Oil demand projections (million b/d) and projected rise in global average temperature by 2100

- Global oil supply cost curve, 2040 production capacity (million b/d)

- Global oil recoverable resource estimates, BP and Wood Mackenzie

What's included

This report contains:

Other reports you may be interested in

Spain upstream summary

Spain has set an end date for oil and gas activities - In 2021, the Spanish government introduced the Climate Change and Energy ...

$4,080Mexico gas, power and renewables service: 2024 in review

Is Mexico’s energy sector at a turning point? Record heat, grid strain, LNG expansion, and sweeping reforms in 2024

$950Future exploration outlook

Focuses on the near-term exploration outlook until 2028 and the sector’s longer-term prospects to 2050.

$11,000