Get Ed Crooks' Energy Pulse in your inbox every week

Tesla’s share price and the future of EVs

After a spectacular rise, Tesla’s shares have been on a downward trend this month. The company’s fundamental prospects still look good

1 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

What the "big beautiful bill" means for US energy

-

Opinion

Inside the ‘crazy grid’

-

Opinion

The Big Beautiful Bill is close to passing

-

Opinion

Ceasefire in the Israel-Iran conflict

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

EBOS: the unsung hero that’s accelerating clean energy deployment

In the Marvel superhero films, the character of the brilliant, bumptious billionaire inventor and philanthropist Tony Stark, also known as Iron Man, is (loosely) based on Elon Musk. Robert Downey Jr, the actor who plays Stark, and Jon Favreau, director of the first Iron Man films, met Musk when they were developing the character. With his bold plans for space exploration, pop star girlfriend and idiosyncratic Twitter feed, Musk certainly has an aura of showbiz about him.

That pop cultural appeal may help to explain the remarkable run-up in the share price of Tesla, the company Musk founded and still leads. At their recent low point in March 2020, Tesla shares fell to about US$72, adjusted for last year’s stock split, but they then went on a run to above US$880 in January 2021. It was a move that did not seem based on any news that would justify an equivalent change in expectations of the company’s future earnings.

This month, some of the glamour attached to Tesla’s shares appears to have faded. After a turbulent week, including a drop of 8% on Thursday, they stood on Friday about 20% below their level on 2 February. Over the same period, shares in ExxonMobil have risen 23%. Tesla shares are still at more than four times their price of a year ago, so it is not as if they have plunged to earth. But it is useful to think about what its recent share price weakness tells us for Tesla’s prospects, and the outlook for electric vehicles more broadly.

The shares have fallen this year as a flurry of adverse news has swirled around the company. Its market share in Europe fell in the second half of last year. China’s government has raised concerns about product quality and safety. Tesla revealed a US$1.5 billion investment in Bitcoin. The US Securities and Exchange Commission was reported to be investigating Musk’s tweets about another cryptocurrency, Dogecoin. The company has cut production temporarily at its California plant, Bloomberg reported. Price cuts for some models have been announced, fueling speculation about faltering demand.

The intense scrutiny of small wisps of evidence is understandable, given Tesla’s elevated share price. But standing back from the noise gives a better sense of how the business is going. Tesla’s share of the battery EV market in Europe did drop from 17.4% in the first half of 2020 to 12.7% in the second half, Wood Mackenzie data show, as sales of Volkswagen’s popular ID.3 took off. Tesla’s European sales volumes in the second half were down 5% from the same period of 2019.

On a global scale, however, the setback in Europe was outweighed by strong growth in China, after Tesla opened its Gigafactory in Shanghai in 2019, and in North America. Tesla’s worldwide sales in the second half of 2020 were almost double what they were in the same period of 2019, and its share of the global BEV market held steady at 23%.

The EV business is clearly becoming more crowded. General Motors said last month that it “aspires” to eliminate tailpipe emissions from all the new light-duty vehicles it sells by 2035. Ford said this month that it would move to an all-electric passenger vehicle range in Europe by 2030. Jaguar plans to become an all-electric brand by 2025. However, Tesla still has highly competitive models, says Ram Chandrasekaran, Wood Mackenzie’s global lead for transportation and mobility. “Every company in the auto industry is trying to chase Tesla’s lead,” he adds.

The announcements from GM, Ford and other manufacturers have been in line with what was expected, given the outlook for the EV industry. It is likely that worldwide sales of internal combustion engine cars peaked in 2017. Wood Mackenzie expects global sales of EVs and plug-in hybrids to rise eight-fold over the coming decade, from 2.3 million last year to 18.3 million in 2030. There is a widespread policy push for EV adoption around the world, with plans to end sales of conventional ICE cars by 2030 in the UK, 2035 in China and California, and 2040 in France. Given the opportunities being created, it was inevitable that Tesla’s global rivals would add more EV models and take market share away as VW has done in Europe. But the expected growth in the market is large enough for Tesla still to be able to grow rapidly, even as its market share shrinks.

That is not to take a view one way or the other on whether the company’s share price is justified. But it is important not to read too much into its moves either on the way up or the way down. The elevated price has helped the company by offering a low-cost source of capital in share sales, but its vicissitudes have only a tenuous link to the fundamental prospects of the business. The recent weakness in Tesla shares should not be taken as a sign that either the company, or the wider EV revolution that Musk helped instigate, are faltering.

