Securing copper supply no China, no energy transition

August 2024

August 2024

The world cannot decarbonise without copper, a key component of electrification. Amid efforts to secure minerals for the energy transition and achieve climate goals, demand is set to surge. We estimate that demand for copper will grow by 75% to 56 million tonnes (Mt) by 2050.

Meeting this demand will require major investment. And while the scale of the investment required in new mine supply is well understood, the implications for the downstream processing (smelting and refining) and semi-manufacturing of copper are being overlooked. Currently, China dominates both these sectors.

At the same time, nations such as the US also seek supply chain diversification away from China. Legislation such as the Inflation Reduction Act (IRA) aims to subsidise supply chain investments in the US. Meanwhile, critical minerals strategies in Europe, Australia and Canada that now include copper lean toward supporting mineral extraction and the circular economy.

These dual goals – of decarbonisation and reducing dependence on metals supply from China – are at odds. Governments and manufacturers that seek to diversify away from China need to consider the full supply chain, not just mining. Hundreds of billions of dollars in new copper processing and fabrication capacity would be required to replace China. This would create inefficiencies that would result in significantly higher-priced finished goods and increase the cost and timeliness of the energy transition.

For the copper market to remain effective and deliver on the world’s requirements, key stakeholders need to chart a realistic course that involves China. Yes, supply risk can be mitigated, and a certain amount of rebalancing has already begun in some countries. However, the scale of China’s dominance in the copper supply chain means it cannot be fully replaced.

It’s not just about copper mining

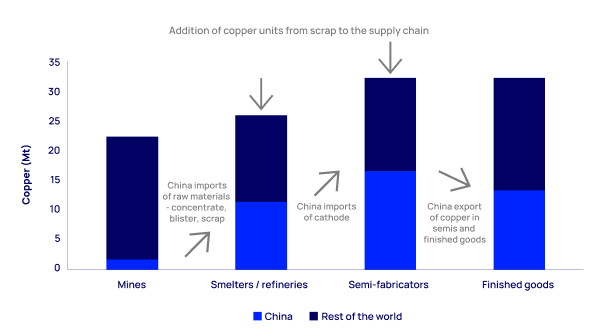

The copper supply chain is a complex, global system comprising trade in both raw materials and semi-fabricated products. Geographically, the net flow of copper units is between raw-material extraction in the Americas and Africa and downstream processing and manufacturing largely in China.

The value chain for primary supply can be broken down into four key stages – mining, smelting-refining, semi-fabricating and the end-use manufacturing of finished goods. Each stage involves different types of company and there is limited vertical integration.

Mining isn’t the only issue. The world, excluding China, currently has more primary mine supply than it needs to meet its requirements. China’s domestic supply accounts for just 8% of global mine output, but its share rises closer to 20% when we include Chinese mining assets overseas. This is still way short of its needs.

As with many other critical metals and minerals, it is China’s overwhelming investment in the downstream processing and semi-manufacturing sectors that presents the biggest challenge to the supply security agenda. These are the sectors that the rest of the world will struggle to dissociate from and, for copper, the risks least discussed in the mineral security debate.

Close to 80% of copper mining produces copper concentrate, which must then be processed at smelters and refineries, often by third parties, to produce the copper cathode traded in terminal markets such as the London Metal Exchange. Cathode, along with high-grade scrap, is then purchased by semi-fabricators (“first use”) to make wire rod, tubes, plates, sheets and strips (PSS) and foil, among other products. These form the basis for the component parts of finished goods.

Ensuring greater security of copper supply does not simply mean investing in new mine supply, be it domestic or through free-trade partnerships. Security of supply is only achieved with heavy investment in stages two and three of the supply chain – smelting/refining and semi-fabricating.

Likewise, investing in copper end uses, such as battery gigafactories, exacerbates supply risks if there is no support for metals processing.

China continues to dominate copper supply

The US introduced a critical mineral strategy in 2017 that has not yet succeeded in reclaiming material market share in the copper supply chain.

Rather, China has continued to dominate investment in the supply chain over the past five years. It has invested nearly half of the US$55 billion committed to new copper mine supply since 2019, primarily in overseas projects.

In smelting and refining, China has added 97% of global capacity, amounting to more than 3 Mt of production and nearly US$25 billion in investment. Since 2000, China has accounted for 75% of all global smelter capacity growth.

China's investment spree extends to fabrication capacity, where it has added nearly 11 Mt of copper and alloy capacity since 2019, some 80% of global additions. About two-thirds of these plants make wire rod, giving China half of the world’s fabrication capacity, with more on the way.

China's dominance of the copper supply chain stems from its rapid industrialisation and urbanisation over the past 25 years. The country's share of global copper demand has grown from less than 20% to more than 50% over the last quarter century, necessitating a huge scaling up of copper imports in various forms.

Initially, Chinese state-owned enterprises prioritised economic growth over profitability and environmental standards. However, China's copper smelting industry has evolved significantly. In the 2000s, a drive for more stringent environmental and efficiency standards led to the regeneration of new smelting capabilities. Outdated furnaces were replaced with modern technology, including domestic Shuikoushan (SKS) and side-blown furnaces, and Chinese versions of European flash technology. The industry today is low cost and meets high environmental standards (especially in sulphur dioxide capture), making Chinese smelters highly competitive.

