Sign up today to get the best of our expert insight in your inbox

How data centre growth is driving up US power prices

Wholesale prices could double as demand outstrips back supply

5 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

War is once again reshaping gas and LNG

-

Opinion

Middle East conflict set to drive oil and LNG prices significantly higher

-

The Edge

Can natural hydrogen deliver its potential?

-

The Edge

The big themes on Big Oil’s mind

-

The Edge

India’s energy challenge

-

The Edge

Is there still life in decarbonising hard-to-abate sectors?

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

War is once again reshaping gas and LNG

-

Opinion

Middle East conflict set to drive oil and LNG prices significantly higher

-

The Edge

The big themes on Big Oil’s mind

-

Opinion

European gas: 6 Q&As on prices, supply, and regulatory impact

-

The Edge

A wild week for gas markets

-

The Edge

How Venezuela complicates the oil market’s delicate rebalancing

Chris Seiple

Vice Chairman, Energy Transition and Power & Renewables

Chris Seiple

Vice Chairman, Energy Transition and Power & Renewables

Chris brings more than 30 years of global power industry experience to his role.

Latest articles by Chris

-

The Edge

How data centre growth is driving up US power prices

-

Opinion

eBook | Navigate power market uncertainty with confidence: the essential guide to profitable energy investments

-

Opinion

Supply chain bottlenecks threaten US data centre power ambitions

-

Opinion

Energy policy shifts: navigating the One Big Beautiful Bill

-

Opinion

eBook | Power surge: can US electricity supply meet rapidly rising demand?

-

Opinion

eBook | Historic opportunities and complex challenges in a volatile world

Ben Hertz-Shargel

Global Head of Grid Edge

Ben Hertz-Shargel

Global Head of Grid Edge

Ben leads research across electrification and grid technologies, drawing on a decade of executive experience.

Latest articles by Ben

-

Opinion

‘Access to power’ has become ‘access to energy’

-

The Edge

How data centre growth is driving up US power prices

-

Opinion

Virtual power plant growth is getting very real

-

Opinion

US utility large-load pipelines: a reality check

-

Opinion

Supply chain bottlenecks threaten US data centre power ambitions

-

Opinion

eBook | Power surge: can US electricity supply meet rapidly rising demand?

Visiting industry and finance customers in the US last week confirmed just how surging demand from hyperscalers is shaking up the US power industry, even beyond our initial take a year ago. WoodMac’s experts, Chris Seiple and Ben Hertz-Shargel, shared their latest thoughts.

How much power demand will data centres add?

Hyperscaler investment in data centres is accelerating rapidly. Spend for five of the biggest companies rose by a third in 2024 and is forecast to jump by 50% to over US$300 billion in 2025.

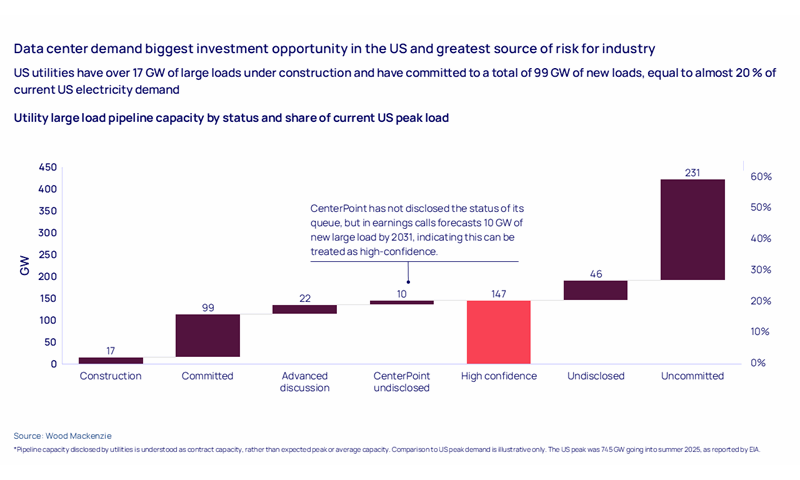

Our tracking shows US utilities have committed to add 116 GW of large loads to their networks, equivalent to approximately 20% of total US electricity demand in 2024. Vertical utilities are building all of the 16 GW under construction, while the rest is concentrated in two major power markets, PJM (the Mid-Atlantic region) and ERCOT (Texas). This is the tip of the iceberg, with an additional 32 GW that utilities are representing to investors as ‘high confidence’ of being built and a further 277 GW with an undisclosed commitment status.

