Discuss your challenges with our solutions experts

Grid edge quarterly briefing: infrastructure and investor spending on the rise

Electrification, resiliency and flexibility continue to be the dominating grid edge themes in 2021. Each quarter, our Grid Edge team provides a comprehensive briefing, including updates and analysis of the key themes and developments in the grid edge ecosystem. Read on for three highlights from the most recent grid edge executive quarterly briefing.

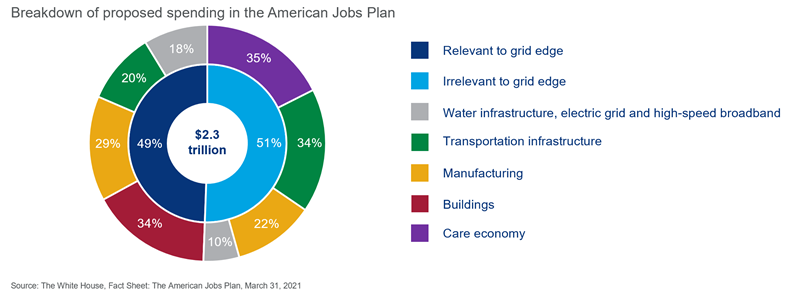

1. The American Jobs Plan proposes US$2.3 trillion in infrastructure spending, of which half is relevant to the grid edge space

In March 2021, the Biden administration released the American Jobs Plan, a sweeping list of proposed actions totaling US$2.3 trillion focused on infrastructure.

Tackling climate change is front and center in the Plan. Grid edge topics that feature heavily include electric vehicles, charging infrastructure, efficient and decarbonized buildings, grid and customer resiliency and widespread broadband internet service. This policy move from the executive branch follows the Consolidated Appropriations Act.

While the Plan is subject to congressional approval, the messaging is clear, especially for transportation electrification. If passed, the American Jobs Plan would be the largest show of support for EVs from the federal government. It also aligns with targets set by local and state governments, utilities and private sector stakeholders to electrify transportation and take into consideration equitable distribution of charging infrastructure.

What was missing from this Plan was support for charging technology standards and vehicle-to-grid studies, as these play a critical role in future-proofing and improving total cost of ownership of EVs.

2. Partnerships form in the EV infrastructure space, while tensions from gas utilities overbuilding electrification intensify

Looking at transportation electrification, partnerships at various points in EV and charger supply chains were formed to reduce waste, increase charger access and minimize friction for fleet electrification. Partnerships announced in Q1 2021 include General Motors and SolidEnergy Solutions; Proterra and Redwood Material; ABB and Amazon Web Services; Rivian and the Colorado Parks and Wildlife Commission.

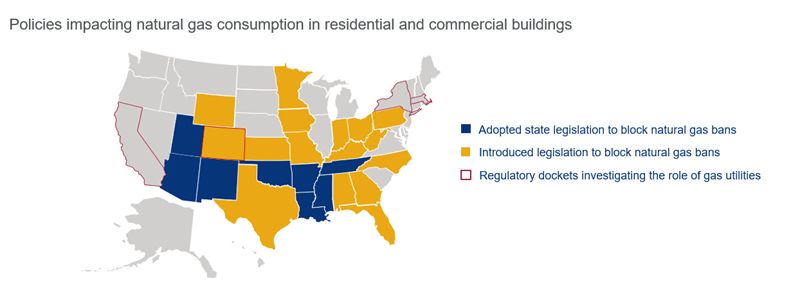

In building electrification, it’s more tension between industries rather than collaboration. While the list of municipalities considering electrification building codes grows, the natural gas industry started preemptively campaigning at the state level against local jurisdictions’ ability to restrict gas usage. In 2020, Flagstaff, Arizona proposed the city’s new construction will reach net-zero emissions by 2040, and this would require aggressive building electrification. Shortly afterward, Arizona was the first state to ban local governments from issuing ordinances limiting or restricting gas hookups. As a result, Flagstaff is looking for other ways to reach net zero, instead of taking on building electrification.

This is the first instance of a state law overturning local efforts, but won’t be the last. As of Q1 2021, more than 20 states have passed or proposed similar bills. While electric heating is the norm in many highlighted states below, these anti-electrification state efforts will slow down installations of efficient heat pumps and take away a crucial tool for municipalities.

3. Commitment to scaling distributed energy resources (DERs) has received significant capital backing through acquisitions, restructuring and partnership models

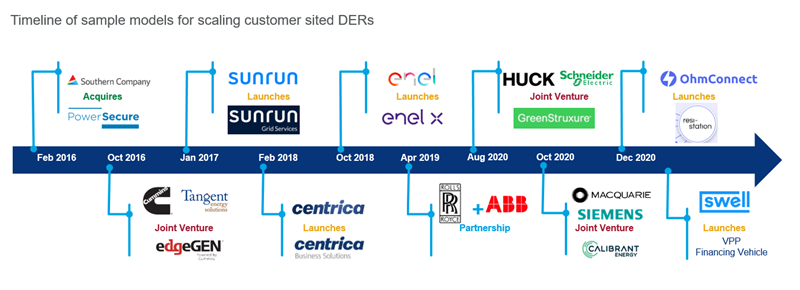

Customer energy solutions – including distributed generation and storage, energy efficiency, electrification, microgrids, load management and energy procurement – provide ample opportunity to shape demand for system-wide flexibility needs. Over the last few years, and especially in 2020, we have seen more corporate activity (illustrated below), as vendors set up to explore DER aggregation business models, while key policies such as FERC Order 2222 move forward.

Aggregation of customer-sited distributed energy resources is now gaining momentum with commitments to provide grid services and participate in wholesale markets. This trend would also unleash the potential of an integrated power model, where a retail portfolio can benefit from electricity generation with locational value.

Source: Wood Mackenzie

The Q2 Grid Edge Briefing provides analysis of the key themes and developments you need to know about the grid edge ecosystem, from electrification to virtual power plants to mircogrids. Each briefing also includes a summary of recent investment and M&A activity.