Gulf of Mexico lease sale 251 - confidence builds

*Please note that this report only includes an Excel data file if this is indicated in "What's included" below

Report summary

Table of contents

-

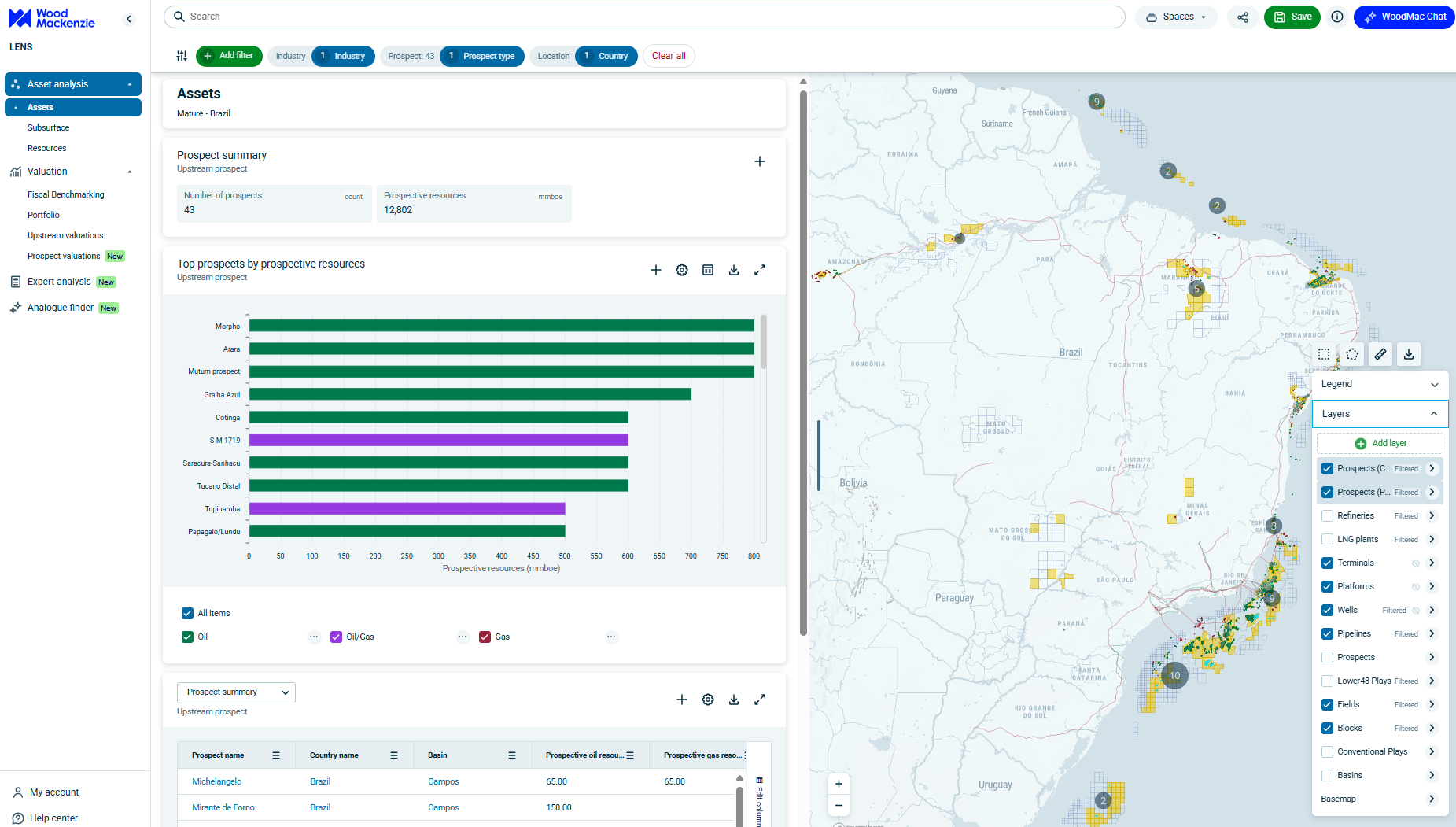

Sale analysis

- A marathon, not a sprint

- A blast from the past

- Operators show signs of increased risk appetite

- (Some) Independents show up

- Smaller players pushdeeper

- Shelf: back to business as usual

-

Putting it all together

- Acreage on offer

-

Terms and conditions

- Timeline

- Evaluation process

Tables and charts

This report includes the following images and tables:

- Fiscal benchmarking using government share and company IRR

- Top 10 companies by high bids in deepwater

- Western Gulf of Mexico bid results

- Most recent lease sales

- Shelf bids and bonuses by lease sale (2010-2018)

What's included

This report contains:

Other reports you may be interested in

US upstream in brief: Chevron and ExxonMobil exceed Q3 expectations

The US week in brief highlights the need-to-know current events from US upstream. Stories are supplemented with proprietary WoodMac views.

$1,350Veracruz Basin

The Veracruz basin is located to the south of the Tampico-Misantla basin along the coastal plain of the Gulf of Mexico. The basin ...

$3,720Perdido Area Discoveries

In 2012, after having previously drilled 22 unsuccessful exploratory wells, Pemex discovered commercial volumes of oil in the Trion ...

$3,720