Learning the lessons of the Texas blackouts

As temperatures in Texas rose back above 20°C this week and life continued to return to normal, the state’s authorities began to investigate the disastrous failure of its power grid last week. The Texas House of Representatives and Senate held hearings on Thursday, taking evidence from ERCOT, the grid operator, generators, electric utilities and the Public Utility Commission of Texas, the regulator. As you would expect, the tone of the questioning was tough at times. Brandon Creighton, a Republican state senator, described the blackouts, which affected more than four million Texans, as “the largest trainwreck in the history of deregulated electricity.”

The blame was widely shared at the hearings, with regulators, the grid, generators and the natural gas industry all coming in for criticism. Gas producers and storage facilities have said they were unable to supply urgently needed fuel because of power outages, and generators including Calpine and NRG said they were unable to reach maximum output because they did not have enough gas. Curtis Morgan, chief executive of Vistra, the power generation company, told the hearing: “The big story here… was the failure of the gas system to perform.” He added: “We just couldn’t get the gas at the pressures we needed.”

Some consequences for that failure have already been felt. Five of the 16 directors of ERCOT, including the chair and vice-chair, resigned on Wednesday. All five live outside Texas. Greg Abbott, the state governor, welcomed the resignations, saying the grid operator had shown an “unacceptable” lack of preparedness. “ERCOT leadership made assurances that Texas’ power infrastructure was prepared for the winter storm, but those assurances proved to be devastatingly false,” he said.

The full cost of the disaster will not be known for some time. The number of people who died as a result of the bitterly cold conditions and the loss of power supplies can never be known precisely. One set of costs that is starting to become clear is the sky-high bills that some customers and utilities are facing as a result of the surge in wholesale power prices last week. As supplies faltered and fell short of demand, wholesale prices rose to the allowed maximum of US$9,000 per megawatt hour. It was at that level for most of the week.

Electric utilities and others caught on the wrong side of those prices are facing losses running into hundreds of millions of dollars for the week. The municipal utility for the city of Denton racked up a $207 million bill in just four days. RWE, which operates wind turbines in Texas, suffered outages and so had to buy power to meet its obligations to supply, and is facing a hit to its earnings of “a low to mid three-digit million euro amount”. Exelon similarly suffered from outages at its gas-fired power plants, and is facing a cost estimated at $560 million - $710 million after tax. Christopher Crane, Exelon’s chief executive, told analysts on a call: “This loss is not acceptable to us.” A quarter of about 100 retail power providers in Texas were said to be at risk of default on their payments to ERCOT.

Griddy, an electricity supplier that charges wholesale prices to retail customers, sent out bills for a few days that in some cases ran into thousands of dollars. Governor Abbott and Texas lawmakers have said they will help people facing exorbitant bills, although it is unclear exactly what form this help will take, or who will end up carrying the cost. Griddy said in a statement that it intended to fight alongside its customers, “to reveal why such price increases were allowed to happen as millions of Texans went without power.”

Analysts from Wood Mackenzie’s Genscape service on Wednesday held an online briefing giving more detail on what happened during that chaotic week. (It is available to watch again on YouTube.) One of the key conclusions is that the cause of the disaster “first and foremost was the failure of thermal generation to perform to ERCOT’s expectations,” and the Genscape data make it possible to see that happening down to the level of individual plants. For example the Lamar gas-fired power plant in north-east Texas was used as an example of good practice in a workshop on cold weather protection in 2019. It turned out to have much better availability than many of its peers last week.

In brief

Ahmed Zaki Yamani, Saudi Arabia’s oil minister from 1962 to 1986, a momentous period in his country’s history, has died at the age of 90. He played a central role in the emergence of OPEC as a key player in global oil markets, and in Saudi Arabia’s nationalization of its oil industry in the 1970s. There were good obituaries carried by Reuters and the New York Times, among others.

US E&P companies have been reporting earnings, in some cases postponed from last week because of the winter storm and blackouts. One key these has been companies pledging to maintain capital discipline and return cash to shareholders as oil prices rise. Devon Energy, for example, last week reiterated its 2021 capital budget and announced a US$0.19/share variable dividend, based on Q4 cash flow. Pioneer Natural Resources this week gave details of how it is following Devon’s lead to launch its own variable dividend, which could distribute up to 75% of free cash flow.

Jennifer Granholm, a former governor of Michigan, has been confirmed as the new US energy secretary. She suggested that her priority would be creating jobs through the energy transition. "I am obsessed with creating good-paying jobs in America," she said. "I understand what it's like to look into the eyes of men and women who have lost their jobs through no fault of their own."

Meanwhile Deb Haaland, President Joe Biden’s nominee for interior secretary, has taken a step closer to confirmation, with Joe Manchin, the influential fossil fuel-friendly Democratic senator from West Virginia, saying he would support her appointment. As a member of Congress in 2018, Haaland said she would “lead and join all efforts to keep fossil fuels in the ground.” But giving evidence to the Senate Committee on Energy and Natural Resources this week, she said: “there’s no question that fossil energy does and will continue to play a major role in America for years to come.” She also pledged to “work my heart out for everyone, [including] the families of fossil fuel workers who help build our country.”