Can the industry deliver sufficient supply to meet the demand?

That’s one of the big questions. There is plenty of political support, with the Trump administration determined that the US wins the battle with China for global AI leadership.

Ideally, large load customers want reliable, 24/7 low-carbon power. Renewables are the cheapest and most readily available resources, and variability can be mitigated when paired with energy storage. Nuclear and geothermal can contribute clean baseload power but are longer-term solutions.

The near-term focus, though, is on new-build gas-fired power plants to do the heavy lifting. The challenge here is a very tight supply chain, with gas turbines a critical bottleneck. GE Vernova has recently announced a 50% increase in turbine manufacturing capacity while Mitsubishi plans to double its capacity. But new orders still face at least a five-year wait for delivery.

Will power prices rise?

They’re already moving up. With supply chain constraints, including turbines, transformers and switchgear, demand growth looks certain to outstrip new supply in the next few years. There are also factors driving costs up that have nothing to do with data centres, including tariffs imposed on materials and components through the power value chain in the One Big Beautiful Bill Act. We estimate the cost of new-build gas-fired plants has soared from US$1,400/kw four years ago to over US$2,400/kw today.

The wholesale power price in ERCOT, for example, needs to double to over US$100/MWh to incentivise the investment required for new-build combined-cycle gas turbine, even before any upside risk to Henry Hub gas prices is taken into account. The impact of rising wholesale prices on consumers will be compounded by higher transmission and distribution costs, including component inflation, as the network is strengthened to replace ageing components and for climate change-induced extreme weather. The price of pad mount single phase transformers, for example, has doubled since 2020.

How are power companies responding to higher demand?

It’s a challenge for a sector that’s just recently had a decade of no demand growth. The majority of data centres we are tracking that are under construction are being built in markets with regulated utilities. In the current power-scarce market, these one-stop shops that can build community support and provide power supply along with the grid connection are dominating new data centre capacity. Some data centre developers have pursued their own on-site generation to reduce their connection requests and speed time to power. This approach is still rare but will become more popular in the future and could include small nuclear and geothermal.

In the meantime, a bring-your-own-capacity movement has begun, calling for utilities to accelerate interconnection if the data centre company brings third-party generating capacity or demand-side resources, such as batteries and demand response. Google is promoting this model, alongside solution providers Cloverleaf Infrastructure, Voltus, Piclo and Camus Energy.

What are the risks to developers?

That they don’t recover the capital cost of their new capacity and are left with underused assets. The concern is that the current, bullish outlook for demand growth might prove a short-lived phenomenon if there’s a breakthrough on chip energy efficiency or less energy-intensive AI models or AI business models turn out to be not as profitable as anticipated. Utilities have started to insist on longer-duration contracts for large load buyers as a risk mitigation strategy. Contracts with large load buyers signed this year have typically been to supply power for 10 to 20 years, whereas in early 2024, few were longer than five years.

Will consumer bills increase?

Yes, and could become a political hot potato – “affordability” was the watchword among energy experts during New York Climate Week in September. A structural increase in wholesale prices will feed through into retail bills over time in deregulated retail markets and will come on top of record bill increases from the current heavy investment in strengthening the grid. State regulators approved US$29 billion in retail rate increases in H1 2025, more than double the same period in 2024.

The difficulty will be developing new utility cost recovery schemes that allocate exclusively to data centres the capital and operating costs that would normally be shared among all customers. One solution which many utilities are working on to protect retail customers’ bills are discrete tariffs for hyperscalers, which reflect the cost of dedicated generation and the associated transmission costs. While many utilities are moving in this direction, there’s a wide variety of approaches.

Who are the winners?

Regulated utilities that provide data centres with certainty of power through grid access. Existing power producers with spare capacity, including old coal plants set for retirement that suddenly have economic life left in them. And a large prize waits for the companies first able to develop cost effective solutions for off grid projects, which are currently proving too expensive and running into engineering challenges.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.

Sign up today using the form at the top of the page.

Business as usual is over

Introducing the latest insight from our thought leaders, the book Connected: Bringing predictability to the increasingly uncertain world of energy.

As climate change accelerates and geopolitical tensions reshape global markets, the energy landscape has become increasingly interconnected. Connected explores why those interconnections have developed, and how they bring clarity to the most important decisions we make about the future of energy.