Discuss your challenges with our solutions experts

The impact and eventual upside of China’s new solar and wind policies

New legislation shakes up policy-driven Chinese renewable markets.

1 minute read

Two recent policy shifts for solar and wind in China come as a short-term pain for the global market but could accelerate grid parity and improve technology innovation in future.

Met with shock from solar businesses around the world, the Chinese government terminated approval of subsidised utility-scale PV power stations in 2018 and capped distributed projects at 10GW. The ruling caused immediate repercussions on the stock market, with solar companies dropping by 15% in the two days following the announcement.

Despite investors’ awareness of delays in renewable energy subsidy payments in China, nobody had expected a ruling of such extent. All solar PV projects grid-connected in China after June 1 2018 will cease to receive FIT benefits, with the exception for those approved last year which are grid-connected by June 30 2018.

Impact on China, and the world

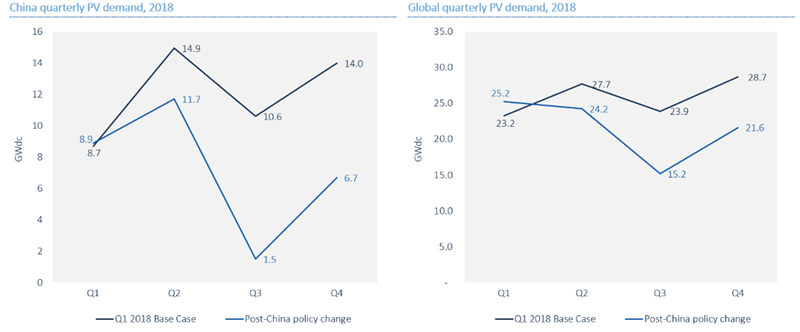

Both utility-scale and distributed solar segments will feel the impact of the decision, with projects expected to come online in the second half of 2018 - other than those being built under the Poverty Alleviation program - especially affected. As a result, we’ve downgraded our China PV forecast for 2018 by 40%, from 48 GW to 28.8 GW.

Boasting PV demand that continually exceeded expectations, China has been the worldwide leader in annual PV demand for the last three years. While this won’t change the country’s ranking, sudden reduced demand from China will likely lead to an oversupply in the global PV module market and further reductions in module prices, indicating that suppliers need to slow down their manufacturing investments.

Since China accounted for more than half of global solar installations in 2017, we do not expect that other markets will be able to make up for this reduction in installations. Accordingly, we expect the backlash for the Chinese industry to cause the first contraction in global PV demand since before the turn of the century.

Quarterly Solar PV Forecast Revision, China & Global

Source: Wood Mackenzie Power & Renewables

An opportunity for improved solar PV quality

Despite this, there is hope that this could mean a positive change to the Chinese solar landscape in the long-term. Chinese developers looking to invest elsewhere than on their home ground could help drive competition in emerging markets. The increased competition, combined with the lower cost of PV modules will bring down prices at competitive auctions and we will likely see more world-record-low tariffs for solar PV in the coming months.

For the Chinese government, the move is sure to ease financial pressure on the renewable subsidy pool that failed to cover expenses in a sustainable fashion.

On the side of developers and consumers, we expect the policy change to motivate a focus on better quality. Competitive auctions have elsewhere shown to boost technological innovation, as developers attempt to increase efficiency and lower cost.

Wind auctions drive fierce competition and further price reduction

The latter upside is likely to extend to the Chinese wind industry, where auctions have just been announced to supersede the current Feed-in-tariff (FIT) scheme. With the introduction of a wind auction scheme from 2019, China’s National Energy Administration (NEA) confirmed prevailing rumours about further FIT reductions on 24 May 2018.

The move comes sooner than the industry expected, as the NEA aims to reduce subsidy pressure on the central government and reach grid parity by 2020. Both developers of new onshore wind projects in the provinces that have not yet published a 2018 Development Plan and developers of new onshore projects approved from the beginning of 2019 will have to now win in auctions.

China’s auction mechanism overview

Competition at auctions in the national wind bases will be extremely fierce, helping wind power prices to reach grid parity. The expected lower power price in the upcoming auctions will further drive price competition among turbine suppliers and intensify pressure on supply chains. High wind utilisation hours and low construction costs of national wind base projects can help developers secure attractive returns if curtailment rates stay at relatively low levels.

Distributed wind power projects are immune from auctions and will continue to be eligible for the FIT scheme for now, which may lead to new opportunities for developers.

The opportunity ahead

Policy shakeups in renewable energy markets, as shown recently when new solar tariffs in the US caused a stir, do not have to lead to crisis. What seems like a great backlash for the renewables industry in China now, could eventually become an opportunity for improvement and, most importantly, a chance for renewables to finally reach grid parity.

To understand all implications of the new auction scheme for Chinese wind power, download our free publication on the topic.