Can LFP technology retain its battery market share?

*Please note that this report only includes an Excel data file if this is indicated in "What's included" below

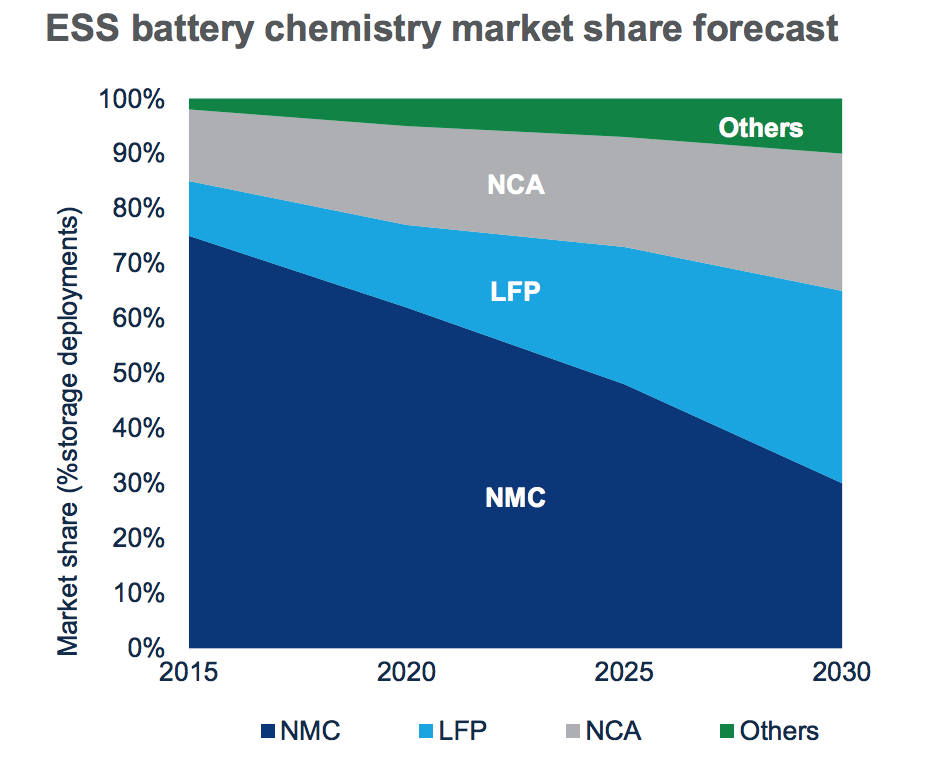

Electric vehicle (EV) and energy storage systems (ESS) battery sectors use a variety of battery technologies and chemistries. These sectors have expanded rapidly over the past decade and OEMs have settled on a few lithium-ion chemistries which now make up the majority of installations. In this brief insight we take a look at the development of LFP technology during the expansion of the EV and ESS markets and outline our future expectations.

This report is also available as part of Wood Mackenie's Energy Storage Service.

Lithium-iron-phosphate (LFP) is poised to overtake lithium-manganese-cobalt-oxide (NMC) as the dominant stationary storage chemistry within the decade, growing from 10% of the market in 2015 to more than 30% in 2030.

Other reports you may be interested in

Yiliping - Lithium brine

A detailed analysis of the Yiliping lithium brine operation.

$2,250Greece power market long-term outlook: May 2025

We present our May 2025 long-term outlook for the Greek power market, with fully integrated supply-demand analysis and prices.

$12,500Italy power market long-term outlook: May 2025

We present our May 2025 long-term outlook for the Italian zonal power market, with integrated supply-demand analysis and prices to 2060.

$18,000