Discuss your challenges with our solutions experts

It’s time for midstream companies to explore renewable energy

Midstream companies can be energy-intense, and self-generation with renewables can make economic sense

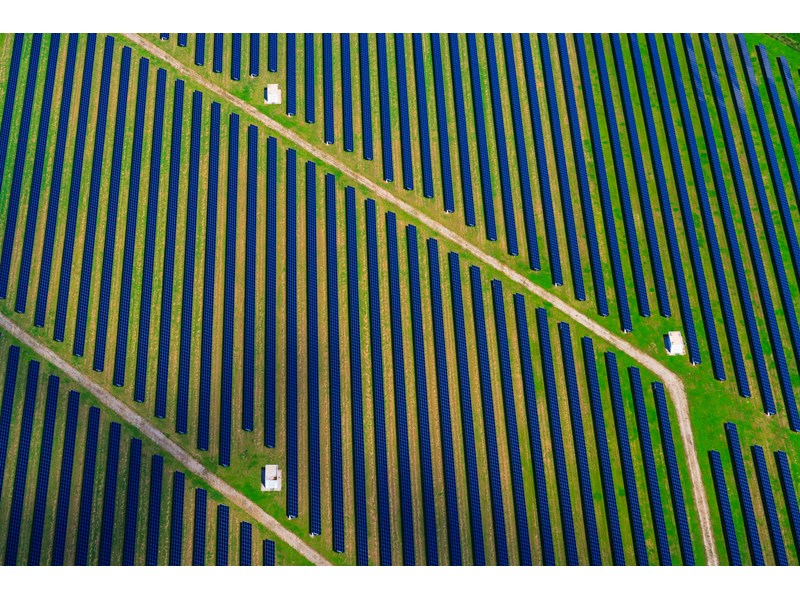

Midstream oil and gas companies are increasingly integrating renewable energy sources, primarily solar, to power some operations. This is not solely part of their ESG commitments, but a decision based on economics.

Williams, for example, announced in May that it will be developing solar at facilities across several different US states. More recently, Chevron announced it will build 500MW of wind and solar installations over the next four years to power certain operations around the globe.

Why renewables?

Midstream companies can be energy-intense, particularly if their operations include processing infrastructure like fractionation. Liquids pipelines also consume a lot of power depending on delivery loads, product viscosity and pumping technology.

Renewable energy, which is becoming highly efficient and cost-competitive, is not only environmentally responsible but can help midstream companies reduce operating costs and drive profitability. And subsidies and incentives are often available to make the value proposition even more appealing.

Midstream companies must also become familiar with the evolving variety of renewable self-generation technologies.

What are the challenges?

Policies and incentives, including rebates and credits, vary widely by country, state and utility. As a result, there is no cookie-cutter approach for considering renewable energy projects across all geographies – that's why we offer policy tracking in our renewables data hub.

Power markets also vary in structure, which impacts the way that self-generated power in excess of the owner’s demand can feed back into the electric grid – and how the owner can be compensated.

Midstream companies must also become familiar with the evolving variety of renewable self-generation technologies.

Within solar photovoltaics, a company will have to decide if it wants mono or bifacial modules, fixed or tracking arrays, which type of inverters are optimal, and more. All of these decisions will feed into the project economics and can vary on a project by project basis.

Then there is the option of adding energy storage to a project. The decision of whether and how to pair rapidly evolving battery chemistries with self-generated renewable power can be complex, as are the potential business cases and investment considerations.

How can Wood Mackenzie help?

Is your firm one of the many that is interested in pursuing a renewable energy strategy?

Leveraging our proprietary research, data tools, and models, Wood Mackenzie's expert analysts and consultants can help clarify the economic justification.

We’ll work with company leaders to develop a renewables investment strategy that contemplates current and future technologies to maximise value and support ESG goals.

Our team of experts can also provide outlooks and assessment on technologies, for example an analysis of solar power and battery storage technologies for desired applications. Fill in the form at the top of this page to find out more.

Read the second article in our series, Paths to energy sustainability for midstream companies.