Talking about the Biden administration’s “pause” on leasing new federal acreage for oil and gas development onshore and offshore, Haaland suggested sales would resume at some point. She told the committee: “This pause ... It’s just that, it’s a pause. It’s not going to be a permanent thing where we’re saying we’re restricting all these lands from something.”

The chief executive of Petrobras is being replaced by the Brazilian government. Presenting the company’s 2020 earnings report on Thursday, Roberto Castello Branco, the outgoing CEO, said he would ensure a smooth transition to his successor. He was wearing a T-shirt with the London Underground slogan "Mind the Gap," a reference to the company’s strategic plan to “eliminate the performance gap that separates us from the best global oil and gas companies.”

And finally: some ideas about fuel for spaceflight that Tony Stark might have approved of. The Perseverance rover, which has been wowing the world with its pictures of Mars, was propelled by an Atlas V rocket burning kerosene fuel, with solid fuel boosters. Elon Musk and Jeff Bezos are working on using liquefied methane, essentially a form of LNG, for their rockets. In principle, methane could be extracted or produced on Mars, to fuel the rocket on its trip home.

This week, scientists advising the US government suggested it could be better to go for a more radical solution: nuclear propulsion. Nuclear electric or nuclear thermal rocket propulsion systems could have significant advantages over current approaches. In particular, nuclear propulsion could allow for faster speeds and shorter journey times, an important consideration for the goal of a crewed mission to Mars by 2039. There are significant technical challenges facing both approaches, however. The scientists say NASA will need to “pursue an aggressive and urgent technology development program” if it is to overcome those challenges and make nuclear propulsion usable. However, they also point out that the rockets will need to be used for a number of uncrewed cargo missions to deliver supplies to Mars before any people make the trip, giving plenty of time for the technology to be tested before human lives are on the line.

Other views

Simon Flowers — Will oil companies start spending again?

Gavin Thompson — Asian buyers stay cool as US LNG hit by the deep freeze

Helge Lund — Why carbon pricing matters

Quote of the week

“If we see oil too much above $70 [a barrel], we know what happens: more people are going to invest in alternative energy. Secondly it’s going to hurt demand. So we’ve got to have a lid to where prices are going. And that’s why I’m hoping we keep it in that $55-$70 [range].” — Scott Sheffield, chief executive of Pioneer Natural Resources, gave his view on why he expected Brent crude to be range-bound around $55-$70 a barrel for the next few years, despite the potential for steep cuts in investment to drive prices higher over the coming decade.

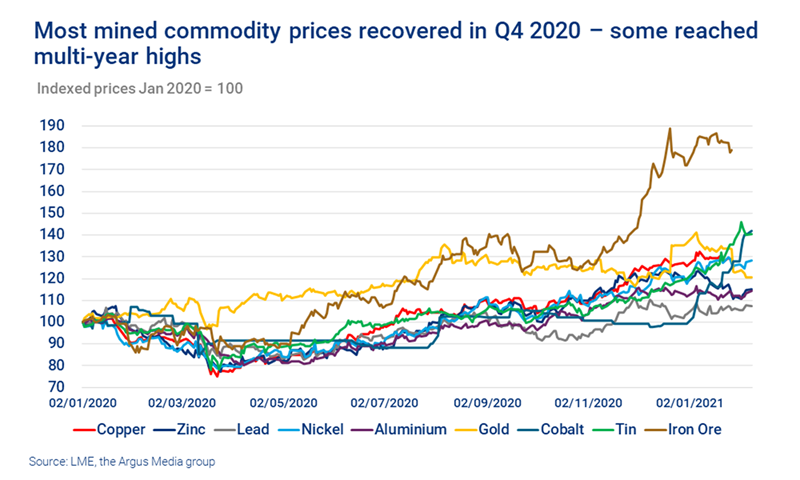

Chart of the week

This chart relates to the hot topic of the moment in commodity markets: the question of whether we are in the early stages of a new supercycle for prices. The chart shows how prices for many mined commodities have picked up strongly since last April. Do those moves mark the start of a cross-commodity supercycle? Julian Kettle, Wood Mackenzie’s vice-chair of metals and mining, argues in a column this week that the answer will be critically dependent on the outcome of the COP26 climate talks in Glasgow in November. As things stand, some of the higher prices shown in this chart are not justified by medium-term fundamentals, he says. But if in Glasgow the world’s governments commit to real action to achieve the Paris climate agreement’s goal of limiting the rise in global temperatures to “well below” 2°C, the impact on demand for metals would be “transformational.” In that event, the supercycle could really take off.