Ultra Petroleum captures Uinta Basin assets for US$650 million

This report is currently unavailable

*Please note that this report only includes an Excel data file if this is indicated in "What's included" below

Report summary

Table of contents

- Executive summary

- Transaction details

- Upstream assets

-

Deal analysis

- Modelling Assumptions

-

Upsides & risks

-

Upsides

- Lower and Upper Green River formations

- Cost and Drilling Efficiencies

- Well Management

-

Risks

- Well Performance

- Uinta crude pricing

-

Upsides

- Strategic rationale

- Oil & gas pricing and assumptions

Tables and charts

This report includes the following images and tables:

- Executive summary: Table 1

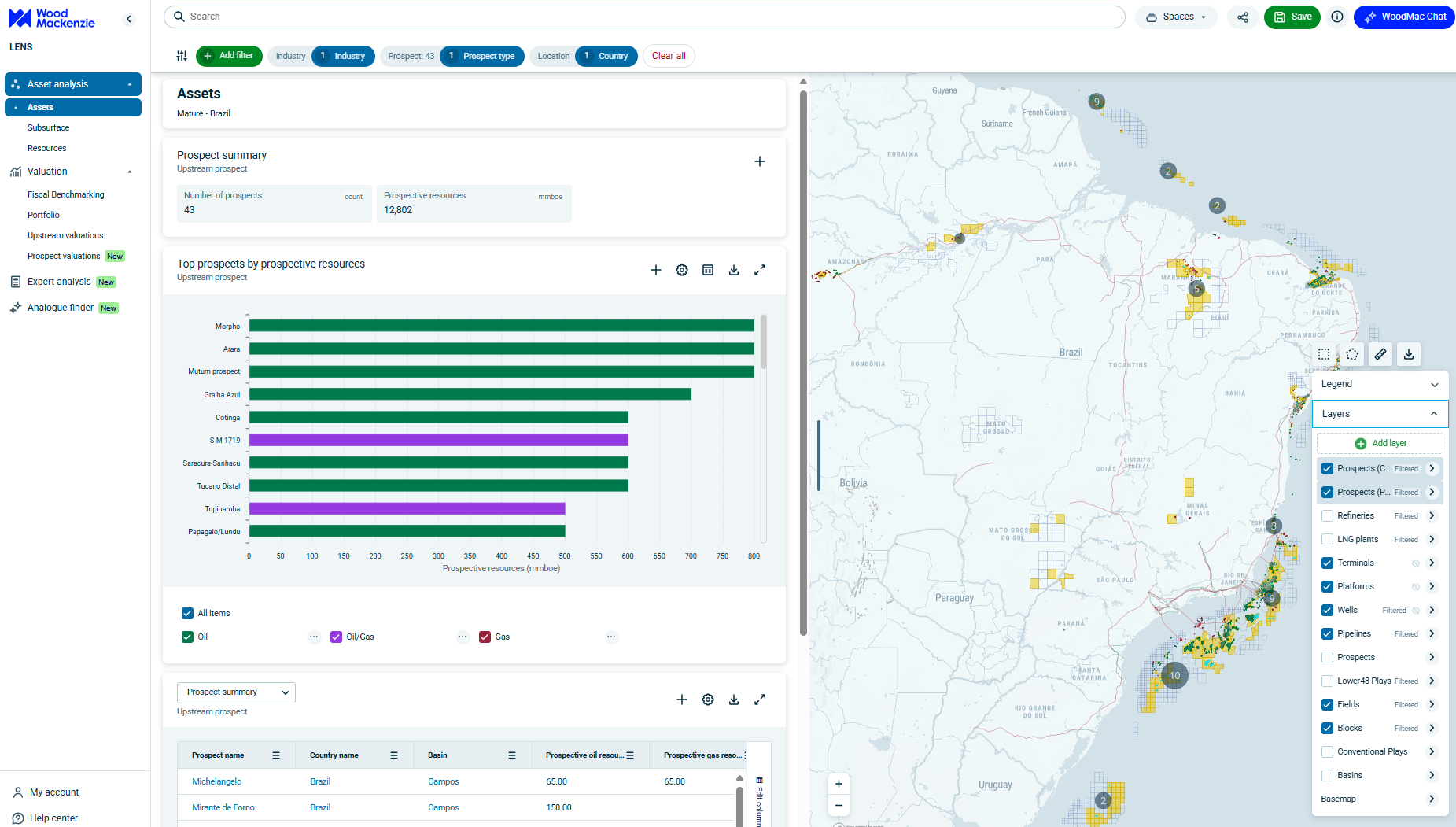

- Uinta Basin Oil wells drilled since 01 January 2012

- Upstream assets: Table 1

- Top L48 oil-weighted transactions in the last three years

- Oil & gas pricing and assumptions: Table 1

- Oil & gas pricing and assumptions: Table 2

- Deal analysis: Table 1

- Deal analysis: Table 2

- Deal analysis: Table 3

What's included

This report contains:

Other reports you may be interested in

Syrian Petroleum Company operated assets

Wood Mackenzie has suspended its analysis of Syria due to the ongoing civil war and the lack of reliable information on the state of ...

$3,720Block 8

Block 8 is located in Peru's Marañon basin and was one of the country's most important oil producing assets for many ...

$3,720Polo Reconcavo

The Reconcavo cluster is composed of 14 fields in the Reconcavo Basin.The cluster was part of Petrobras divestment plan and it was ...

$3,720