Global aluminium long-term outlook Q3 2019

This report is currently unavailable

*Please note that this report only includes an Excel data file if this is indicated in "What's included" below

What’s the key takeaway in our latest quarterly aluminium outlook report?

A sharp slowdown in global economic activity, escalating trade tensions and rising geopolitical risks will keep annual average LME aluminium prices below US$1900/t out to 2023. Out to 2030, we expect prices to trend upwards.

Why buy this report?

Get answers to all your questions about the global aluminium market, including:

- How will global warming and decarbonisation impact the aluminium industry?

- Will rising scrap availability affect the level of investment in new smelting capacity?

- Are Chinese semis exports here to stay, or will they go away?

- As the dynamic between the China and rest of the world changes, where are the other emerging aluminium production hotspots?

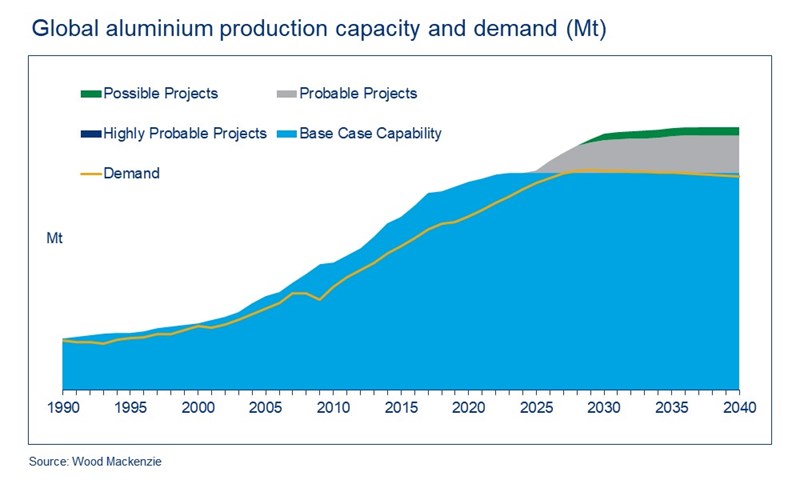

The report includes a full set of data and charts, including this one, tracking changes in aluminium production capacity and demand for the last 30 years, and providing forecasts out to 2040. Scroll down to see the complete table of contents.

Report summary

Table of contents

- Aluminium market outlook

- Alumina market outlook

-

Seaborne bauxite market outlook

- Main risks around our base case aluminium market outlook

- Long term aluminium prices

-

Long-term alumina prices

- Changes to consumption forecasts since Q2 2019

-

Forecasts by region

- Asia

- China

- Asia ex-China

-

Europe

- North America

- United States

- Project Classification

-

Smelter production and capacity

- Summary

- Global smelter production and capacity 2018-2040

- Africa

- North America

- Latin America

- Middle East

- Asia

- Europe

- 3 more item(s)...

-

Refinery production and capacity

- Summary

- Global refinery production and capacity 2018-2040

- Africa

- North America

- Latin America and the Caribbean

- Middle East

- Asia

- India

- 5 more item(s)...

-

Bauxite production

- Regional focus

- Africa

- Latin America

- North America

- Middle East

- Asia

- Other Asia

- Europe

- 2 more item(s)...

Tables and charts

This report includes the following images and tables:

- Global supply-demand balance, LME cash prices and stocks in days of consumption

- China swings into deficit in 2019

- Elevated days of consumption in world ex-China points to lower requirement for new capacity over the medium term

- Global aluminium balance, 2018-2023, 2025, 2035, 2040

- World ex-China alumina capacity and demand (Mt)

- Long-term alumina market balance and price forecast

- Atlantic Seaborne supply & demand, 2010-2035, Mt

- Indo-Pacific Seaborne supply & demand, 2010-2035, Mt

- Bunker fuel mix assumptions

- Indicative freight rates, Atlantic to Yantai (China), 2015-2025, US$/t bauxite

- Global seaborne bauxite balance and prices, 2018-2023, 2025, 2035, 2040

- Metal prices, cash costs and aluminium stocks

- 68 more item(s)...

What's included

This report contains:

Other reports you may be interested in

Huayou Nickel Cobalt HPAL nickel operation

A detailed analysis of Huayue Nickel and Cobalt HPAL nickel operation

$2,250Can America smelt again? The power challenge of building new greenfield aluminium capacity

Can America smelt again? We assess power costs & Midwest premium requirements for viable US primary aluminium smelter projects.

$1,050Global zinc and lead mine cost summary

This global cost summary report examines production and cost trends in the zinc and lead mining industry.

$6,750