Swimming against the tide of market forces

Because of the scale and low cost of China’s smelters, the rest of the industry has had to adapt. This includes focusing on niche areas such as complex concentrate treatment and secondary material processing. These specialisations help counteract margin pressures from higher input costs and global overcapacity. Meanwhile, semi-fabricators outside China, especially in Europe, struggle to compete due to lower utilisation rates and higher operating costs.

Carbon emission regulations, such as the EU’s Carbon Border Adjustment Mechanism (CBAM), may reduce competitiveness by imposing higher taxes on the European copper industry without equivalent benefits. Moreover, government incentives, such as the Inflation Reduction Act (IRA) in the US, may not guarantee long-term industry sustainability.

The investment case for building subsidised capacity outside China in a market already teeming with capacity is lacking, with players desperate to avoid a race to the bottom. Meanwhile, it is unlikely that government incentives such as the IRA will prop up these industries indefinitely.

What would it take to decouple copper supply from China?

China’s first use of copper now amounts to 17 Mt, or 50% of global demand. However, we estimate that 20% of this, or 3.3 Mt, is subsequently exported in finished goods. This is about the same volume of refined copper production capability that China has managed to add over the last five years.

But what about future growth? In a non-China scenario, significantly more processing capacity would be required to meet energy transition targets. We estimate around 8.6 Mt of additional copper demand in the world ex-China over the next decade, driven by growth in transport, power and electrical networks. This equates to 70% of smelter capability and 55% of fabricator capacity in the rest of the world. Assuming global average capital intensity, nearly US$85 billion in new smelting and refining capability would be needed to displace Chinese supply.

Yet, over the last 20 years, capacity has barely changed outside China. This raises the question of whether such a shift is achievable. Semi-fabricators might manage with lower entry barriers and nascent markets such as foil. However, they still need local copper raw materials. A wave of new primary copper smelters in the US and Europe seems unlikely.

Financing would also need to be made available. However, even if policy incentives make returns more attractive, resistance to new smelter projects on environmental and social grounds is high, especially in Europe. Smelting’s environmental risks, stemming from emissions and impurities such as arsenic and mercury, make it unappealing to both policymakers and communities.

Tinkering at the edges

Notwithstanding these challenges, some small changes are starting to emerge in certain segments of the market.

New primary and secondary smelter capability outside China

This year will see the commissioning of one custom smelter in India and two integrated smelters in Indonesia. A new smelter is also due to be completed in the Democratic Republic of the Congo next year, although this is driven in part by Chinese investment. At 1.6 Mt combined, these will be the largest smelter capacity additions outside China for decades. Interestingly, however, no new primary capacity is planned for North America or Europe.

Instead, the US has tilted towards the secondary market and scrap. The country is a net exporter of scrap copper, but plans to rebalance this trade and secure the copper units for domestic use. A new complex in the state of Georgia will be the country’s first secondary smelter for treating complex materials.

Foil dominates semi-fabricator plant additions

In the semi-fabricator segment of the market, we have seen significant investments in foil plant capability in all regions to feed the burgeoning electric vehicle sector. Globally, we estimate that 2.0 Mt of capacity was announced in 2021 and 2022 alone ‒ although 80% of this was still in China. The US and Europe are steadily adding incremental wire-rod capacity, too.

Foil is the key product used as a current collector in batteries. It is still a small, but very fast-growing part of the fabricating landscape. Similar to investment in mining, building foil capacity in isolation will not secure the full supply chain, but the opportunity here is in scrap and the circular economy.

Scrap looks set to play a more significant role within the market if copper is to meet the environmental challenges facing the world today. We have begun to witness an acceleration in the direct use of scrap at the semi-fabricator level, especially for the manufacture of copper foil in the world outside China. Copper producers and consumers are also either developing standalone secondary capacity or increasing the share of scrap into their raw-material feed where possible, given the challenges associated with primary supply.

Mine-site processing technology can reduce the need for smelting

In the mining sector, there is now significant investment being made in technology to reduce the requirement for the traditional concentrate-smelter-refinery route altogether. Hydrometallurgical leaching of ores can produce cathode onsite, negating the smelting stage, meaning copper goes straight to semi-fabrication. Already, 20% of mine supply is produced in this way, but only on oxide ore types. The opportunity lies in expanding this to sulphide deposits as well.

Crunch time for copper smelters

The sincerity of the reshoring mantra looks set to be tested sooner rather than later. Additions to smelting capacity in China, coupled with the new capability in India and Indonesia this year, are leading to huge overcapacity and a deep implied deficit in the copper concentrate market. Smelters are struggling with low spot treatment charges and refining charges (TCRCs) as a result. TCRCs, the discount to the full value of the metal processed, are the main source of revenue for smelter-refineries.

Mining companies now face a decision. They can squeeze out inefficient capacity but present China with more market share, or they can accept less attractive terms with some smelters outside China, but potentially embed market inefficiencies.

Annual contract TCRC negotiations will begin later this year and the outcome will be telling for the direction of the industry.

Got questions? Watch the Horizons Live Q&A

At Horizons Live, our Horizons authors discussed the report findings and tackled audience questions in a Q&A session.

Missed it?

Explore our latest thinking in Horizons

Loading...