Sign up today to get the best of our expert insight in your inbox.

AI and data centres will transform US power market dynamics

A shake-up of regulation and processes is essential to meet soaring demand

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Upstream’s mounting challenge to deliver future oil supply

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

Chris Seiple

Vice Chairman, Energy Transition and Power & Renewables

Chris Seiple

Vice Chairman, Energy Transition and Power & Renewables

Chris brings more than 30 years of global power industry experience to his role.

Latest articles by Chris

-

Opinion

eBook | Navigate power market uncertainty with confidence: the essential guide to profitable energy investments

-

Opinion

eBook | Power surge: can US electricity supply meet rapidly rising demand?

-

Opinion

eBook | Historic opportunities and complex challenges in a volatile world

-

Opinion

The 2025 US power market outlook

-

The Edge

How gas could displace renewables in meeting surging US data centre demand

-

Opinion

Uncertainty dominates the 2025 US power outlook

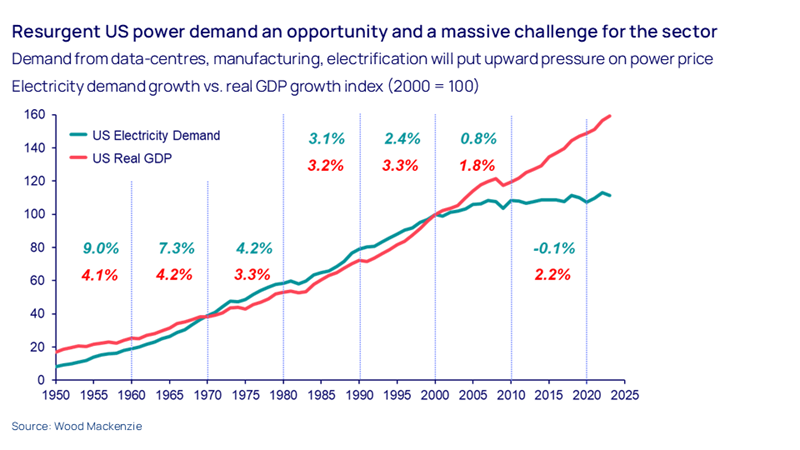

US power demand is sparking back to life. After two decades of managing pancake-flat demand, utilities and regulators will have to jump into action if they are to meet the burgeoning needs of big tech and manufacturing customers. I spoke to Chris Seiple, Vice Chair, Power and Renewables and author of our latest Horizons, about the opportunities and challenges for the US power industry.

How much is power demand going to grow?

No one knows for sure, not even the technology companies closest to understanding their own electricity needs. But when we look at the range of possible outcomes and the drivers, US demand growth is likely to be at least 2% to 3% a year through 2030. The other critical uncertainties are how much demand utilities will allow to connect to their system and how much growth we’ll see in behind-the-meter generation that’s unable to connect to the grid. All in all, it’s a huge change after virtually no growth since the turn of the century.

What’s driving the growth?

Three main factors. First, explosive growth from data centres to power the adoption of AI and the complex large language models used by bots like ChatGPT. Second, the industrial renaissance in energy-intensive cleantech manufacturing – batteries, solar equipment and semiconductors. Third, the wider electrification of the economy, with EVs and electric heating making ground in some parts of the country.

Why are these customers ‘different’?

They’re a new class of customer for utilities – extra-large, high load-factor consumers who want mostly green power. Each new load presents unique challenges for the utility managing them onto the system. Significant planning and investment will be needed, and there’s risk associated with each load. Utilities will have to work out how to prioritise individual projects and, to protect ratepayers and shareholders, how to recoup investment if a project fails. What adds to the challenge is meeting high load-factor customers’ requirement for carbon-free power when they are located far from wind and solar resources.

Will there be enough power supply?

That’s one of the industry’s biggest challenges. Supply has already been reduced in some systems, with grid operators cutting ‘accreditation’ – effectively downgrading the capacity they regard as reliable. Planned coal retirements will exacerbate the reduction in supply. Projected lead times of three years or more for new transformers and breakers will delay the grid-infrastructure upgrades needed to accommodate the new supply.

And new supply is looking to come onto the system. We forecast renewables capacity additions will increase from 29 GW a year currently to 40 GW, barely enough to keep up with demand growth, let alone enough to decarbonise the power sector. New capacity beyond this level will run into permitting and interconnection constraints.

Importantly, intermittent renewables paired with storage won’t satisfy the 24/7 high-load needs of new manufacturing and data centre demand. There will likely be a diverse mix of alternatives with new gas capacity and delayed coal retirements near-term solutions providing flexibility – albeit with climate implications. Nuclear SMRs are among the options further out.

Will power prices go up?

That’s highly likely if demand comes through as we expect, and supply can’t respond quickly enough – particularly in systems where demand growth is strongest. The major uncertainty is how this plays out in different markets. In those with vertically integrated monopoly utilities, it will be easier for utilities only to add load when they have supply to accommodate it. In more deregulated markets, where retail customers have choice, there will be more volatility and upward pressure on prices, which could lead to regulatory intervention.

How does the US power industry seize the opportunity?

The bigger picture is that regulators and utilities have to find a way to expedite the permitting, transmission planning and interconnection process, particularly for large loads. If progress is to be made, data centres and utilities will have to talk to each other and collaborate.

Utilities already have a significant challenge balancing affordability, reliability and decarbonisation goals. But there’s a big prize for the ones that figure out how to quickly scale their infrastructure to accommodate growth, speed the process of studying interconnections and gain system efficiencies. These efficiencies can be won by scaling the use of grid-enhancing technologies and maximising the value of distributed energy resources, strategically placed batteries and controllable loads on the utility’s system. The successful will define what the 21st century utility looks like.

Is data centre power demand growth purely a US thing?

No – it’s being talked about everywhere. All governments want to build data centres for domestic data security. One challenge many face, though, is supplying the decarbonised power the tech companies want. China is investing heavily in data centres, but the growth in power demand is somewhat lost in a market that’s already growing at 7%. Europe, in contrast, has few, if any, tech companies investing in large language models.

The US advantage is that, outside of China, all the major tech companies investing in AI and large language models are based there. The US administration, like any government, will be at pains to ensure as much processing and IP as possible resides in the US.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.